Why Solar Panels May Not Be the Best Investment for Arizona Homeowners: A Comprehensive Financial Analysis

In Arizona, where the sun shines almost year-round, solar energy seems like an obvious choice for homeowners looking to cut down on their electricity bills. However, the financial realities of installing solar panels aren't as straightforward as they might seem. This comprehensive guide will explore the costs, savings, and the impact on your home's value, particularly when the system is leased or financed, and why you might be better off investing your money elsewhere.

The Investment: Upfront Costs vs. Potential Savings

The average cost for a solar panel system in Arizona is about $28,426 before incentives, and after applying the federal solar tax credit, this drops to around $19,898(NerdWallet: Finance smarter)(EnergySage). Let’s break down the savings if this system eliminates your electricity bill entirely throughout the year:

-

Initial Cost: $40,000 for a standard solar panel system (before incentives).

-

Annual Savings:

- Summer Months (June - September): Average monthly savings of $400 (with bills ranging from $300 to $500).

- Fall, Winter, and Spring (October - May): Average monthly savings of $150 (with bills ranging from $100 to $200).

Assuming four high-usage months and eight lower-usage months:

- Total Summer Savings: $400 x 4 = $1,600

- Total Fall/Winter/Spring Savings: $150 x 8 = $1,200

- Total Annual Savings: $1,600 + $1,200 = $2,800

-

Time to Break Even: If you save $2,800 annually, it would take approximately 14.3 years to break even on your $40,000 investment ($40,000 ÷ $2,800 ≈ 14.3 years).

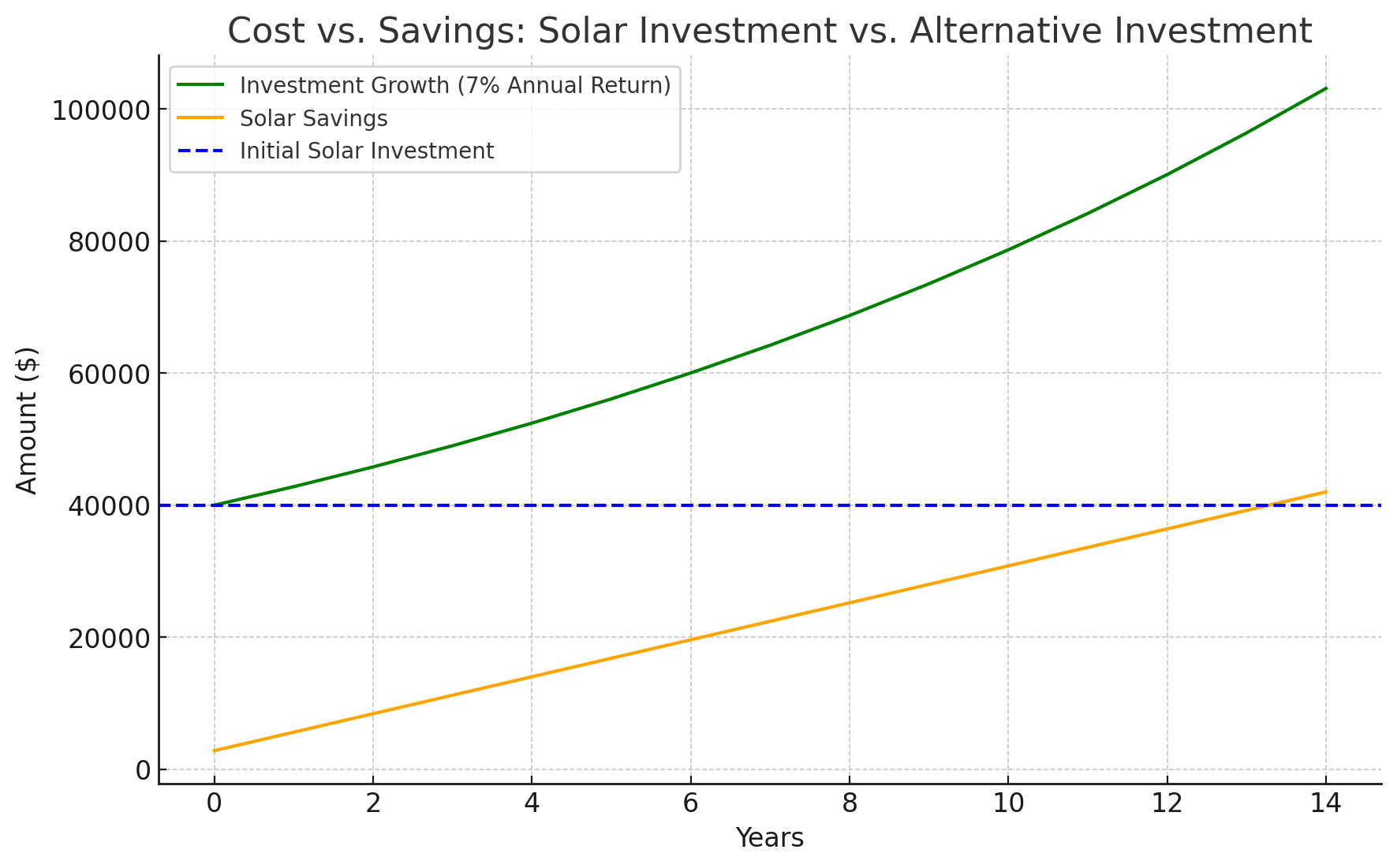

Visual Aid: Cost vs. Savings

To better illustrate the financial implications, consider the following graph. It compares the cumulative savings from solar panels over 14.3 years with the potential growth of a $40,000 investment in a diversified portfolio yielding a 7% annual return.

As shown in the graph:

- Green Line: Represents the growth of a $40,000 investment over 14.3 years with a 7% annual return.

- Orange Line: Represents the cumulative savings from solar over the same period, based on an annual savings of $2,800.

- Blue Dashed Line: Represents the initial $40,000 investment in the solar system.

The comparison shows that investing the $40,000 in a diversified portfolio with a 7% return significantly outpaces the savings achieved through solar panels over the same period. This visual aid reinforces the idea that the opportunity cost of not investing the $40,000 elsewhere could lead to substantially greater financial gains.

Alternative Investment: The Power of Compounding Returns

Now, let’s consider an alternative scenario. Instead of spending $40,000 upfront on a solar system, you could invest that money in a diversified portfolio with a conservative annualized return of 7%. Here's how that investment would grow over the same 14.3 years:

- Initial Investment: $40,000

- Annual Return: 7%

- Investment Period: 14.3 years

Using the formula for compound interest, by the end of 14.3 years, your $40,000 investment would grow to approximately $108,720. This return is significantly higher than the potential savings from the solar panels, highlighting the opportunity cost of investing in solar(NerdWallet: Finance smarter).

Engaging Question:

Is tying up $40,000 in solar panels the best use of your money, or could investing that amount elsewhere yield better returns?

Financing Solar: A Risky Bet

Financing a solar panel system may seem like a smart way to avoid the upfront cost, but it comes with significant drawbacks that can affect your financial stability and the future sale of your home:

-

Interest Costs: When you finance a $40,000 solar system at 5% interest over 15 years, the total cost balloons to approximately $56,880, adding over $16,000 to your original investment. This increases the time it takes to see any real financial benefit from the system(Solar).

-

Impact on Home Value: While an owned solar system can add some value to your home, this is only true if the system is fully paid off. If you still owe money on the solar panels, this debt could complicate the sale of your property. The new buyer would either have to assume the loan, which might not be appealing, or you would have to pay off the remaining balance before completing the sale. This can be a significant financial burden and could even deter potential buyers(NerdWallet: Finance smarter)(EcoWatch).

-

Savings vs. Payments: If your monthly loan payment is $400 but your energy savings are only $233 (based on annual savings of $2,800 ÷ 12 months), you’re effectively losing $167 each month. This adds up to $2,004 in losses every year, making the financial benefits of solar much less attractive(NerdWallet: Finance smarter).

Leased Solar Systems: A Complex and Costly Dilemma

Leasing solar panels might seem like an easier option than financing or paying upfront, but it brings its own set of complications:

-

No Added Value to Your Home: Since you don’t own the leased system, it doesn’t increase your property’s value. In fact, it can sometimes be seen as a liability by potential buyers(EcoWatch).

-

Complex Sale Process: Selling a home with leased solar panels can be tricky. The new buyer must qualify to take over the lease, which can be a hurdle in the sales process. Alternatively, you might have to pay off the lease in full before selling the home, which can be a substantial cost that eats into your sale profits(NerdWallet:Finance smarter).

-

Limited Financial Gains: Even if the leased system covers your electricity bill, the lease payments might not be much lower than your previous utility bills, meaning the net financial benefit is minimal(EcoWatch).

Owned Solar Systems: Potential for Long-Term Benefits

If you can afford to purchase the system outright, the financial outlook improves:

-

Home Value Increase: An owned solar system can increase your home’s value, though often not enough to recoup the full investment (EcoWatch).

-

Long-Term Savings: Without loan payments, your monthly savings are more significant, and over time, these can add up. After about 14.3 years, you could start seeing real returns on your investment, provided the system continues to perform well (EnergySage).

-

Incentives and Storage Costs: Arizona offers various incentives, including state income tax credits and property tax exemptions. However, these do not always offset the high initial costs. Additionally, many homeowners opt to include a solar battery system to store energy for use during non-peak sun hours. This addition can increase the overall system cost by $12,000 to $22,000, further extending the payback period(NerdWallet: Finance smarter)(EcoWatch).

APS and SRP: Are the Incentives Worth It?

Arizona's utility companies, APS and SRP, offer incentives and buyback programs for solar energy, but these come with limitations:

-

Net Metering: Both APS and SRP offer net metering, where you can sell excess energy back to the grid. However, the buyback rates have been decreasing, reducing the financial benefits(EcoWatch).

-

Incentives: APS and SRP provide rebates, but these are often capped and may not significantly reduce the system’s overall cost(NerdWallet: Finance smarter).

-

Utility Rates: Both companies have adjusted their rate structures in ways that reduce the financial returns of solar, such as increasing peak-time rates or charging higher fees for solar customers(EcoWatch).

The Bottom Line: Should You Invest in Solar?

For most Arizona homeowners, particularly those considering leasing or financing, solar may not be the best investment. The high initial costs, the burden of loans or leases, and the complicated impact on your home’s value and saleability make solar less appealing.

However, if you can purchase the system outright and plan to stay in your home long enough to see the returns, solar can provide long-term savings. But even in this scenario, consider the opportunity cost of not investing that $40,000 elsewhere. With a conservative investment approach, you could potentially more than double your money over the same period(Solar).

Before making a decision, carefully consider your energy needs, financial situation, and long-term plans. While solar energy might seem like a bright idea, without careful consideration, it could end up being a dim financial decision.

References:

- NerdWallet - Solar Panels in Arizona: Costs, Trends, Incentives(NerdWallet: Finance smarter)

- EnergySage - Solar Panel Cost in Arizona: September 2024 Prices

- Solar.com - Are Solar Panels Worth It? Calculate Your Return on Investment

- EcoWatch - Is Solar Worth It in Arizona? (2024 Homeowner's Guide)

Categories

- All Blogs (253)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.