Comprehensive Financial Planning

Comprehensive Financial Planning

We offer detailed financial plans covering retirement, tax, estate, and insurance planning, along with cash flow and budgeting. This holistic approach ensures all aspects of your financial life are considered and addressed.

Scenario Planning

Scenario Planning

We run various 'what-if' scenarios to show you the potential impact of different decisions or market conditions on your financial future. This feature helps you understand potential outcomes and make informed choices.

Retirement Planning

Retirement Planning

We provide advanced retirement planning features, including Social Security optimization, Medicare planning, and detailed retirement income projections. These tools help you plan for a secure and comfortable retirement by addressing key elements of your retirement strategy.

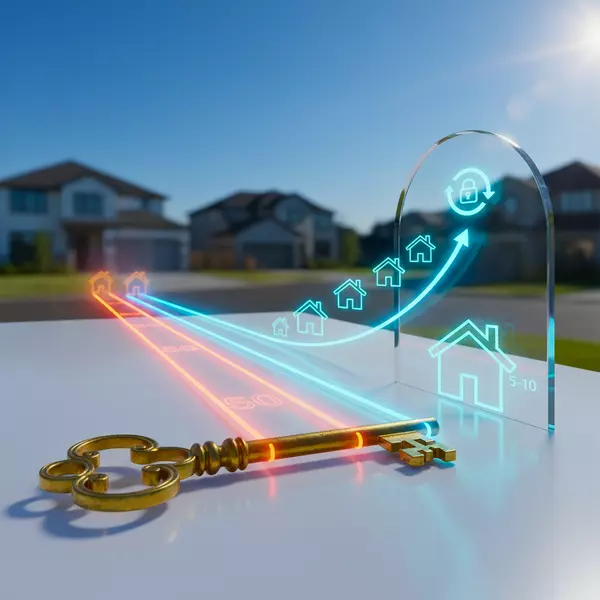

Down Payment Savings Forecasting

Down Payment Savings Forecasting

We offer down payment savings forecasting to help you determine how much you need to save for a home purchase. Our tools and advice ensure you set realistic goals and stay on track to achieve them.

Behavioral Finance Coaching and Guidance

Behavioral Finance Coaching and Guidance

Our behavioral finance coaching and guidance services help you understand the psychological factors that influence your financial decisions. We provide strategies to manage emotions and biases, promoting better financial behaviors and outcomes.

Rental Income Analysis

Rental Income Analysis

We provide rental income analysis to evaluate the potential returns from rental properties. Our analysis includes market trends, rental rates, and expenses, helping you make informed decisions about real estate investments.

Spending Analysis

Spending Analysis

Our spending analysis service helps you understand your spending patterns and identify areas where you can save money. By providing insights into your financial habits, we assist you in creating a more effective and sustainable budget.

WEALTH PLANNING INSIGHTS & GUIDES

🎙️ THE HOUSE OF RAVENSCROFT

Smart real estate + financial strategy insights to build your future with confidence.