Unlock Your Path to Wealth and Early Retirement: The Hidden Power of a Solo 401(k) for Self-Employed Professionals

For real estate agents and self-employed professionals, securing your financial future is crucial. The Solo 401(k) stands out as one of the most powerful retirement plans for individuals who are self-employed, offering high contribution limits, tax advantages, and investment flexibility. This guide explores the benefits of the Solo 401(k), unique strategies for maximizing its potential, and why it should be used by every self employed individual and real estate professional.

What is a Solo 401(k)?

A Solo 401(k), also known as an Individual 401(k) or Self-Employed 401(k), is a retirement plan designed for self-employed individuals with no full-time employees, except possibly a spouse. It offers the unique advantage of allowing contributions as both an employer and an employee, significantly boosting your retirement savings potential.

For real estate agents and other independent professionals, the Solo 401(k) provides flexibility in managing variable income while offering the potential for tax-deferred growth and long-term wealth accumulation.

With over 14 years of experience in financial planning and wealth management, I’ve seen firsthand how combining the Solo 401(k) with strategies like the Mega Backdoor Roth can transform retirement planning. This approach has completely changed the way I structure my own retirement, giving me the flexibility to maximize tax-free growth and secure my financial future.

Why Real Estate Agents and Self-Employed Professionals Should Consider a Solo 401(k)

Your financial planning needs differ from those with traditional employment, and the Solo 401(k) caters directly to these differences. It allows you to maximize contributions, take advantage of tax-deferred growth, and leverage unique investment opportunities, including real estate.

1. Maximize Your Contributions

The Solo 401(k) allows contributions in two ways:

- As an employee: For 2024, you can contribute up to $23,000.

- As an employer: You can contribute up to 25% of your net income, with a combined maximum of $66,000 in total contributions.

This ability to contribute in both roles offers an unmatched opportunity to grow your retirement savings quickly, especially compared to traditional retirement accounts like IRAs. Staying consistent with these contributions sets the stage for early retirement, which is a major benefit for those with fluctuating income, such as real estate agents and self-employed professionals.

Example Scenario:

A self-employed professional earning $120,000 annually can contribute $23,000 as the employee and an additional $30,000 as the employer, totaling $53,000 in contributions. This dual-role contribution strategy allows you to accelerate retirement savings far beyond what other retirement plans permit.

2. Tax-Deferred Growth and Roth Options

The Solo 401(k) provides both Traditional and Roth options, giving you flexibility in how your contributions are taxed. A Traditional Solo 401(k) allows you to contribute pre-tax dollars, reducing your taxable income, while a Roth Solo 401(k) offers tax-free withdrawals in retirement since contributions are made after taxes.

For those looking to maximize their tax-free growth potential, the Mega Backdoor Roth strategy allows after-tax contributions to be converted into a Roth account, further boosting your retirement savings without increasing your taxable income.

Example Scenario:

A self-employed consultant in Phoenix, AZ, expects to be in a higher tax bracket during retirement. By using the Mega Backdoor Roth option, they contribute $23,000 pre-tax as an employee and an additional $28,500 in after-tax contributions, which they then convert to a Roth account. This strategy maximizes tax-free growth for retirement.

3. Loan Provisions for Financial Flexibility

One of the unique advantages of a Solo 401(k) is the ability to take out a loan from your plan. You can borrow up to 50% of your account balance, or $50,000, whichever is less. This loan feature provides a level of financial flexibility that many other retirement plans don’t offer. You can use this for:

- Real estate investments

- Business expenses

- Emergency funds

This flexibility is particularly valuable for self-employed professionals who may experience fluctuations in income, providing a built-in safety net while keeping your retirement savings on track.

4. Real Estate Investment Opportunities

For real estate agents, a Solo 401(k) allows you to invest in what you know best: real estate. This type of retirement account provides the flexibility to invest in real estate properties, rental homes, or land within the tax-deferred or tax-free environment of a 401(k). This allows you to diversify your retirement portfolio with assets you can actively manage while also leveraging your industry expertise.

Self-employed professionals from other industries can also diversify their Solo 401(k) investments by adding real estate assets to their portfolio, providing long-term growth and the potential for tax-deferred wealth accumulation.

5. Tax Deductions and Credits

Contributions to a Solo 401(k) are tax-deductible, which can significantly reduce your taxable income. Additionally, if you set up your plan with automatic enrollment, you may qualify for a tax credit of up to $500 per year for the first three years, totaling $1,500 in potential savings.

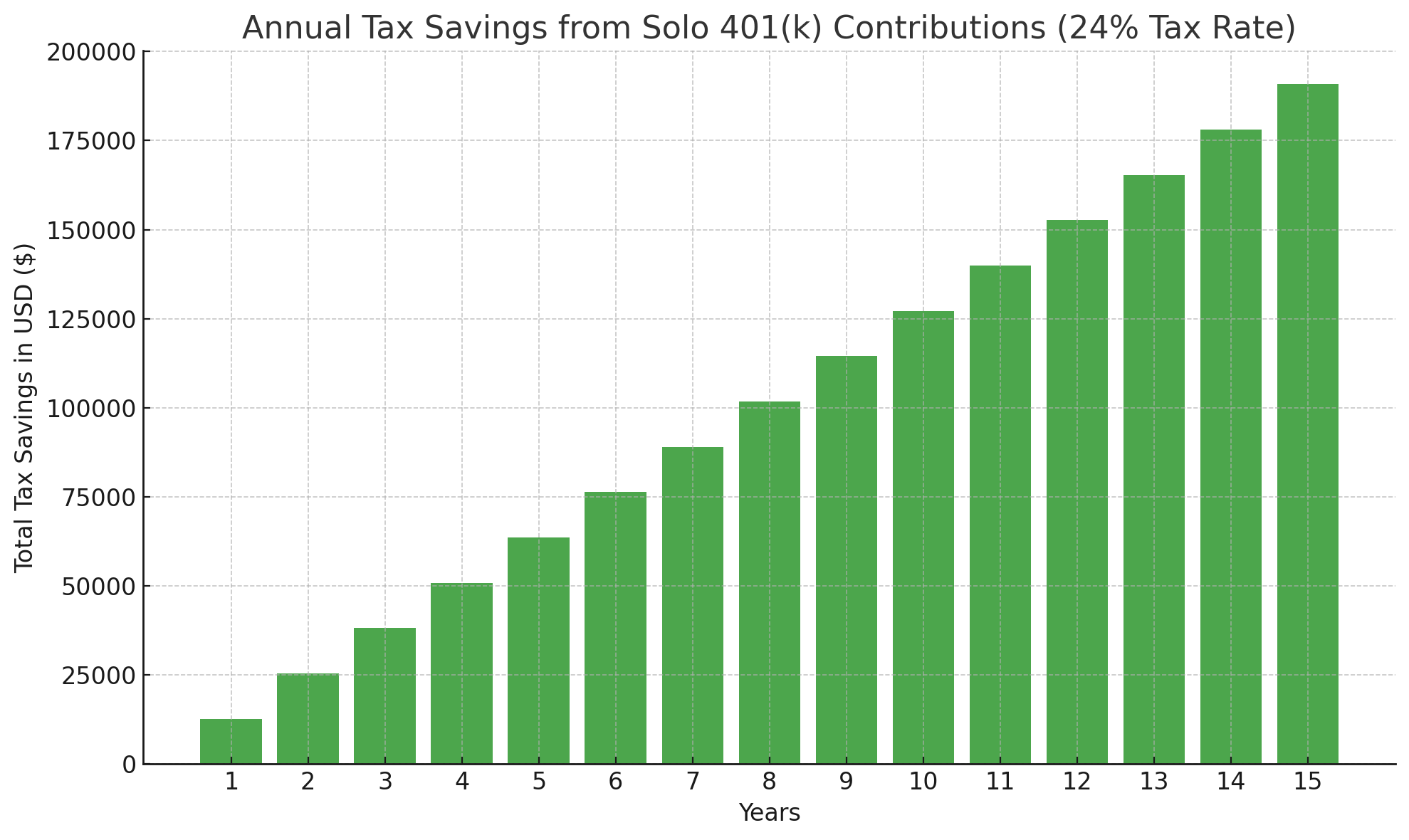

Example Scenario:

A real estate agent contributes $53,000 in 2024 to their Solo 401(k). In the 24% tax bracket, that contribution could reduce their taxable income by over $12,000, resulting in significant tax savings. These tax advantages make the Solo 401(k) a powerful tool for those earning a variable income, such as real estate agents and self-employed professionals.

The Power of Consistent Contributions: Early Retirement on the Horizon

One of the key advantages of a Solo 401(k) is the ability to build significant wealth over time through consistent contributions. By regularly contributing the maximum amount each year as both an employee and an employer, you not only secure your financial future but also position yourself for early retirement.

Scenario: Maxing Out Contributions

- Annual Income: $120,000

- Employee Contribution: $23,000

- Employer Contribution: $30,000

- Total Annual Contribution: $53,000

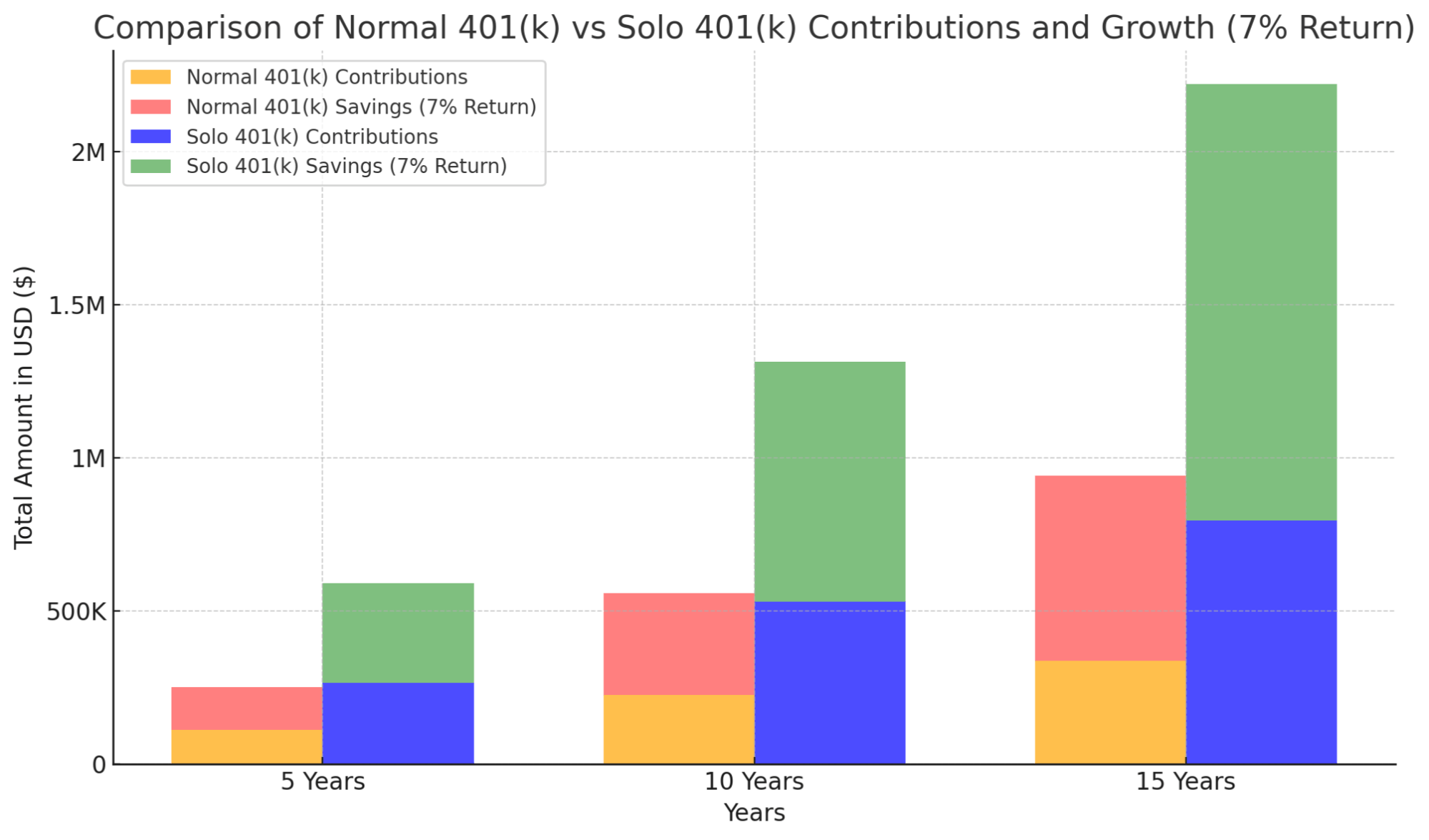

Let’s explore what your retirement savings could look like if you maintain this consistent contribution schedule over the next 5, 10, and 15 years, assuming a conservative 7% annual return:

By following this steady contribution pattern, after just 15 years, you could accumulate over $2 million in retirement savings, even with a conservative return rate. This type of wealth-building strategy could easily place early retirement within reach—especially for real estate agents and self-employed professionals whose income fluctuates but who remain diligent and disciplined in their contributions.

With this approach, achieving your financial goals becomes much more than just a possibility. By taking advantage of the Solo 401(k)’s high contribution limits and tax-deferred growth, your path to financial independence can be significantly shortened, allowing you to retire early and enjoy the lifestyle you’ve worked so hard to achieve.

Unique Strategies for Self-Employed Professionals

1. Invest in Real Estate Within Your Solo 401(k):

For self-employed professionals, particularly real estate agents, the Solo 401(k) offers the unique advantage of allowing direct investment in real estate. Whether you’re purchasing rental properties, investing in land, or flipping homes, you can do so within your retirement plan and benefit from tax-deferred growth.

2. Mega Backdoor Roth for Tax-Free Growth:

If you expect to be in a higher tax bracket in the future, consider the Mega Backdoor Roth strategy. This allows you to contribute after-tax dollars, then convert them into a Roth account for tax-free withdrawals in retirement. This is especially useful for high-income earners or those who anticipate increasing their earnings significantly over time.

Setting Up a Solo 401(k)

Setting up a Solo 401(k) can be done through many financial institutions. However, working with a financial professional can ensure that you maximize your plan’s potential and avoid any common pitfalls. Here's a step-by-step guide to help you get started:

- Choose a Financial Institution: Look for providers that offer diverse investment options suitable for your goals.

- Set Contribution Levels: Decide how much to contribute as both an employee and an employer.

- Establish Your Plan: Submit required documents and ensure compliance with IRS rules.

- Invest Your Funds: Diversify your investments across different assets, including real estate if desired.

- Monitor and Adjust: Regularly review your contributions and investments to ensure you're on track.

Also, make sure to comply with IRS regulations, such as filing Form 5500 when your plan assets exceed $250,000, to avoid penalties.

Conclusion: Why a Solo 401(k) is Essential for Real Estate Agents and Self-Employed Professionals

The Solo 401(k) offers a unique combination of high contribution limits, tax advantages, and investment flexibility, making it one of the best retirement plans for self-employed professionals. Whether you are a real estate agent looking to invest in properties or a consultant aiming to build wealth tax-deferred, the Solo 401(k) provides an opportunity to secure your financial future.

With over 14 years of experience in financial planning and wealth management, I’ve helped countless real estate agents and self-employed professionals set up and optimize their retirement strategies. If you have any questions or need assistance with establishing your Solo 401(k) or reviewing your current plan, feel free to contact me today for personalized guidance.

Categories

- All Blogs (253)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.