Turning Your Home into a Rental: A Smart Investment Strategy

Real estate has long been heralded as one of the most reliable and lucrative avenues for wealth creation. Among the various strategies available to budding investors, turning your first home into a rental property stands out as both practical and effective. This approach not only offers a foothold in real estate but also provides a sustainable method for building long-term wealth.

By purchasing your first home with the intention of converting it into a rental property down the line, you set the stage for a strategic investment journey. This article will guide you through the steps needed to turn your first home into a rental and how to leverage that property to build a thriving real estate portfolio.

Choosing the Right Property

The success of this strategy begins with choosing the right property. As a first-time homebuyer, it’s easy to be swayed by aesthetics or personal preferences. However, when your goal is to eventually convert the property into a rental, it’s essential to evaluate the home through an investment lens.

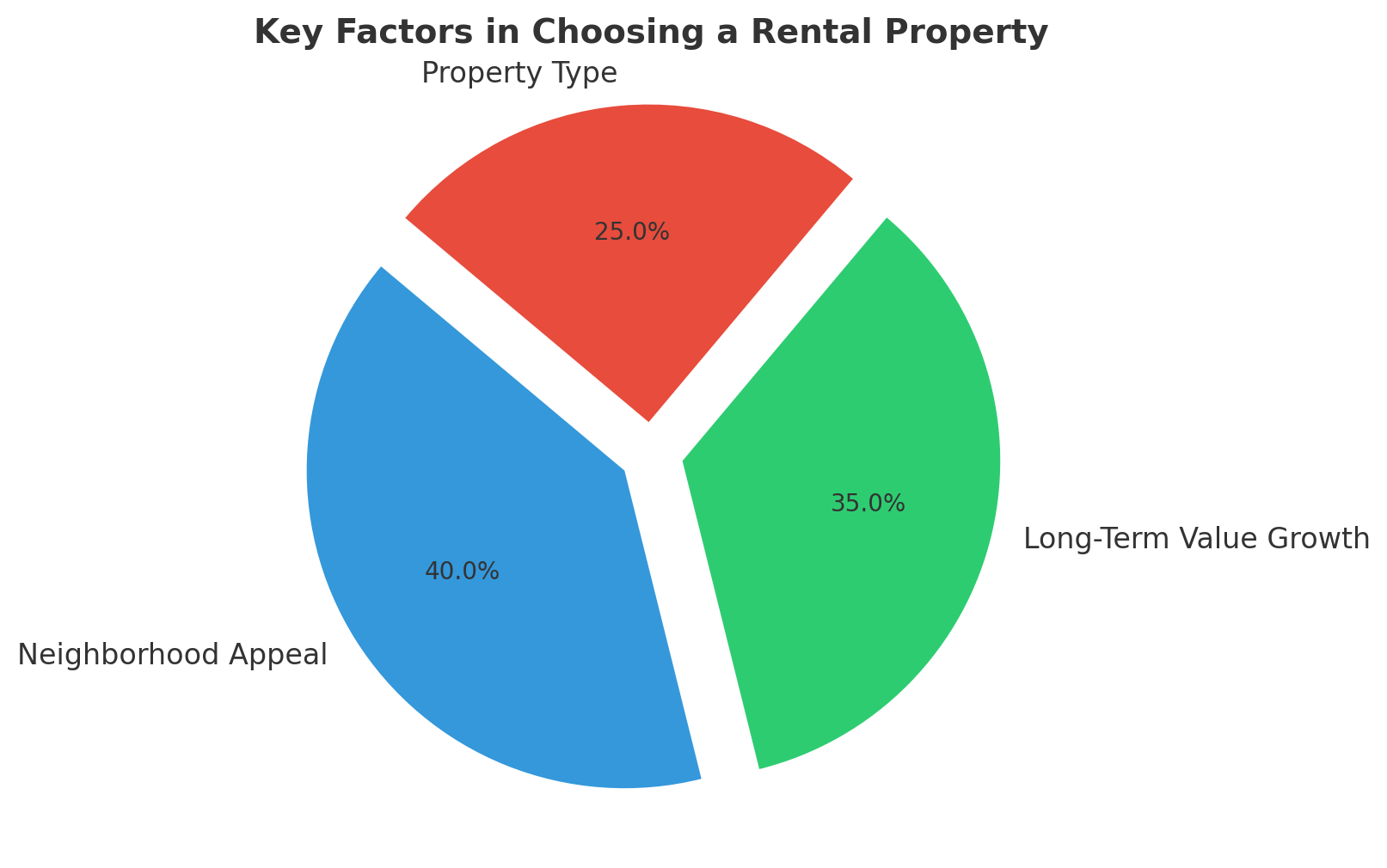

Key Factors to Consider:

- Neighborhood Appeal: Look for neighborhoods with strong rental demand. Proximity to amenities such as schools, parks, public transport, and shopping centers can significantly boost a property’s rental appeal.

- Long-Term Value Growth: Consider areas with potential for appreciation. Emerging neighborhoods with planned infrastructure developments often present excellent opportunities for future value growth.

- Property Type: Single-family homes and small multi-family properties are often easier to manage and more desirable to renters. Focus on properties that offer features like ample parking, low-maintenance landscaping, and functional layouts.

By selecting a property that meets these criteria, you ensure that your first home will not only serve your immediate needs but also thrive in the rental market.

Financing Your First Home

Securing the right financing is crucial when buying your first home with the intent to convert it into a rental. As an owner-occupant, you have access to more favorable loan terms compared to purchasing a property purely as an investment.

Exploring Financing Options:

- Low Down Payment Loans: Programs like FHA loans allow first-time buyers to secure a home with as little as 3.5% down. This lower barrier to entry makes it easier to get started.

- Favorable Interest Rates: Owner-occupied loans typically come with lower interest rates, reducing your monthly payments and increasing potential future cash flow when the property is rented.

- Leverage and ROI: By utilizing a low down payment loan, you maximize leverage, increasing your return on investment (ROI) once the property begins generating rental income.

Understanding these financial advantages allows you to enter the real estate market with confidence, knowing that your first purchase can set the foundation for future investments.

Converting Your Home into a Rental Property

Once you’re ready to move on from your first home, converting it into a rental property involves a few important steps. Proper preparation will ensure a smooth transition and maximize your rental income.

Preparing Your Property for Rent:

- Maintenance and Upgrades: Address any maintenance issues and consider upgrades that can increase rental value, such as modern appliances, fresh paint, and energy-efficient fixtures.

- Legal Considerations: Check local zoning laws and homeowners’ association (HOA) rules to ensure your property can be rented out. Obtain any necessary permits and ensure you comply with local regulations.

- Property Management: Decide whether to manage the property yourself or hire a professional property management company. While DIY management can save money, a management company can handle tenant relations, maintenance, and legal compliance, freeing up your time.

Taking these steps will not only make your property attractive to potential tenants but also protect your investment and ensure a steady stream of rental income.

Maximizing Rental Income

Setting the right rental price and attracting quality tenants are key to maximizing the profitability of your rental property. Here’s how you can optimize your rental income.

Strategies for Success:

- Market Research: Conduct a thorough analysis of local rental rates to set a competitive price that maximizes income while minimizing vacancies.

- Tenant Screening: Implement a rigorous screening process to ensure you select reliable tenants who will pay rent on time and take care of the property.

- Minimizing Turnover: Focus on tenant retention by addressing maintenance requests promptly and maintaining open communication. Happy tenants are more likely to renew their leases, reducing costly turnover.

By following these strategies, you can ensure that your rental property remains profitable and contributes positively to your overall investment strategy.

Repeating the Process to Build a Portfolio

With one successful rental property under your belt, the next step is to repeat the process, using the equity and income from your first property to acquire additional investments.

Scaling Your Portfolio:

- Leveraging Equity: As your first property appreciates, you can tap into its equity through refinancing or a home equity line of credit (HELOC) to fund the down payment on your next property.

- Using Rental Income: Channel the positive cash flow from your rental property into savings or reinvest it directly into acquiring additional properties.

- Diversification: As you grow your portfolio, consider diversifying across different property types and locations to mitigate risk and maximize returns.

This snowball effect allows you to build a robust portfolio of rental properties over time, each contributing to your financial independence.

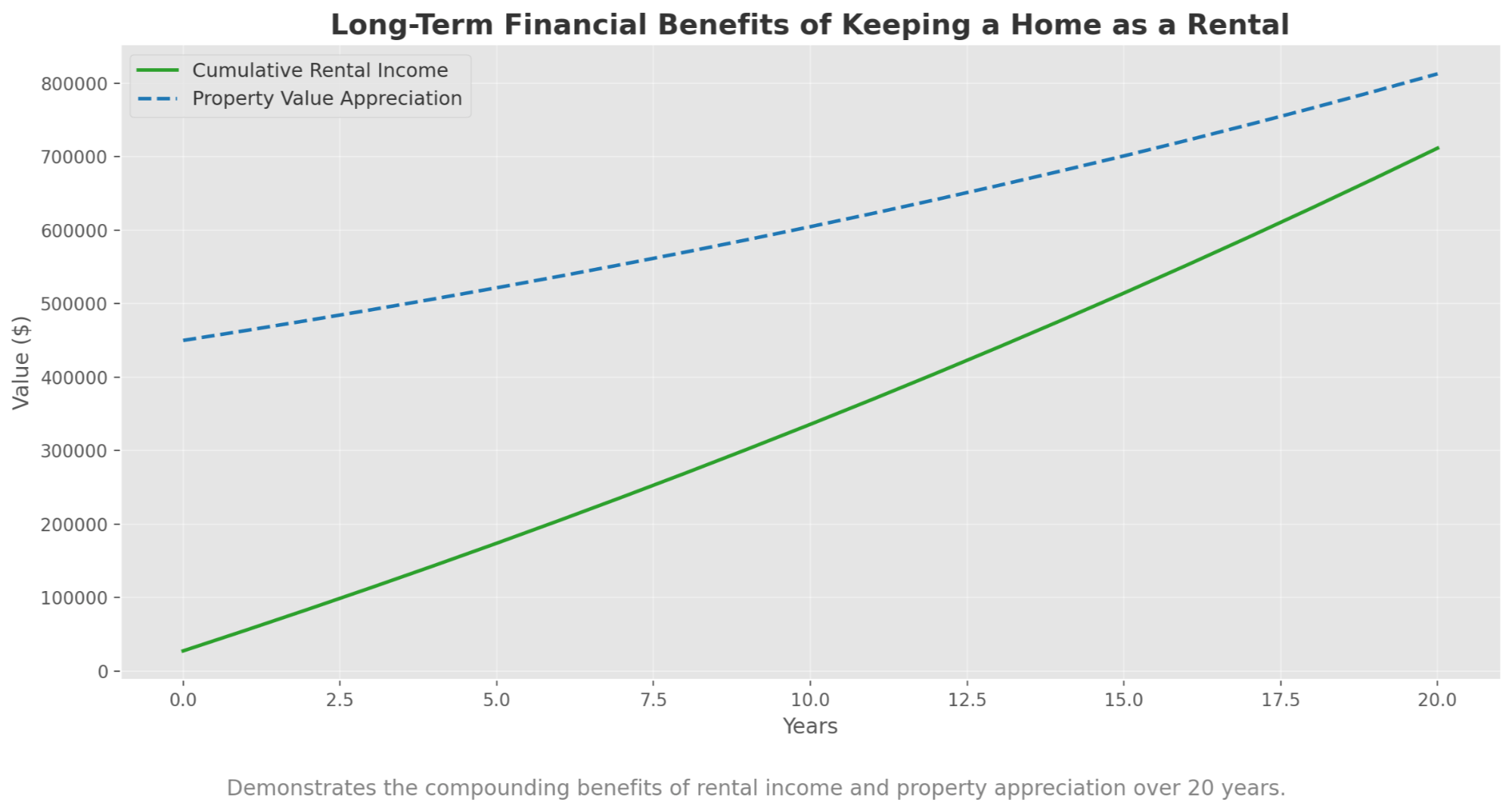

Long-Term Wealth Building Through Real Estate

Real estate is a long-term game, and the compounding effect of property appreciation, mortgage paydown, and rental income can lead to significant wealth accumulation.

The Power of Long-Term Strategy:

- Compounding Returns: As you hold onto properties over the years, the combined effects of appreciation and mortgage amortization will dramatically increase your equity.

- Tax Advantages: Real estate investors benefit from various tax advantages, including depreciation, which can offset rental income and reduce your tax liability.

- Financial Independence: With a well-managed portfolio, you can achieve financial independence, enjoying a steady stream of passive income that grows over time.

By staying committed to this strategy and continually seeking out opportunities to expand your portfolio, you can build substantial wealth through real estate, securing a financially prosperous future.

Real-World Scenarios in Arizona: Building Wealth by Turning Your First Home into a Rental Property

Scenario 1: The Starter Home in Goodyear, AZ

Example: Emma, a 28-year-old teacher, purchases her first home in Goodyear, AZ, a rapidly growing suburb of Phoenix known for its family-friendly neighborhoods and new developments. She buys a 3-bedroom, 2-bathroom home for $400,000 using an FHA loan with a 3.5% down payment.

- Rental Income: After living in the home for three years, Emma decides to move to a larger home but keeps her first property as a rental. She rents it out for $2,300 per month, which covers her mortgage and leaves her with $300 in positive cash flow.

- Equity Growth: The Goodyear area has seen consistent growth, with property values increasing due to new infrastructure and amenities. Her home appreciates to $450,000 over three years, allowing her to refinance and use the equity to purchase a second property in nearby Buckeye, AZ.

Sources:

- Roofstock: How to Build a Real Estate Portfolio

- All Property Management: How to Build a Real Estate Portfolio

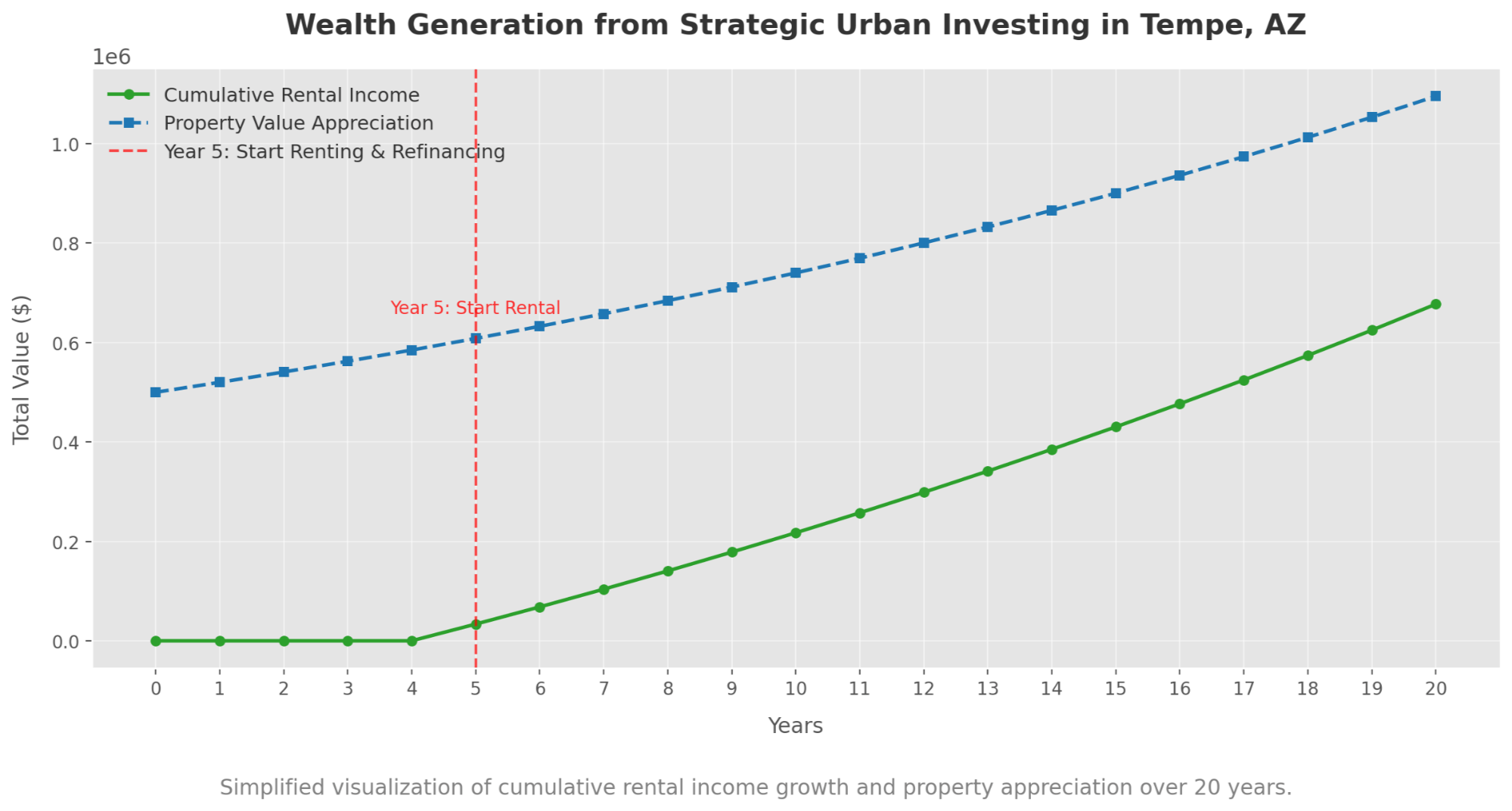

Scenario 2: Strategic Urban Investing in Tempe, AZ

Example: Carlos, a 30-year-old firefighter, buys a historic home in Tempe, AZ, a vibrant college town with a strong rental market due to Arizona State University. He purchases the home for $500,000, taking advantage of the area’s mix of students and young professionals seeking rental properties.

- Rental Income: After living in the property for five years, Carlos rents it out for $2,800 per month. The high demand for rental housing near the university ensures that his property is consistently occupied, providing $400 in monthly cash flow.

- Equity and Refinancing: The property appreciates significantly to $700,000 over five years, reflecting Tempe's strong market growth and demand for housing. This appreciation allows Carlos to refinance and pull out $100,000 in equity. He uses this capital to purchase a small multi-family property in Mesa, AZ, further diversifying his real estate portfolio.

Sources:

Scenario 3: Building a Portfolio in Chandler, AZ

Example: Sara and Tom, a young couple, purchase their first home in Chandler, AZ, for $550,000. Chandler is known for its tech industry presence and top-rated schools, making it a highly desirable area for families.

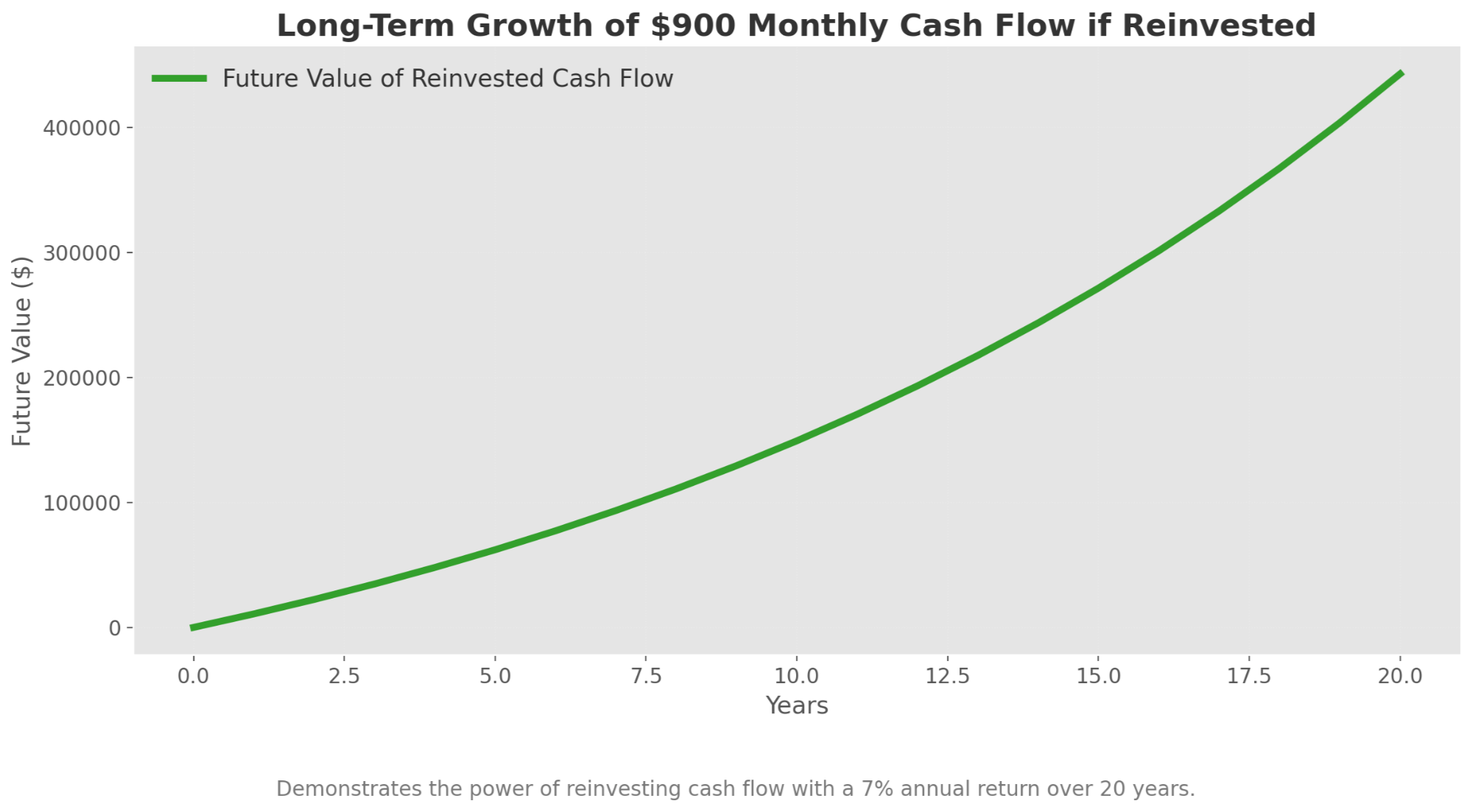

- Rental Income: After living in the home for just two years, they decide to move to a larger property. Rather than selling their first home, they convert it into a rental property. Given Chandler’s strong rental market, they rent the property for $3,200 per month, generating $900 in positive cash flow due to the home’s prime location near good schools and tech companies.

- Portfolio Growth: With the equity built up over two years and the rental income, Sara and Tom purchase additional rental properties in nearby Gilbert and Queen Creek, AZ. Their strategy focuses on selecting homes in areas with robust economic growth and strong rental demand, ensuring steady appreciation and cash flow.

Conclusion

These updated Arizona-specific scenarios reflect the current real estate market trends and demonstrate how turning your first home into a rental property can lead to significant financial growth. By strategically selecting locations like Goodyear, Tempe, and Chandler, leveraging equity, and reinvesting rental income, you can build a diversified and profitable real estate portfolio. Each of these cities offers unique advantages, from strong rental demand to appreciating property values, making them ideal for executing this wealth-building strategy.

Additional Sources and Links

-

Investopedia - Rental Property Investing

- Link: Investopedia Guide to Rental Property Investing

- Description: A comprehensive guide to rental property investing, covering everything from financing to management tips.

-

Roofstock - Real Estate Investing Resources

- Link: Roofstock Investing Resources

- Description: Roofstock provides valuable resources and insights for real estate investors, including market analysis and tips for buying rental properties.

-

BiggerPockets - Real Estate Investment Strategies

- Link: BiggerPockets Rental Property Strategy

- Description: BiggerPockets offers a wealth of information on rental property investing, including strategies for beginners and experienced investors.

-

Arizona Department of Housing

- Link: Arizona Department of Housing

- Description: Official site providing information on housing policies, market data, and programs specific to Arizona, which can be beneficial for understanding the local market.

-

RealtyTrac - Real Estate Market Trends

- Link: RealtyTrac Market Trends

- Description: RealtyTrac offers data and analysis on real estate market trends, foreclosures, and investment opportunities across the U.S., including Arizona.

-

Bankrate - Home Equity and Mortgage Guide

- Link: Bankrate Home Equity Guide

- Description: Bankrate provides detailed guides on home equity loans, HELOCs, and refinancing options, which are crucial for financing additional rental properties.

-

Arizona Real Estate Investors Association (AZREIA)

- Link: AZREIA - Arizona Real Estate Investors Association

- Description: AZREIA offers resources, networking opportunities, and education for real estate investors in Arizona.

-

U.S. Census Bureau - Housing Statistics

- Link: U.S. Census Bureau Housing Data

- Description: Access data on housing starts, homeownership rates, and rental vacancies, which can inform your investment strategy.

FAQs

Q: How long should I live in my first home before converting it into a rental property?

A: While there’s no set rule, many experts recommend living in your home for at least a year or two before converting it into a rental. This period allows you to establish equity and may also help you take advantage of owner-occupant mortgage rates, which are typically lower than investment property rates. Additionally, living in the home first can help you better understand the property and neighborhood, which can be beneficial when managing it as a rental.

Q: Can I use a property management company to handle my first rental property?

A: Yes, hiring a property management company is a great option, especially if you prefer not to handle the day-to-day responsibilities of being a landlord. A property management company can manage tenant screening, rent collection, maintenance, and legal issues, which can be particularly useful if you plan to scale your real estate investments and manage multiple properties.

Q: What are the potential risks of turning my first home into a rental property?

A: Some potential risks include fluctuations in the rental market, unexpected maintenance costs, and the challenge of managing tenants. It’s also important to consider the financial impact if the property remains vacant for an extended period. Proper planning, including setting aside emergency funds and conducting thorough tenant screening, can help mitigate these risks.

Q: How do I set the right rental price for my property?

A: To set the right rental price, research the local rental market by looking at similar properties in your area. Consider factors like the size, location, and condition of your property. Online tools and rental pricing calculators can also provide guidance. Setting a competitive price is crucial to attracting tenants and minimizing vacancy rates.

Q: What is the best way to finance additional rental properties after converting my first home?

A: There are several ways to finance additional rental properties, including using the equity in your first property through a cash-out refinance or home equity line of credit (HELOC). You can also consider conventional investment property loans, portfolio loans, or even partnering with other investors to pool resources. Each option has its pros and cons, so it’s essential to choose the one that aligns with your financial goals and risk tolerance.

Categories

- All Blogs (253)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.