Unlock Wealth Through Homeownership: How a Builder-Paid 3-2-1 Buydown Can Help You Grow Your Investment Portfolio

In today's real estate landscape, many buyers are deterred by high home prices and rising interest rates. However, for those willing to think strategically, the builder-financed 3-2-1 buydown offers not only a path to affordable homeownership but also a unique opportunity to build wealth. With initial savings on your monthly mortgage payments, the 3-2-1 buydown allows buyers to leverage those funds as an investment—putting you on the path to growing wealth from day one of homeownership.

How the 3-2-1 Buydown Creates a Financial Advantage

The 3-2-1 buydown is a financing strategy where the interest rate on your mortgage is reduced over the first three years, gradually increasing to the full rate by year four. Here’s how it typically works:

- Year 1: Interest rate reduced to 1%

- Year 2: Interest rate rises to 2%

- Year 3: Interest rate reaches 3%

- Year 4 onward: The rate adjusts to the final rate, typically around 4-4.75%

For buyers, this structure means significant monthly savings over the first three years, with monthly payments increasing incrementally. Many builders are now offering to cover the cost of this buydown, allowing buyers to direct those savings toward building wealth instead of covering additional upfront costs.

The Wealth-Building Opportunity: Investing Your Buydown Savings

With the builder covering the cost of the 3-2-1 buydown, buyers can invest the money saved each month instead of simply absorbing it into other expenses. When invested strategically, these savings can grow and compound over time, generating significant returns. This approach turns the builder’s incentive into a wealth-building tool, allowing you to create financial assets alongside your home equity.

Example Scenario: Using Buydown Savings to Build Wealth

Let’s take a closer look at how this can work. Suppose you’re purchasing a $500,000 home with a 30-year fixed mortgage, where the full interest rate is 4.75%. With the builder’s 3-2-1 buydown, here’s how your monthly payments would look over the first three years:

- Year 1 at 1%: Monthly payment: $1,608 (saving $1,000 per month compared to the full rate of $2,608)

- Year 2 at 2%: Monthly payment: $1,848 (saving $760 per month)

- Year 3 at 3%: Monthly payment: $2,108 (saving $500 per month)

Total savings over the first three years: $26,400

Instead of spending this savings, let’s assume you invest it in a diversified fund yielding an 8% annual return. Here’s how your investment could grow:

- Year 1 Investment: Saving $1,000 per month gives you $12,000 by the end of the year. With an 8% return, this grows to $12,960 by the end of Year 2.

- Year 2 Investment: Saving $760 per month gives you $9,120. Adding this to your previous balance ($12,960) and growing it at 8% results in $23,042 by the end of Year 3.

- Year 3 Investment: Saving $500 per month gives you an additional $6,000. By the start of Year 4, your total balance has grown to approximately $31,885, thanks to compound interest.

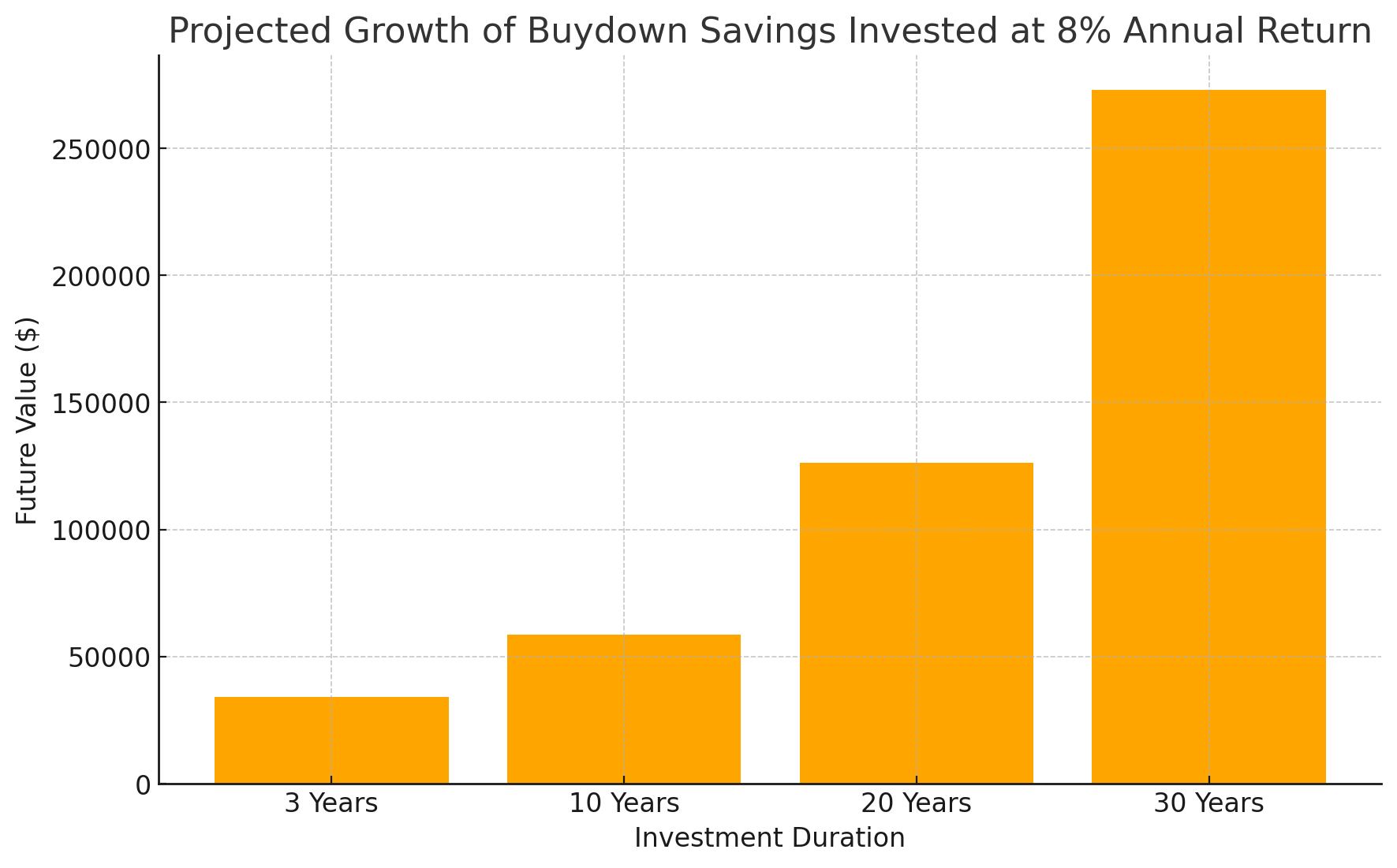

Long-Term Growth Potential of Buydown Savings

Assuming you leave this initial $26,400 invested and it continues to earn an 8% annual return, here’s the potential growth over time:

- In 10 years: Approximately $57,021

- In 20 years: Approximately $122,523

- In 30 years: Approximately $263,942

By simply redirecting your buydown savings into an investment account, you’ve created a long-term financial asset that adds significant value to your net worth.

Who Can Benefit Most from a Wealth-Building 3-2-1 Buydown?

The 3-2-1 buydown with an investment strategy can be especially beneficial for buyers who are focused on maximizing their wealth-building potential and are comfortable with investing. Here’s who might find this approach particularly advantageous:

- First-Time Buyers: New homeowners can ease into monthly payments while using the savings to create a financial cushion or investment fund.

- Professionals Expecting Income Growth: Buyers who anticipate income growth (e.g., recent graduates or early-career professionals) can use this time to build an investment portfolio while benefiting from a gradual increase in mortgage payments.

- Strategic Investors: Buyers with a long-term outlook on wealth-building can maximize returns by investing saved funds early and letting compounding work in their favor.

Important Considerations for Wealth Building with a 3-2-1 Buydown

Before committing to this strategy, consider the following:

- Can You Afford the Full Rate? Ensure that you can comfortably manage the mortgage payments once the rate adjusts in the fourth year.

- Do You Have Stable Income? A stable income or anticipated income growth can help you maintain this approach without needing to dip into your investment savings prematurely.

- Are You Comfortable with Investing? For those new to investing, consulting a financial advisor can help make this wealth-building approach more effective.

Turning Savings into Wealth: A Path to Financial Growth

While the builder-financed 3-2-1 buydown provides immediate financial relief, its true value lies in the wealth-building potential it offers. By investing the savings generated from reduced payments, buyers can turn a builder’s incentive into a powerful financial asset that grows over time. With consistent returns, these early investments can significantly bolster your financial future, helping you build wealth while enjoying the benefits of homeownership.

Final Thoughts: Transforming Homeownership into a Wealth-Building Journey

For buyers ready to think strategically, the 3-2-1 buydown offers more than affordability—it’s a pathway to building long-term wealth. By investing monthly savings and letting compound interest work in your favor, you can turn your home purchase into a wealth-building opportunity that yields financial rewards for years to come. If you’re ready to learn more about homes with builder-paid buydown options and how this strategy can help grow your wealth, reach out to explore this unique approach to homeownership.

Categories

- All Blogs (253)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.