Selling your property may seem like the obvious choice, but many homeowners are unaware of the alternative: keeping your property and transforming it into an income-generating asset.

At The Ravenscroft Group, we specialize in helping clients build wealth through real estate. We offer a unique solution that not only provides a valuation for your property but also estimates potential earnings from short-term, mid-term, and long-term rentals. Discover the benefits and strategies of these rental options below to start maximizing your property's earning potential.

For more detailed information and personalized advice, explore our resources below.

ATTRACTIVE MORTGAGE RATES

The vast majority of American homes with mortgages are benefiting from historically low-interest rates, typically averaging between 2.5% and 3%. This makes your current home incredibly affordable in terms of monthly payments. However, if you're considering upgrading to a new home, be prepared to face significantly higher interest rates — sometimes up to 250% more than your current rate.

This substantial increase in mortgage payments understandably deters many homeowners from making a move. Consequently, the housing market experiences low inventory, driving home prices upward due to the basic principles of supply and demand.

By staying put and taking advantage of your low-interest mortgage, you can maintain affordable payments and potentially benefit from increasing property values. Explore why holding onto your current home could be a smart financial decision in today's market.

ECONOMIC BOOM IN ARIZONA

Phoenix has emerged as an economic powerhouse in the United States. Major corporations like Intel, Amazon, Lucid Motors, Microsoft, State Farm, Liberty Mutual, and Chase Bank are moving thousands of well-paying jobs into the community. This influx of employment opportunities not only strengthens the local economy but also drives substantial price appreciation in the housing market. Phoenix led the nation in economc growth this last year.

Additionally, Phoenix boasts one of the lowest costs of living among major metropolitan areas and has very pro-business governmental policies, creating even more incentives for continued growth. Explore how Phoenix's economic momentum and housing market potential make it an attractive destination for both residents and investors.

FINANCIAL BENEFITS OF KEEPING AND RENTING OUT YOUR HOME

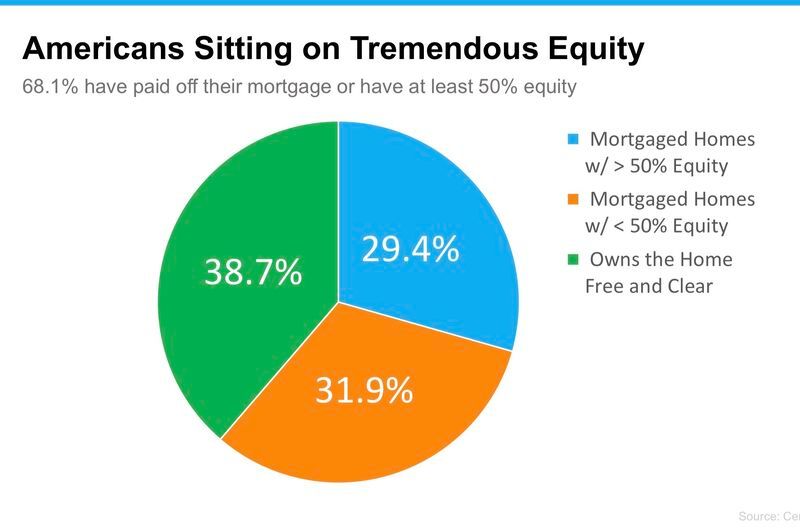

Consider this: the average mortgage payment contributes significantly to paying down the principal balance, typically between $800 to $1,200 per month — that's about $15,000 annually building equity in your property. In contrast, market rents often exceed current mortgage payments by $500 to $750 per month, adding an additional $10,000 or more to your net worth each year.

By not selling your home, you could see an increase of $25,000 to $35,000 annually in your net worth. For example, I recently leased a home in Prosper where the client will easily make an additional $50,000 per year by choosing to lease instead of sell. Want to see the home and the math? Just ask, and I’ll show you how this strategy can work for you!

Discover how holding onto your property can be a lucrative financial decision, boosting your wealth year after year.

YOUR HOME CAN SIGNIFICANTLY BOOST YOUR WEALTH

Historically, homes in Phoenix have demonstrated strong appreciation rates, averaging between 4% to 5% annually. Let's break down what this means for your financial future.

If you own a median-priced home valued at $400,000, even with a conservative estimate of 4% annual appreciation, your home's value would increase by $16,000 per year. Over time, this appreciation compounds, further accelerating your property's value growth.

Consider this: as your home appreciates, your tenant continues paying off the mortgage each month, increasing your equity. This dual benefit significantly boosts your net worth and long-term financial security.

Additionally, rental properties are treated as standalone businesses, making all related expenses tax-deductible. Homeowner's insurance, repairs, HOA payments, and even mileage driven for property management or for property management expenses can all be deducted.

Reflect on the past: have you ever looked at a home you grew up in or previously sold and been stunned by its current market value? If you sold a home 4 or 5 years ago, you likely missed out on $200,000-$250,000 in appreciation. This is the nature of real estate values, which tend to rise with inflation, especially given our government's current monetary policies.

Your home will continue to appreciate in value, benefiting you and your family as the current owner. Alternatively, by selling, you give away that potential equity to someone else. Why hand over this financial advantage to another buyer? Keep your home and pass the wealth on to your children, creating a life-changing financial legacy.

Explore the graphic on the side to see the anticipated price growth and understand how holding onto your Phoenix home can be a powerful wealth-building strategy for your family's future.

YOU CAN BENEFIT FROM BILLIONS IN INVESTMENTS

Take note of the billions of dollars being invested in Phoenix real estate by some of the world's smartest investors. When Wall Street investment firms pour countless billions into our area, it's a clear signal that Phoenix real estate holds significant potential for growth and profitability.

Following these institutional investors' lead could prove advantageous for your financial future. Phoenix is projected to see substantial population and economic growth, contributing to its already thriving real estate market.

Warren Buffett recently invested over a billion dollars in home builders due to the chronic shortage of homes, exacerbated by current owners' reluctance to sell their properties with 2.5% mortgages. These builders are focusing on high-growth states like Arizona, where the demand for housing continues to surge.

For example, in 2023, Phoenix's population growth outpaced many other major metropolitan areas, reflecting the city's booming economy and appealing quality of life. Meanwhile, other cities like New York saw significant population declines, highlighting a national shift toward states with better economic prospects and lower living costs.

These are once-in-a-lifetime changes to America's demographic and economic landscape, and you can capitalize on this trend by NOT selling your property. Keeping your home allows you to benefit from rising property values and increasing rental income, securing a prosperous financial future for you and your family.

Explore how holding onto your Phoenix home can be a strategic move to maximize your wealth in this dynamic and evolving market.

EXPERT STRATEGIST AND ADVISOR | ERIC RAVENSCROFT

You'll have the advantage of working with me, Eric Ravenscroft, an exceptionally experienced Realtor who ranks in the top 2% of Certified Residential Specialists in the country! With over 14 years of experience in real estate and a solid background in wealth management as an advisor, manager, and director of wealth management, I specialize in building generational wealth through real estate for families like yours.

Through my complimentary financial planning offering, you can learn your exact financial picture, factoring in tax benefits, income projections, appreciation, and more. My guiding principle is simple: if a property is good enough for your family to live in, it's good enough to rent out.

I aggressively protect my clients' financial interests, helping numerous families each year transition from renting to homeownership to becoming landlords, thereby transforming their lives and their children's futures. I will be by your side as a non-paid consultant, advising you on tenant screening, lease negotiations, fighting property taxes, tips on saving money on insurance, and more.

I will never try to sell you an internet course or a set of books. All I ask is that you tell everyone you know about how I helped your family to help grow my business. Experience my unparalleled expertise and dedication, and learn how you can build lasting wealth through real estate.

Short Term Rental

Short-term rentals have gained popularity with the rise of platforms like Airbnb and provide an alternative to traditional hotel stays. They offer travelers the flexibility of finding accommodations that suit their needs for shorter durations, whether it's for a weekend getaway, a business trip, or a holiday. Short-term rentals often come fully furnished and equipped with amenities to provide a comfortable stay.

Mid Term Rental

Involves leasing a property for a period ranging from a few weeks to several months. Mid-term rentals offer flexibility to individuals or organizations who require temporary housing or office space for a medium-length stay. These rentals can cater to various needs, such as individuals relocating for work, students studying abroad, or businesses seeking temporary office setups.

Long Term Rental

An arrangement where an individual or entity leases a property for an extended period, usually lasting several months to years. Such rentals commonly require a formal agreement between the landlord and tenant. In a long-term rental, the tenant has the right to occupy and utilize the property for an extended duration, paying a predetermined monthly rent to the landlord.

Choosing not to sell your home and converting it into an investment property could potentially yield over $40,000 per year in increased net worth. This figure considers mortgage paydown, rental income exceeding mortgage costs, and property appreciation. Each year, these numbers compound, as tenants pay off more of the mortgage balance, and price appreciation increases the market value.

This strategy aligns perfectly with the unique economic trends in Phoenix. The area benefits from low mortgage rates, incredible economic growth, a lower cost of living compared to other major cities, and a tight housing market driven by historically low interest rates. Everywhere you look, massive apartment buildings are being constructed by savvy Wall Street firms who already understand these benefits. Why sell your home and let the new owners boast about how much it has appreciated?

Before making any decisions, I encourage you to have a conversation with me. With over 14 years of real estate experience and a solid background in wealth management, I can provide personalized insights that could create generational wealth for your children.

Take advantage of the current economic climate and consider the long-term benefits of holding onto your property. It could be a decision that significantly enhances your financial future. By the way... When is the last time an extremely experienced Realtor told you NOT to sell your home?

If you are interested and would like to learn more about how much income your property can generate for you, fill out the information to request a full comprehensive analysis and revenue projection. Also learn if your property can quality as a mid term or short term/vacation rental.

RECEIVE YOUR INCOME ESTIMATE FOR YOUR PROPERTY

Maximize Your Property’s Potential: Turn Your Home into a Wealth-Building Income Generator

HOW TO GENERATE INCOME FROM YOUR PROPERTY

Check out our videos highlighting Strategies for Maximizing Rental Income and Tax Savings