Building Wealth with Real Broker’s Wealth Plan Tool: Your Guide to Financial Independence in Real Estate

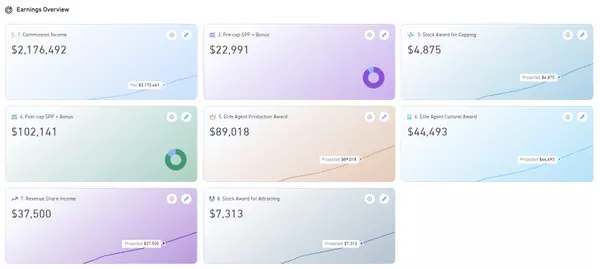

Real estate agents have long sought a career where income meets independence, but many professionals still find the journey to financial security challenging. Real Broker’s Wealth Plan stands out as a comprehensive initiative designed to support agents in building and sustaining wealth. By offering

Real Broker Unveils Game-Changing Updates at Annual RISE Conference: Discover New Tools like Leo CoPilot, Real Wallet, and More

Announcements from the RISE Conference: Real Broker's Latest Innovations The recent RISE conference in Las Vegas marked a significant step forward for Real Broker, unveiling a suite of new tools and services that are set to elevate agent productivity, enhance client services, and strengthen commun

Building Wealth with Real Broker: Unlocking Revenue Share, Stock Awards, Real Wallet, Elite Agent Status, and More

Building wealth as a real estate agent involves more than just closing deals—it’s about leveraging the right opportunities to maximize earnings, invest wisely, and create long-term financial stability. Real Broker offers agents multiple avenues for wealth generation, positioning them to thrive finan

REAL Broker Stock Program: How Agents Build Wealth Through Ownership, Stock Rewards, and Incentives

One of the standout features that sets REAL Broker apart from other real estate companies is its status as a publicly traded company. This unique structure allows real estate agents to become owners of the company they work for, creating a shared environment of success and mutual benefit. Unlike tra

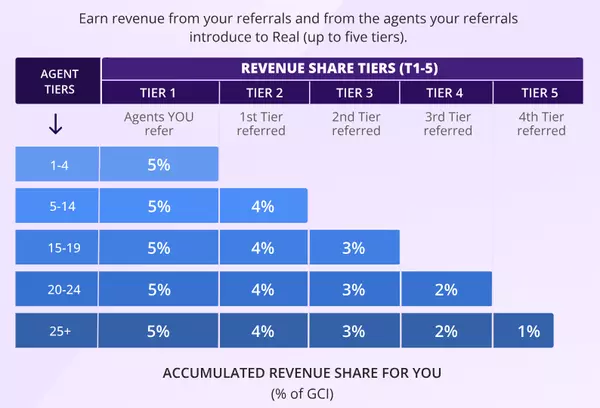

REAL Broker Revenue Share Explained: How to Maximize Your Income and Build Wealth with REAL's 5-Tier Model

Over the past decade, the real estate industry has undergone a remarkable transformation, particularly in how brokerages grow and incentivize their agents. One of the most impactful shifts has been the rise of the "revenue share" model, a strategy that has redefined traditional growth methods. Initi

REAL Broker’s Commission Splits & Caps: Maximize Your Earnings in Real Estate

In the evolving world of real estate, cloud-based brokerages like REAL Broker have risen in popularity among agents for several key reasons. One of the most significant advantages is the ability to offer more favorable commission splits, caps, and lower fees compared to traditional franchise-based b

Everything You Need to Know About Real Broker's REAL Wallet: A Game-Changer for Real Estate Agents

In an era where technological innovation meets the real estate industry, something revolutionary is on the horizon, poised to transform the relationship between brokerages and real estate agents. The introduction of the REAL Wallet by Real Broker marks a pivotal moment in the industry, merging finte

Complete Guide to Joining REAL Broker: Step-by-Step Onboarding and Success Strategies

In this article, I will provide you with a comprehensive step-by-step guide to joining REAL Broker, onboarding into the company, and getting started as an agent. Step One: Apply to Join REAL Broker The first step is to apply to join REAL Broker. You can do that by clicking this link. Then, click on

Eric Ravenscroft, CRS

Phone:+1(480) 269-5858

Leave a Message

REQUEST A TOPIC TO BE PUBLISHED