Mortgage Payoff vs. Investing: How to Leverage Your Home and Build Wealth Faster

One of the most critical decisions for homeowners is whether to pay off a mortgage early or invest extra capital. This blog will explore various scenarios, demonstrating how leverage — using borrowed capital to invest — can be a powerful tool in building wealth. I’ll analyze the opportunity costs of paying off a mortgage compared to investing that same money, showing why it’s often more beneficial to keep your capital working for you in investments rather than sitting in an asset like your home.

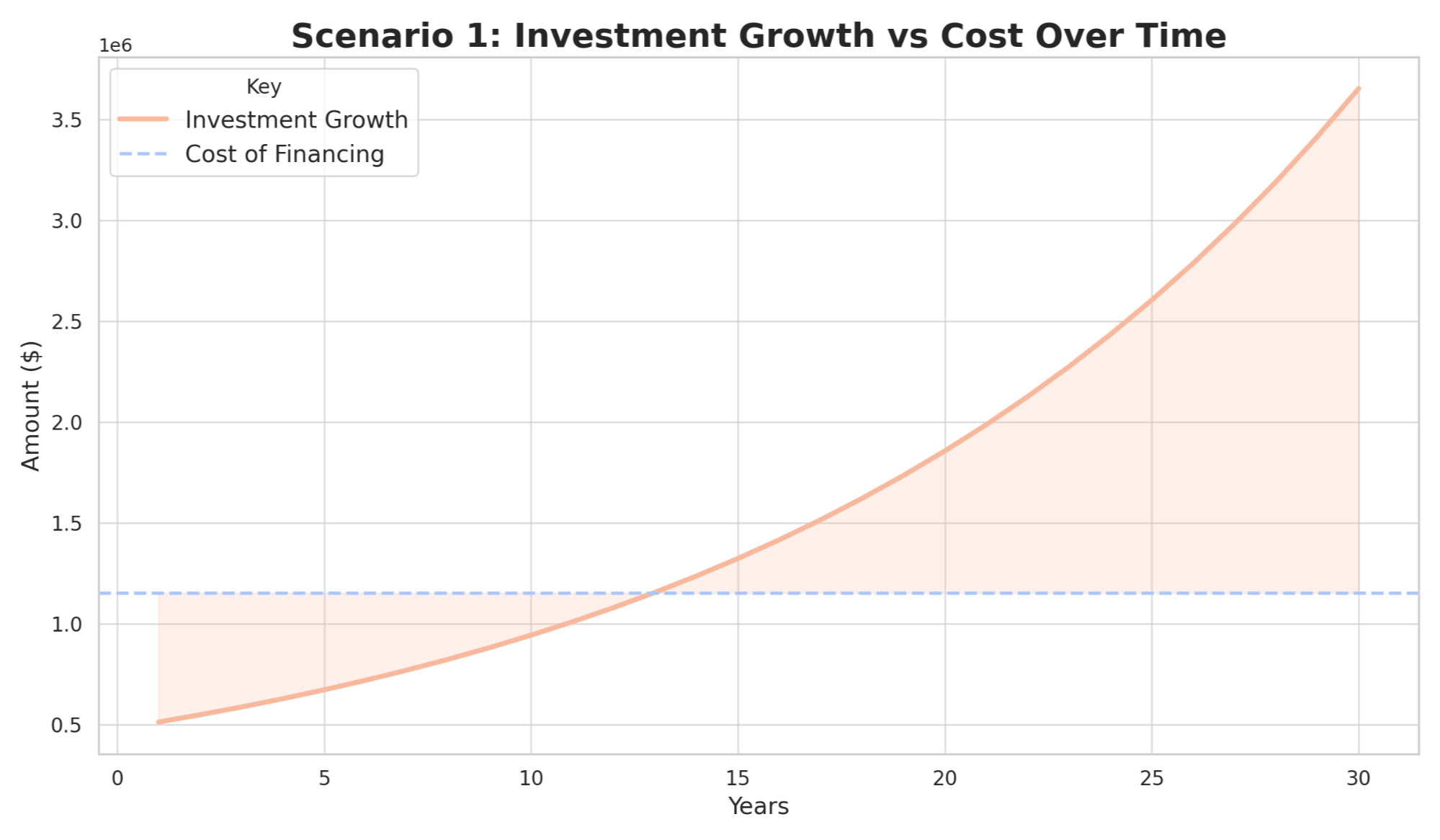

Scenario 1: Cash Purchase vs. Financing at 6% for a $600,000 Home

In this scenario, let’s compare two options for buying a $600,000 home:

- Paying Cash: The homeowner buys the home outright without financing.

- Financing at 6%: The homeowner finances 80% of the home’s value ($480,000) with a 30-year mortgage at a 6% interest rate, putting down 20% ($120,000).

Paying in Cash

When you pay in cash, the benefits are straightforward:

- Home Price: $600,000

- Interest Paid Over 30 Years: $0

- Total Cost: $600,000

Paying in cash means no interest payments, and you own your home outright immediately. However, by putting all your capital into your home, your money is no longer working for you. Your home, while valuable, doesn’t generate returns beyond potential appreciation.

Financing at 6% Interest with 20% Down

If you choose to finance the home, the numbers look like this:

- Down Payment: $120,000

- Loan Amount: $480,000

- Monthly Payment: $2,878 (based on 6% over 30 years)

- Total Interest Paid Over 30 Years: $552,951

By financing, you’ll pay a significant amount in interest over the loan term. However, your capital remains available for investment.

Opportunity Cost: Investing the $480,000 Instead of Paying Cash

What happens if you finance the home and invest the $480,000 you would have used to pay for it outright?

- Initial Investment: $480,000

- Average Annual Return: 7% (assumed stock market return)

- Investment Term: 30 years

If you invest the $480,000 at a 7% average annual return over 30 years, it grows to $3,658,584. Even after accounting for the $552,951 in mortgage interest payments, you would come out ahead with a net gain of $3,105,633.

Leverage: How It Builds Wealth

In this scenario, leverage is working in your favor. By taking on a mortgage, you’re using the bank’s money to finance your home while keeping your capital invested and growing. This allows your money to work for you rather than sitting idle in a non-productive asset.

Summary: Paying cash avoids interest, but financing allows you to leverage your capital for greater returns through investment. For those focused on wealth-building, leveraging your home with a mortgage while investing the available cash can be one of the most powerful tools in your financial strategy.

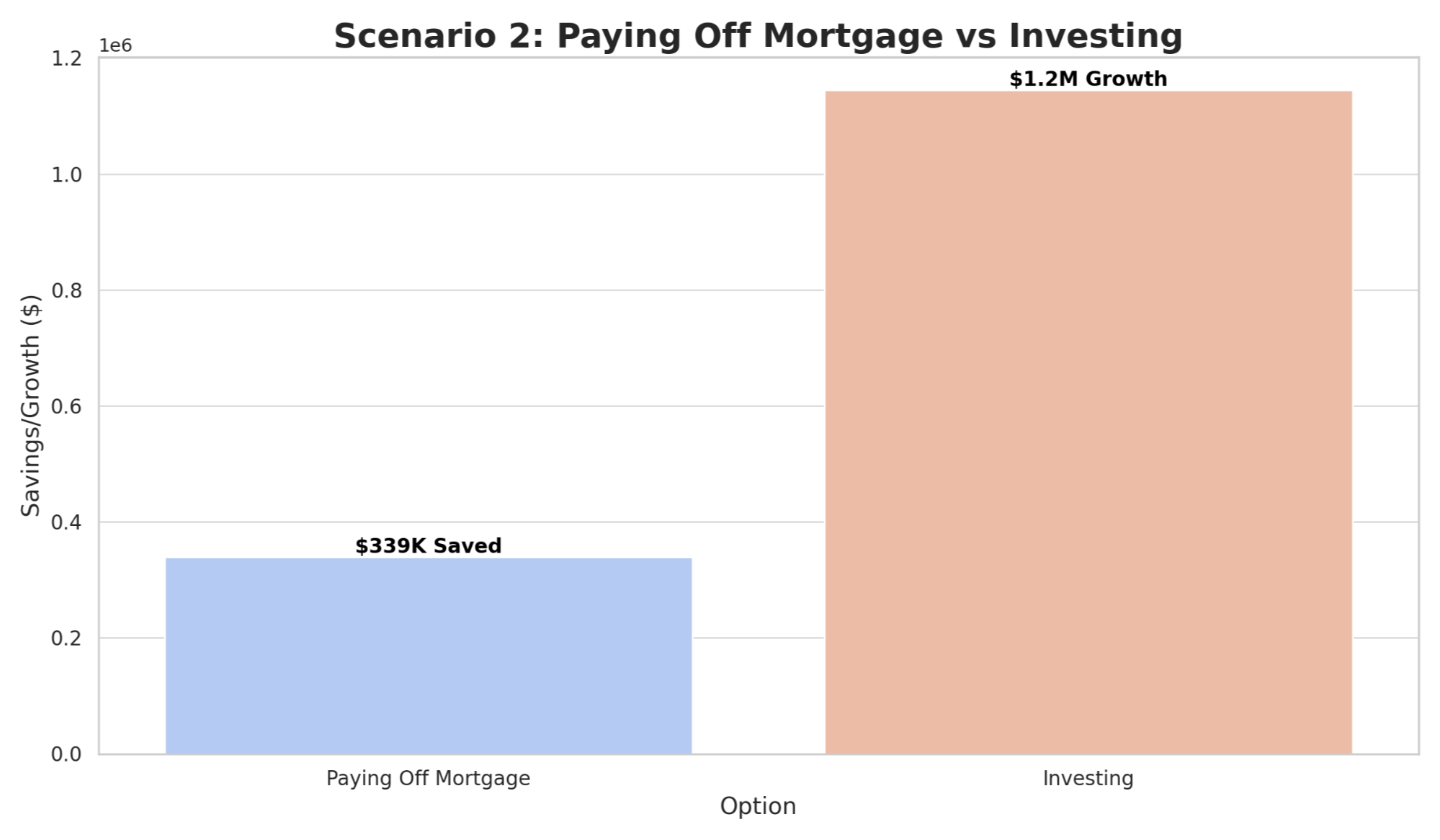

Scenario 2: Paying Off the Mortgage After 10 Years vs. Investing

Let’s say a homeowner has been making regular mortgage payments for 10 years and is now considering paying off the remaining balance. We’ll compare the cost savings of paying off the mortgage versus the potential gains of investing that lump sum.

Mortgage Terms

- Home Price: $600,000

- Down Payment: $120,000 (20%)

- Loan Amount: $480,000

- Interest Rate: 6%

- Monthly Payment: $2,878

- Original Loan Term: 30 years

After 10 Years: Remaining Mortgage Balance

After 10 years of payments, the remaining balance on the mortgage is approximately $398,000.

Option 1: Paying Off the Mortgage

If the homeowner chooses to pay off the remaining $398,000 mortgage balance, they save on the interest payments that would have been made over the next 20 years. The total interest saved by paying off the mortgage early is approximately $339,300.

Option 2: Investing the $398,000 Instead

If the homeowner decides not to pay off the mortgage and instead invests the $398,000, the results are as follows:

- Initial Investment: $398,000

- Average Annual Return: 7%

- Investment Term: 20 years (remaining mortgage term)

In this scenario, the $398,000 invested at a 7% annual return grows to $1,542,613 over the next 20 years.

Opportunity Cost: Payoff vs. Investing

- Interest Saved by Paying Off the Mortgage: $339,300

- Total Investment Growth by Investing: $1,542,613

The opportunity cost of paying off the mortgage early is the potential $1,203,313 in additional gains you would have made by investing that amount instead.

Summary: Paying off the mortgage provides a sense of security, but it comes with a steep opportunity cost. If your goal is building wealth, investing the money instead of paying off your mortgage can significantly increase your financial returns.

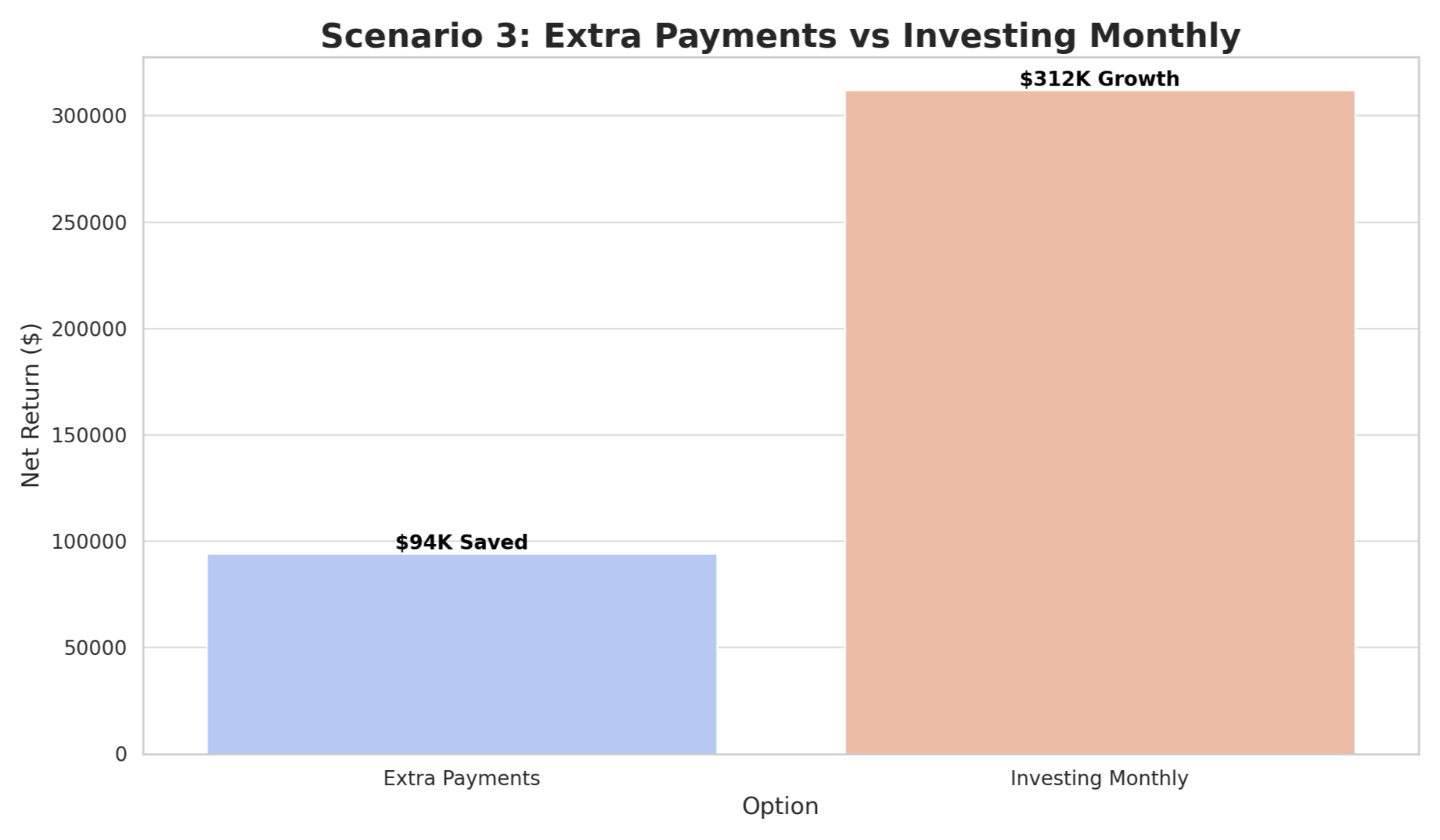

Scenario 3: Monthly Extra Payments vs. Investing

In this final scenario, we explore whether it’s better to make extra monthly payments toward the mortgage or invest that extra cash.

Making Extra Payments

Let’s assume the homeowner can afford to put an extra $500 per month toward their mortgage.

- Additional Monthly Payment: $500

- Interest Rate: 6%

- Mortgage Term: 30 years

By making these extra payments, the homeowner can pay off the mortgage approximately 5 years earlier and save $94,000 in interest.

Investing the Extra $500

Alternatively, the homeowner could invest the extra $500 per month at an average return of 7%.

- Monthly Investment: $500

- Investment Term: 25 years (the time it would take to pay off the mortgage early)

By investing the $500 monthly, the investment grows to approximately $406,000 over the 25-year period.

Opportunity Cost: Extra Payments vs. Investing

- Interest Saved by Extra Payments: $94,000

- Investment Growth by Investing: $406,000

The opportunity cost of making extra payments instead of investing is missing out on $312,000 in potential returns.

Summary: Making extra payments toward the mortgage may feel like a prudent move, but from a wealth-building perspective, investing the extra money can yield far greater financial returns.

Leveraging Your Capital to Build Wealth

When considering whether to pay off your mortgage or invest, it’s essential to understand how leverage works. By borrowing money at a low interest rate (your mortgage), you can use your capital for higher-return investments rather than letting it sit idle in a home. A home is not a productive asset in the same way that investments are — it doesn’t generate income or compound in value like stocks or other investment vehicles.

By using leverage, you allow your capital to work for you, growing your wealth over time. The key takeaway is that leveraging your home financing while investing can significantly boost your financial position in the long term, especially if your investments outperform the interest rate on your mortgage.

Tailoring the Strategy to Your Financial Goals

Whether you're considering a cash purchase, mortgage payoff, or extra payments, the decision should align with your financial goals. For homeowners looking to build wealth, leveraging your mortgage while investing offers the best opportunity to grow your capital over time. Rather than letting your money sit in an asset that isn’t working for you, you can use it to build a portfolio that compounds and delivers returns.

If you’re unsure about the best strategy for your unique financial situation, feel free to schedule time with me below to discuss your personal situation.

Categories

- All Blogs (249)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (11)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (155)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (35)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (95)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (33)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (56)

- Scottsdale Arizona (14)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (23)

- Verrado (14)

- Vistancia (11)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.