Scottsdale 85254 Short-Term Rental Case Study: Turn-Key STR with Bonus Depreciation Strategy

5701 East Charter Oak Road, Scottsdale, AZ 85254

This is what happens when real estate execution, tax planning, and timing are aligned from day one.

I represented the buyer on this acquisition with a very clear objective: secure a turn-key short-term rental, fully furnished, already producing income, and purchased early enough to support year-end tax planning, including a bonus depreciation strategy.

I regularly advise clients—many of them high-income professionals and business owners—on short-term rental acquisitions and tax-aligned real estate strategies across the Greater Phoenix and Scottsdale markets.

Toward the end of the year—when STR demand is about to surge and the best properties get competitive—that’s not an easy combination to pull off. This win happened because we approached it like a business decision, not a “let’s see what pops up” purchase.

Like any investment, outcomes are driven by acquisition price, operations, market conditions, and execution—not hype or assumptions.

The Buyer’s Goal

This wasn’t just about buying a Scottsdale home.

The criteria were intentionally built around execution + tax efficiency:

-

A turn-key short-term rental (not a renovation project or setup marathon)

-

Fully furnished, allowing immediate operation

-

Proven STR performance, not projections

-

A year-end timeline that supported bonus depreciation planning

-

Minimized upfront risk, with major expenses shifted away from the buyer

In short: an income-producing asset from day one, with a tax strategy already mapped out.

Why This Opportunity Existed

The leverage in this deal came from alignment.

The seller was ready to step away from operating a vacation rental that had become more work than expected. The property itself was strong—the operations were the burden.

Because we moved early, before the year-end rush, we were able to negotiate from a position of strength.

Seller motivation + clear strategy + decisive timing = leverage.

And leverage is what drives outcomes like this.

The Result

Here’s where the negotiation landed:

-

$170,000 below list price

-

All furniture and contents included — a true turn-key takeover

-

Seller covered all closing costs

-

Brand-new roof paid for by seller

-

New multi-panel slider added to enhance indoor/outdoor living

-

Strong existing reviews and occupancy already in place

This wasn’t a “buy it and hope it works” scenario.

The buyer stepped directly into a fully functioning STR operation.

The Property: 5701 E Charter Oak Rd, Scottsdale AZ 85254

📍 Scottsdale, Arizona 85254

5 Bedrooms | 2.5 Bathrooms | Resort-Style Corner Lot

The home blends Santa Fe character with modern upgrades and is designed around guest experience—one of the most overlooked drivers of STR performance.

Backyard features that consistently move the needle:

-

Heated PebbleTec pool & jacuzzi

-

Outdoor kitchen + BBQ

-

Putting green

-

Palms, misters, string lights, and waterfall ambiance

These features aren’t cosmetic. In Scottsdale’s STR market, they directly influence booking velocity, nightly rates, and review quality.

Why Scottsdale 85254 Continues to Perform for Short-Term Rentals

Scottsdale’s 85254 zip code, often referred to as the “Magic Zip Code,” remains one of the most sought-after areas for short-term rentals due to its balance of lifestyle appeal and accessibility.

Guests are drawn to this area for its proximity to:

-

Kierland Commons

-

Scottsdale Quarter

-

TPC Scottsdale

-

World-class golf, dining, and entertainment

-

Easy access to Paradise Valley and North Scottsdale

For STR guests, convenience and experience drive booking decisions—and 85254 consistently delivers both.

Proven STR Performance (Not Projections)

Before the buyer even closed, this property already had meaningful traction:

-

⭐ 4.98-star guest rating

-

📈 Approximately 87% occupancy

That history matters. Acquiring an STR with existing momentum removes much of the uncertainty that derails new operators and compresses the path to stabilized cash flow.

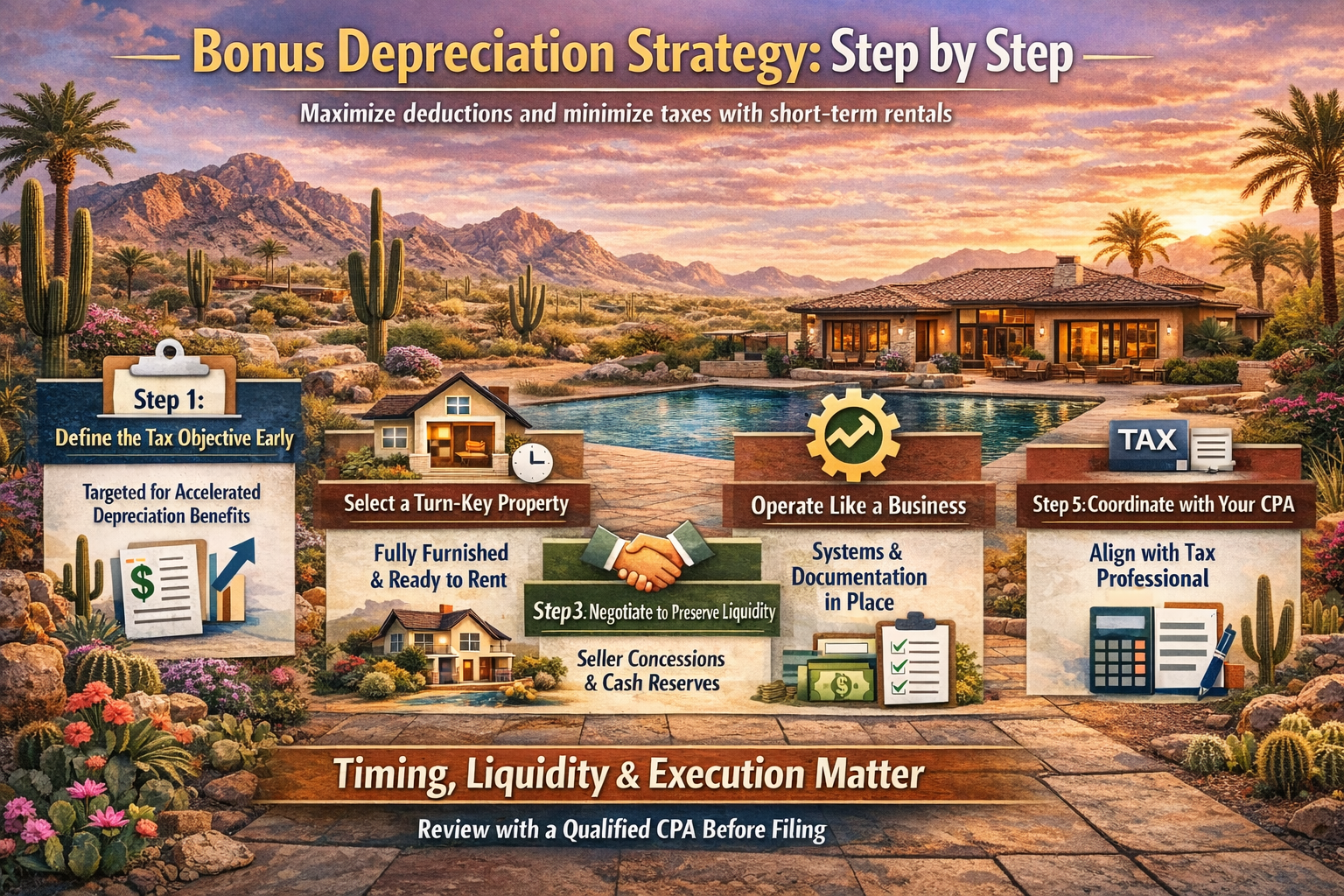

Bonus Depreciation Strategy: Step by Step

This is the part most investors hear about—but few execute correctly, especially with short-term rentals.

Below is the step-by-step framework we aligned to from day one. This same framework is used when advising clients where timing, tax exposure, and operational certainty all matter.

Step 1: Define the tax objective early

The strategy started before touring properties. The buyer wanted an asset that could potentially support accelerated depreciation to help offset high W-2 or business income (when eligible and properly structured).

Step 2: Select a property that can be “placed in service” quickly

Bonus depreciation planning is often dependent on when a property is placed in service. A turn-key STR dramatically improves this because you’re not waiting on:

-

renovations

-

furnishing delays

-

contractor schedules

-

months of setup

This is why “fully furnished and operational immediately” was non-negotiable.

Step 3: Negotiate to preserve liquidity

Even the best tax strategy breaks down if a buyer is over-leveraged or cash-constrained. Negotiation focused on:

-

seller-paid closing costs

-

major deferred expenses handled by the seller

-

preserving capital for reserves and operations

Liquidity matters just as much as deductions.

Step 4: Ensure the property is operated like a business

For STR-related tax strategies, intent and execution matter. This isn’t a casual listing—it needs real systems, documentation, and operating discipline.

That’s why every STR client I work with receives a Vacation Rental Ownership & Operations Guide, so ownership is intentional, not reactive.

Step 5: Coordinate with the buyer’s CPA before filing

I’m not a CPA, and I don’t try to be one. But I do ensure clients are prepared with the right questions and aligned with their tax professional so the real estate decision supports the broader financial plan.

Tax strategies discussed should always be reviewed with a qualified CPA to determine individual eligibility and proper execution.

Who This Type of STR Strategy Is Best For

This approach tends to be a strong fit for:

-

High-income W-2 professionals seeking tax efficiency

-

Business owners with uneven or elevated income years

-

Investors who value certainty over speculation

-

Buyers who want STR exposure without a long ramp-up period

-

Out-of-state investors targeting proven Scottsdale demand

This strategy prioritizes risk control, operational clarity, and tax timing, not chasing the highest possible headline return.

“STRs Don’t Work Anymore” Is Usually an Execution Problem

When people say:

-

“Short-term rentals don’t cash flow anymore,” or

-

“The market is saturated,”

…it’s rarely a market issue.

More often, it’s an execution issue:

-

Overpaying at acquisition

-

Underestimating setup and operational demands

-

Weak marketing and guest experience

-

No strategy beyond “list it and hope”

When STRs are acquired and operated like a business—with the right asset, negotiation, and operating framework—the results look very different.

A Note for STR Owners Considering an Exit

This transaction is also a reminder that well-run short-term rentals remain highly marketable assets.

For owners who:

-

Are tired of day-to-day operations

-

Want to capitalize on strong performance history

-

Are thinking about timing an exit strategically

Positioning, documentation, and timing matter just as much on the sell side as they do on the buy side.

Frequently Asked Questions (STR & Scottsdale 85254)

Is Scottsdale 85254 a good area for short-term rentals?

Yes. Demand drivers, proximity to entertainment and golf, and guest preference for resort-style homes make 85254 one of Scottsdale’s strongest STR pockets.

Can short-term rentals qualify for bonus depreciation?

In many cases, yes—when structured correctly and placed in service appropriately. Eligibility and execution should always be confirmed with a CPA.

Is it better to buy a turn-key STR or renovate one?

For tax timing and risk control, turn-key STRs often provide more certainty, especially when year-end planning is involved.

Do short-term rentals still cash flow in Scottsdale?

They can—but results depend on acquisition price, amenities, operations, and marketing execution, not simply location.

The Bigger Takeaway

Real estate is rarely just about buying a house.

It’s about making the right move, at the right time, with the right plan behind it.

This acquisition at 5701 East Charter Oak Road, Scottsdale, AZ 85254 is a clear example of what happens when:

-

The asset is right

-

The negotiation is disciplined

-

The operations are intentional

-

And the tax strategy is aligned from the start

If you’re considering buying, selling, or investing in Scottsdale 85254—especially if you want STR strategy and tax planning working together—start with the strategy.

The property comes second.

Categories

- All Blogs (251)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.