Building Wealth with Real Broker: Unlocking Revenue Share, Stock Awards, Real Wallet, Elite Agent Status, and More

Building wealth as a real estate agent involves more than just closing deals—it’s about leveraging the right opportunities to maximize earnings, invest wisely, and create long-term financial stability. Real Broker offers agents multiple avenues for wealth generation, positioning them to thrive financially in ways that many other brokerages don’t. Here’s a look at how you can build wealth with Real Broker, along with real-life examples and scenarios to highlight how these strategies work in practice.

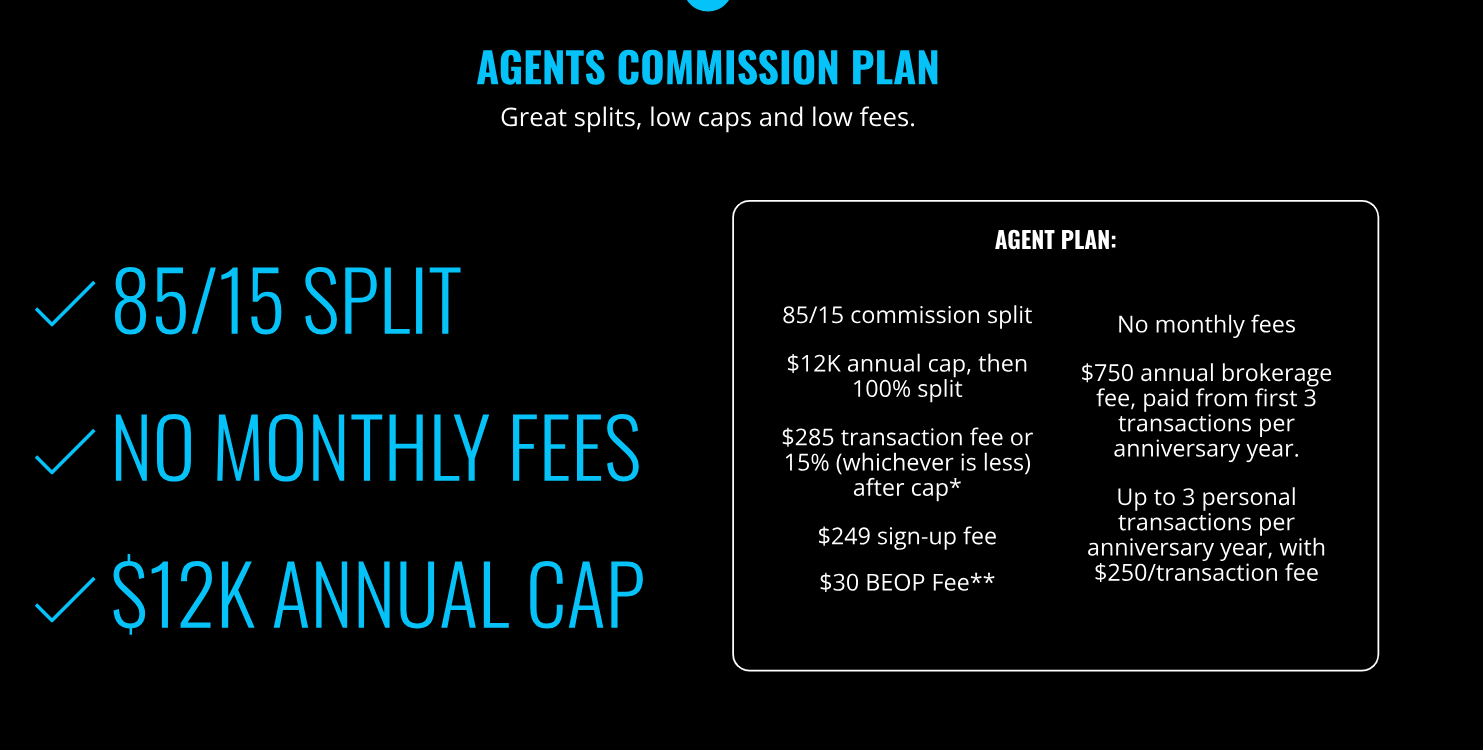

1. Industry-Leading Splits

Real Broker’s 85%/15% commission split with a $12,000 cap allows agents to keep more of their earnings. After reaching the cap, you retain 100% of your commissions for the rest of the year, with no monthly fees to worry about. This structure is highly competitive with other brokerages, many of which have higher splits, monthly fees, or larger caps that limit an agent's ability to retain more of their hard-earned commissions.

Example Scenario:

An agent who closes $5 million in sales annually with an average commission of 3% earns $150,000. After hitting the $12,000 cap, they keep the full commission on all future sales for that year. Without the burden of monthly fees, their earnings grow faster than they would at a traditional brokerage with higher splits and additional costs.

At a brokerage offering a lower split (such as 70%/30%) and a $20,000 cap, a significant portion of earnings would be lost to brokerage fees. Real Broker’s model allows the agent to reinvest more into their business, giving them a clear financial advantage.

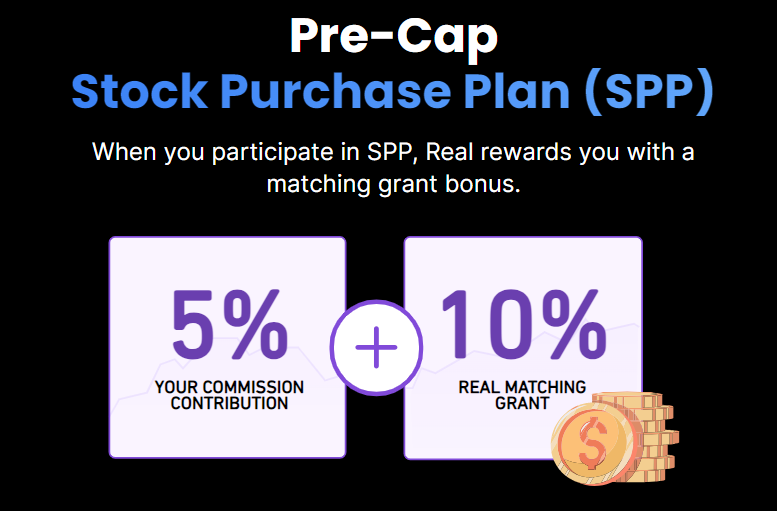

2. Pre-Cap Stock Purchase Plan and Bonus

Agents at Real Broker can invest up to 5% of their commission in company stock before they cap, with a 10% bonus on their stock investment at the end of the year. This creates an opportunity for agents to build wealth through stock ownership.

Example Scenario:

If an agent earns $10,000 in commissions before capping, they can invest 5% ($500) into Real stock. With the 10% bonus, they receive an additional $50 in stock at the end of the year. Over time, as the company grows, this investment appreciates, giving the agent a valuable source of wealth outside of commissions.

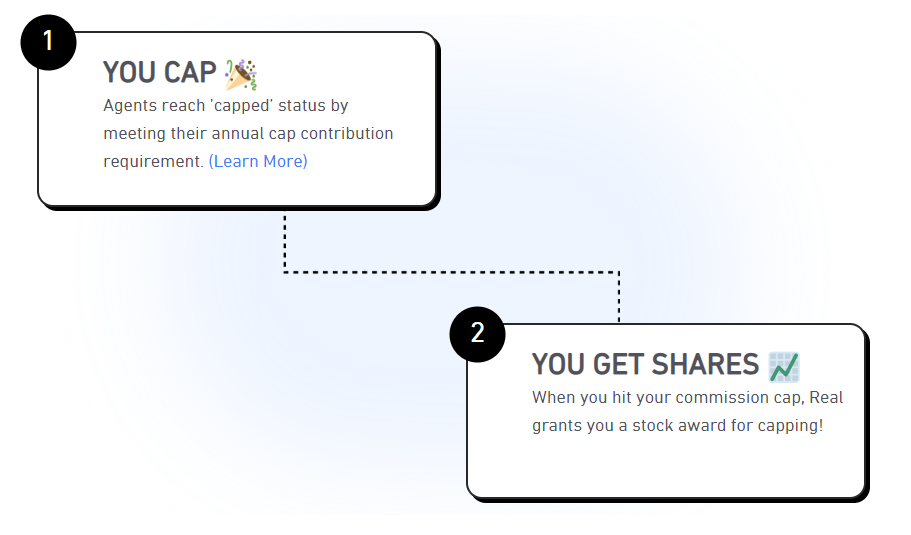

3. Capping Stock Award

Once an agent reaches the $12,000 cap, Real Broker rewards them with 150 shares of company stock. This award gives agents equity in the company, which has the potential to grow over time.

Example Scenario:

After capping, the agent receives 150 shares, valued at $6 per share. The initial value of this award is $900. Assuming the stock appreciates by 7% annually, the value of the award would grow as follows:

- After 1 year: $963

- After 5 years: $1,261

- After 10 years: $1,769

If the agent caps for five consecutive years, their total stock value could grow as follows:

| Year | Initial Value | Growth Rate (7% annually) | Final Value After 5 Years |

|---|---|---|---|

| 1 | $900 | 7% annually | $1,408 |

| 2 | $900 | 7% annually | $1,179 |

| 3 | $900 | 7% annually | $1,102 |

| 4 | $900 | 7% annually | $963 |

| 5 | $900 | 7% annually | $900 |

Total Stock Value After 5 Years: $5,552

This long-term wealth-building strategy through stock ownership provides significant financial security and growth potential.

4. Elite Agent Production Award

High-performing agents at Real can earn $16,000 in company stock as part of the Elite Agent program. Additionally, their transaction fees are reduced by over 50% until their next anniversary date.

Example Scenario:

When an agent qualifies as an Elite Agent, they earn $16,000 in Real stock, receiving approximately 2,666 shares at $6 per share. Assuming the stock grows at 7% annually, the value of the shares would increase as follows:

- After 1 year: $17,120

- After 5 years: $22,462

- After 10 years: $31,482

If the agent qualifies as an Elite Agent for five consecutive years, their portfolio could grow significantly:

| Year | Initial Value | Growth Rate (7% annually) | Final Value After 5 Years |

|---|---|---|---|

| 1 | $16,000 | 7% annually | $22,462 |

| 2 | $16,000 | 7% annually | $20,996 |

| 3 | $16,000 | 7% annually | $19,624 |

| 4 | $16,000 | 7% annually | $18,336 |

| 5 | $16,000 | 7% annually | $17,120 |

Total Stock Value After 5 Years: $98,538

5. Post-Cap Stock Purchase Plan and Bonus

After agents cap, they can invest up to 10% of their commission in Real stock, with a 20% bonus at the end of the year.

Example Scenario:

If an agent invests $5,000 in stock post-cap and receives a 20% bonus, they would receive $1,000 in additional stock, for a total investment of $6,000. Assuming the stock grows at 7% annually:

- After 1 year: $6,420

- After 5 years: $8,444

- After 10 years: $11,856

If they repeat this for five consecutive years, the portfolio would grow as follows:

| Year | Initial Value | Growth Rate (7% annually) | Final Value After 5 Years |

|---|---|---|---|

| 1 | $6,000 | 7% annually | $8,444 |

| 2 | $6,000 | 7% annually | $7,890 |

| 3 | $6,000 | 7% annually | $7,375 |

| 4 | $6,000 | 7% annually | $6,896 |

| 5 | $6,000 | 7% annually | $6,420 |

Total Stock Value After 5 Years: $37,025

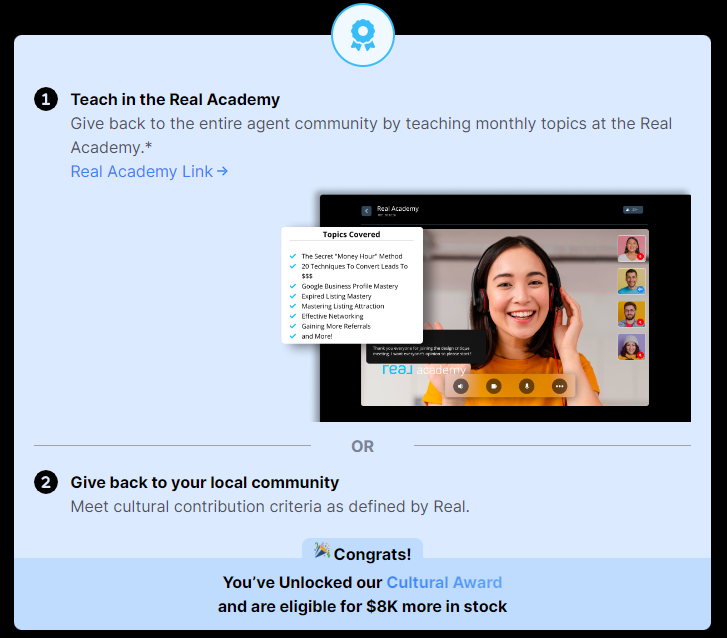

6. Elite Agent Cultural Award

Elite Agents can also earn an additional $8,000 in restricted stock units (RSUs) by teaching monthly at Real Academy. These RSUs vest over three years, providing long-term financial benefits.

Example Scenario:

An agent receives $8,000 worth of RSUs, or 1,333 shares at $6 per share. Assuming a 7% annual growth rate, the value of these RSUs would grow as follows:

- After 1 year: $8,560

- After 5 years: $11,262

- After 10 years: $15,831

If the agent earns this award for five consecutive years, the total value of their RSUs would grow as follows:

| Year | Initial Value | Growth Rate (7% annually) | Final Value After 5 Years |

|---|---|---|---|

| 1 | $8,000 | 7% annually | $11,262 |

| 2 | $8,000 | 7% annually | $10,527 |

| 3 | $8,000 | 7% annually | $9,842 |

| 4 | $8,000 | 7% annually | $9,202 |

| 5 | $8,000 | 7% annually | $8,560 |

Total Stock Value After 5 Years: $49,393

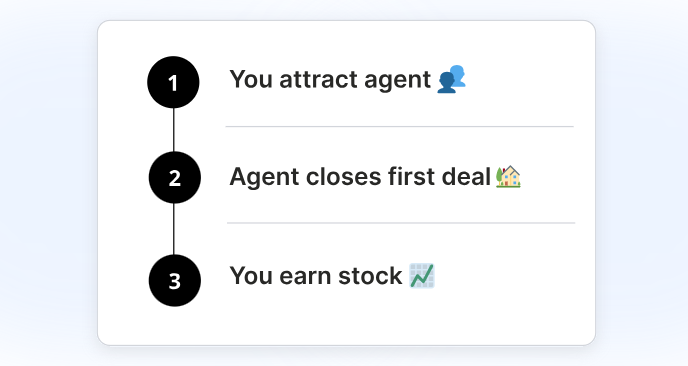

7. Attracting Stock Award

Agents can earn 75 RSUs for each agent they recruit who closes a deal.

Example Scenario:

If an agent recruits three agents each year, they receive 75 RSUs per agent. Assuming each RSU is worth $6 and grows at 7% annually, the total stock value would grow as follows:

| Year | Initial Value (75 RSUs per agent) | Number of Agents | Growth Rate (7% annually) | Final Value After 5 Years |

|---|---|---|---|---|

| 1 | $450 | 3 agents | 7% annually | $1,897 |

| 2 | $450 | 3 agents | 7% annually | $1,771 |

| 3 | $450 | 3 agents | 7% annually | $1,655 |

| 4 | $450 | 3 agents | 7% annually | $1,548 |

| 5 | $450 | 3 agents | 7% annually | $1,450 |

Total Stock Value After 5 Years: $8,321

This adjustment reflects the agent recruiting three agents per year, demonstrating the wealth potential of Real Broker’s Attracting Stock Award program through consistent recruiting efforts.

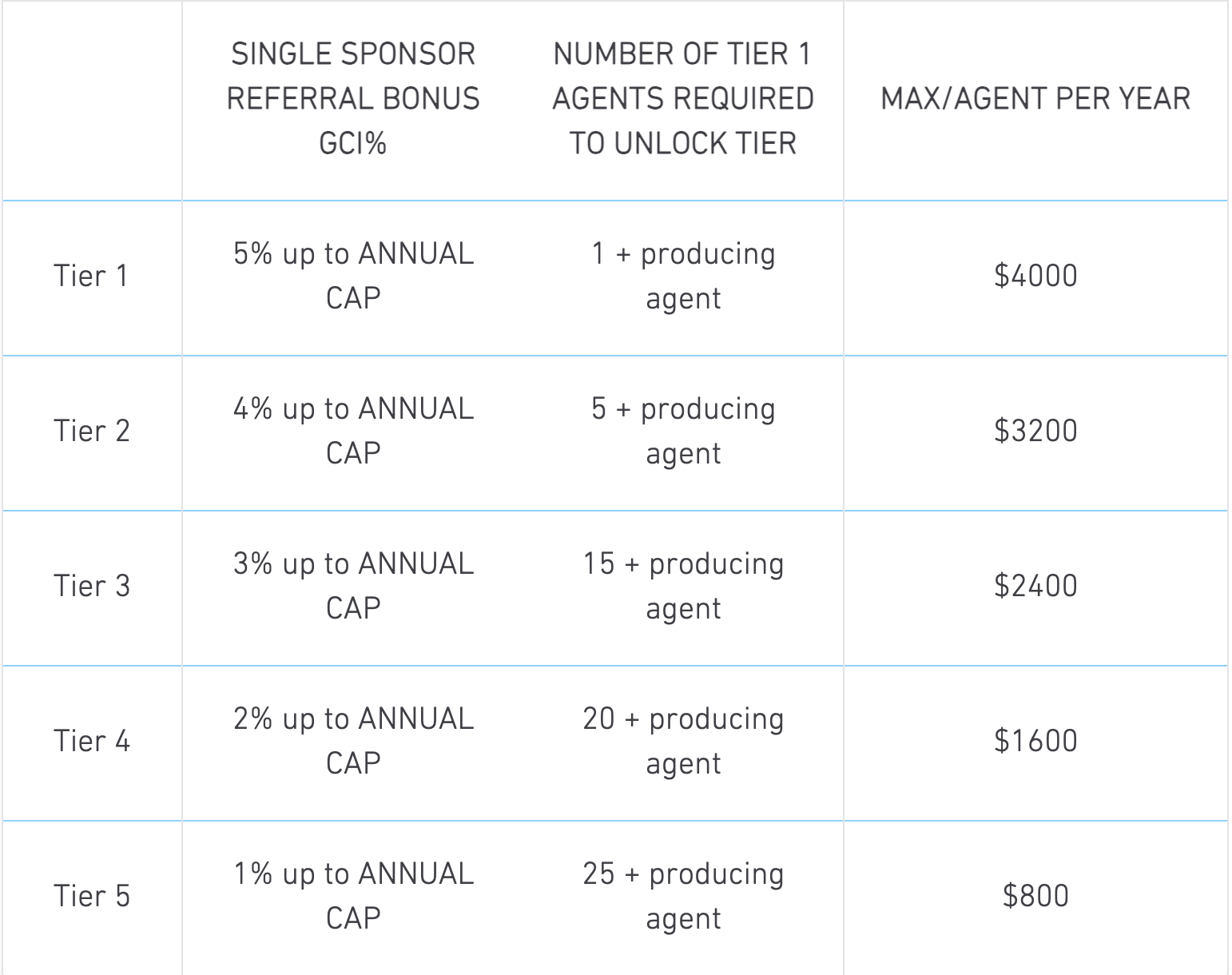

8. Revenue Share Program

Real Broker’s Revenue Share Program allows agents to earn a percentage of their recruits’ commissions, creating a recurring income stream.

Example Scenario:

If an agent earns $10,000 annually in revenue share from their recruits, and this income grows by 5% annually, the total revenue share could grow as follows:

| Year | Revenue Share (Initial) | Growth Rate (5% annually) | Final Value After 5 Years |

|---|---|---|---|

| 1 | $10,000 | 5% annually | $12,763 |

| 2 | $10,000 | 5% annually | $11,500 |

| 3 | $10,000 | 5% annually | $10,947 |

| 4 | $10,000 | 5% annually | $10,420 |

| 5 | $10,000 | 5% annually | $10,000 |

Total Revenue Share After 5 Years: $55,630

9. Real Title Joint Venture

Agents at Real Broker have the opportunity to invest in Real Title after they cap. Once they cap, agents can purchase shares in Real Title and begin earning profit-sharing from the transactions completed through Real Title. This unique offering allows agents to diversify their income streams and benefit from the growth of Real Title, adding another layer of wealth-building potential.

10. Real Mortgage: Become a Licensed Loan Officer

Agents can become licensed loan officers with One Real Mortgage, earning income by closing loans.

Example Scenario:

If an agent closes five loans annually, earning $2,000 per loan, their earnings over five years would be as follows:

| Year | Number of Loans | Earnings per Loan | Total Earnings After 5 Years |

|---|---|---|---|

| 1 | 5 loans | $2,000 | $10,000 |

| 2 | 5 loans | $2,000 | $10,000 |

| 3 | 5 loans | $2,000 | $10,000 |

| 4 | 5 loans | $2,000 | $10,000 |

| 5 | 5 loans | $2,000 | $10,000 |

Total Earnings After 5 Years: $50,000

11. Real Wallet

The Real Wallet will centralize banking and unlock financing options for agents. Using the Real Debit Card in normal day-to-day transactions allows agents to offset their brokerage fees and cap. Every transaction made with the Real Debit Card contributes toward reducing the annual $12,000 cap an agent pays to Real Broker, offering significant savings.

Example Scenario:

If an agent uses the Real Debit Card for everyday business expenses like marketing, client gifts, or travel, they could offset their entire $12,000 cap over the course of the year. This eliminates the financial burden of the cap, allowing agents to save $12,000 annually and reinvest those savings back into their business.

12. Real Credit Card (Coming Soon)

The Real Credit Card will allow agents to further offset brokerage fees and cap by applying normal credit card usage to cover the costs of doing business with Real Broker. With responsible use of the Real Credit Card for both personal and business expenses, agents can apply the savings to their $12,000 cap.

Example Scenario:

An agent charges business-related expenses to the Real Credit Card, such as office supplies or staging costs for properties. Throughout the year, these expenses help offset their brokerage fees and cap, allowing them to save $12,000 annually by using the card strategically, reducing the out-of-pocket cost of the cap.

Note: Agents can choose to use either the Real Wallet or the Real Credit Card to offset their cap, but they won’t be able to double the savings by using both products. The maximum savings for either option is $12,000 annually.

Revised Total Wealth Potential by Being a Part of Real Broker Over 5, 10, and 20 Years

Now that we've clarified that agents can use either the Real Wallet or the Real Credit Card to offset their cap, but not both, here’s the updated total wealth potential over 5, 10, and 20 years:

5-Year Wealth Potential

By leveraging all these opportunities (excluding Real Title), an agent could potentially build the following wealth over five years:

- Capping Stock Award: $5,552

- Elite Agent Production Award: $98,538

- Post-Cap Stock Purchase Plan and Bonus: $37,025

- Elite Agent Cultural Award: $49,393

- Attracting Stock Award: $8,321

- Revenue Share Program: $55,630

- Real Mortgage Loan Officer: $50,000

- Real Wallet or Real Credit Card Savings (Cap Offset): $12,000 x 5 = $60,000

Revised Total Wealth Potential After 5 Years: $364,459

10-Year Wealth Potential

Using the same growth rates, here’s how the total wealth could grow over 10 years:

| Category | 5-Year Total | Growth Rate (7% annually for stock/5% for revenue share) | 10-Year Total |

|---|---|---|---|

| Capping Stock Award | $5,552 | 7% annually | $7,784 |

| Elite Agent Production Award | $98,538 | 7% annually | $137,869 |

| Post-Cap Stock Purchase Plan & Bonus | $37,025 | 7% annually | $51,773 |

| Elite Agent Cultural Award | $49,393 | 7% annually | $69,069 |

| Attracting Stock Award | $8,321 | 7% annually | $11,643 |

| Revenue Share Program | $55,630 | 5% annually | $71,037 |

| Real Mortgage Loan Officer | $50,000 | N/A (flat) | $100,000 |

| Real Wallet or Real Credit Card Savings (Cap Offset) | $12,000 x 10 = $120,000 | N/A (flat) | $120,000 |

Revised Total Wealth Potential After 10 Years: $569,175

20-Year Wealth Potential

Let’s further extend the calculation to 20 years:

| Category | 10-Year Total | Growth Rate (7% annually for stock/5% for revenue share) | 20-Year Total |

|---|---|---|---|

| Capping Stock Award | $7,784 | 7% annually | $15,291 |

| Elite Agent Production Award | $137,869 | 7% annually | $271,074 |

| Post-Cap Stock Purchase Plan & Bonus | $51,773 | 7% annually | $101,813 |

| Elite Agent Cultural Award | $69,069 | 7% annually | $135,763 |

| Attracting Stock Award | $11,643 | 7% annually | $24,103 |

| Revenue Share Program | $71,037 | 5% annually | $116,413 |

| Real Mortgage Loan Officer | $100,000 | N/A (flat) | $200,000 |

| Real Wallet or Real Credit Card Savings (Cap Offset) | $12,000 x 20 = $240,000 | N/A (flat) | $240,000 |

Revised Total Wealth Potential After 20 Years: $1,104,457

Long-Term Wealth-Building Opportunities

By taking full advantage of Real Broker’s wealth-building programs (excluding Real Title), an agent could potentially accumulate $569,175 over 10 years and $1,104,457 over 20 years. These figures don’t even account for an agent's commission income, showing just how powerful Real Broker's unique compensation and investment opportunities can be for long-term financial success.

Ready to start your journey toward long-term wealth with Real Broker? Join today and unlock the potential to build significant wealth through a brokerage that puts your financial future first!

Categories

- All Blogs (253)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.