Can You Still Afford a Home in 2024? The Truth About Homeownership Costs (and How Buyers Are Winning in Arizona)

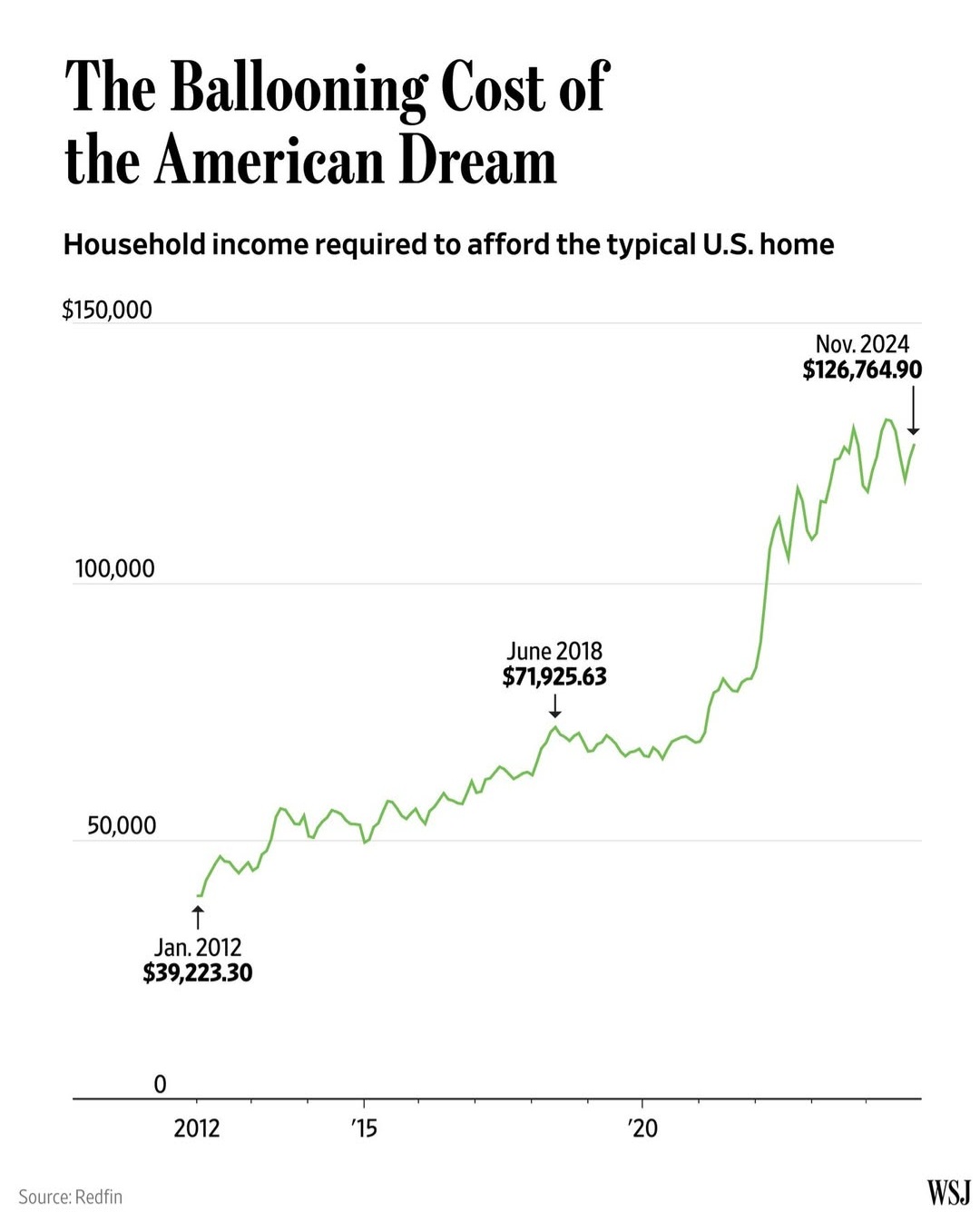

A recent viral chart from The Wall Street Journal claims you need $126,000+ to afford a typical home in America today. Since its release, many buyers have reached out to me, worried they can’t afford a home or assuming that homeownership is completely out of reach.

But is this national data really telling the whole story? NO, NOT EVEN CLOSE!

Just this past week, I helped multiple buyers earning under $65,000 get pre-qualified and go under contract on homes right here in the Phoenix Metro, often with mortgage payments lower than what they were paying in rent.

Let’s break down why national housing data can be misleading and why homeownership is still achievable—especially in Arizona.

The Data That Started the Panic

The Wall Street Journal article referenced a Redfin study showing how much income is required to afford a typical U.S. home:

- January 2012: $39,223

- June 2018: $71,925

- November 2024: $126,764

It’s true that home prices and mortgage rates have risen sharply, but this national data doesn’t reflect local realities—and that’s where the real opportunity lies.

Why National Data Can Be Misleading

Many buyers assume they need a six-figure salary to own a home, but that’s not the case in many areas—including Phoenix Metro.

Here’s why national statistics don’t tell the full story:

- Real estate is LOCAL. While some markets (like San Francisco or New York) require high incomes, others still offer affordable options with the right financing.

- Affordability varies by market. Loan programs, down payment assistance, and builder incentives make homeownership possible even for middle-income buyers.

- Great opportunities still exist—especially in Arizona! Many homes in Phoenix Metro remain affordable compared to high-cost cities, with mortgage payments often equal to or less than rent.

Arizona vs. Expensive Markets: What Your Income Can Get You

To put things in perspective, here’s how Phoenix Metro compares to some of the most expensive U.S. markets:

📍 Phoenix Metro (Arizona) – Still Affordable

- Buckeye, AZ – New construction homes for $350K-$400K, with 3-4 bedrooms and community amenities. A buyer earning $65K-$75K can qualify here.

- Surprise, AZ – Townhomes and single-family homes in the $350K-$450K range, with builder incentives offering lower interest rates.

- Mesa, AZ – Well-established city with homes in the $375K-$500K range, offering strong job access.

- Avondale, AZ – Growing area where homes in the $350K-$450K range remain accessible, especially for first-time buyers.

📍 Expensive Markets – Higher Incomes Required

- San Francisco, CA – Average home price $1.2M+, requiring an income above $200K.

- Los Angeles, CA – Homes $850K-$1M+, requiring an income above $150K.

- Seattle, WA – Home prices $750K-$900K+, requiring $140K+ income.

- New York City, NY – Small condos start at $600K-$800K+, requiring $150K+ to qualify.

Breaking Down Affordability Further

- Mortgage Payments – A $400K home in Phoenix with today’s rates often has a monthly payment of $2,500 or less, while a $900K home in Seattle or LA could cost $6,000+ per month.

- Property Taxes – Arizona has some of the lowest property taxes in the U.S. (0.66% average) compared to California (1.25%) or New Jersey (2.5%).

- Home Insurance – Homeowners insurance in Arizona averages $1,000-$1,500/year, compared to $3,000+ in hurricane-prone Florida.

- Cost of Living – Everyday expenses like groceries, utilities, and gas are much lower in Phoenix compared to New York, California, or Washington.

Buyer Success Stories & Real-Life Scenarios

Real buyers are still finding homes within their budget in Phoenix Metro:

- Young professional in Mesa: Bought a $340K townhome with an FHA loan and only 3.5% down, making mortgage payments cheaper than rent.

- Family relocating from California: Sold their $900K home in Orange County and bought a 4-bed, 3-bath home in Peoria for $525K—twice the space for nearly half the price.

- First-time buyer in Buckeye: Used down payment assistance and got a new construction home for $375K with a 4.99% builder rate buy-down.

First-Time Buyer & Financing Options in Arizona

Many buyers think they need a massive down payment or high income—but that’s not true. Arizona has programs to make buying easier:

- Down Payment Assistance: Up to $15,000 available for eligible buyers.

- Low-Down-Payment Loans: FHA, VA, and USDA loans allow purchases with as little as 3-5% down—or even 0% down.

- Builder Incentives: New construction homes offering 4.99% interest rates and covering closing costs.

- Seller Concessions & Rate Buydowns: Many sellers help lower monthly payments to make homeownership more affordable.

🏡 Myth vs. Reality: Can You Really Buy a Home in 2024?

-

Myth: “I need to earn at least $126,000 to buy a home.”

Reality: In Phoenix Metro, homes are still accessible to buyers earning $65K+ with the right financing strategies. -

Myth: “I need a 20% down payment.”

Reality: Many buyers purchase homes with 3-5% down—or even 0% with VA loans!

Why Arizona is a Smart Long-Term Investment

Even if you’re not sure about buying right now, consider Arizona’s strong market potential:

✔ Phoenix is one of the fastest-growing cities in the U.S.

✔ Job growth is booming (Intel, TSMC, Lucid Motors, etc.).

✔ Rising rental prices make owning a home a great investment.

✔ Arizona has no state income tax on Social Security, attracting retirees.

📩 Thinking About Buying? Let’s Review Your Options!

Are you considering buying a home in the Phoenix Metro area? Whether you're a first-time buyer or relocating, I can help you navigate the market and find opportunities others miss.

📞 Schedule a call with me today to review your options and see what’s possible for your situation!

Categories

- All Blogs (253)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.