The Magic of Compound Interest: How Small Investments Grow into Big Wealth Over Time

Compounding is one of the most effective ways to grow your wealth. It’s simple, it’s powerful, and it’s something anyone can take advantage of. Compounding happens when the money you earn from an investment starts to earn money itself. Over time, this snowball effect can lead to impressive results, even with small amounts of money.

I’ll break down how compounding works, explore a few simple scenarios, and show how you can use this powerful tool to your advantage.

What is Compounding?

At its core, compounding is when you earn interest on both your initial investment and the interest that has already been added. In simple terms, your money makes more money, and then that new money makes even more.

Think of it like planting a tree. In the beginning, it’s just a small seed, but as it grows, it sprouts branches and leaves. As the years go by, the tree produces more seeds, which grow into more trees. Eventually, you have a whole forest from that single seed.

Scenario 1: Starting Small, Growing Big

Let’s look at a simple example. Imagine you invest $100 today in an account that earns 5% interest each year. After one year, you’ll have $105. In the second year, you won’t just earn interest on the original $100—you’ll earn interest on the $105. By the end of the second year, you’ll have $110.25.

It might not seem like much at first, but as the years go by, the interest starts earning interest. By year 10, your $100 investment will grow to about $163. By year 20, it will be $265. Over time, the growth speeds up, and that’s the magic of compounding.

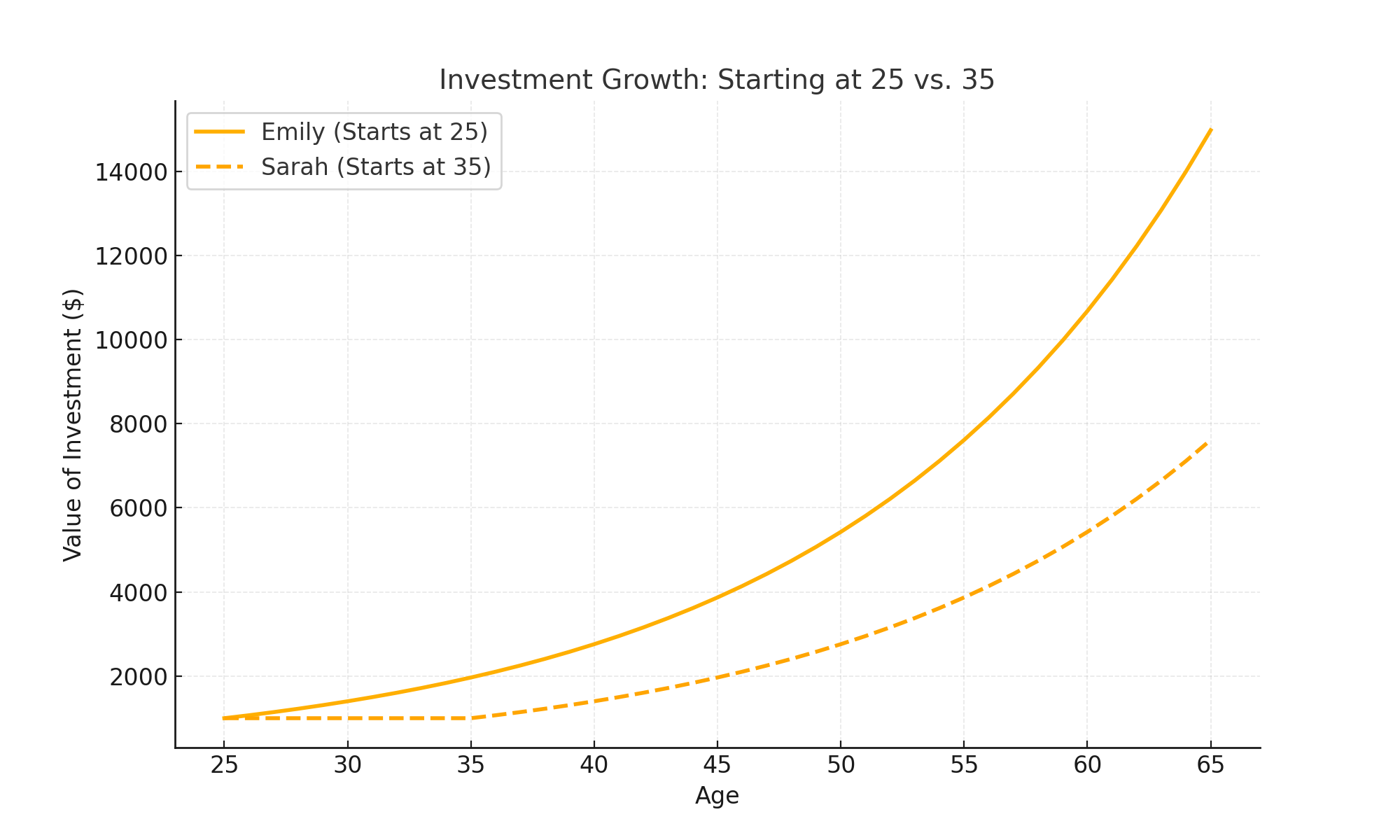

Scenario 2: Starting Early vs. Starting Late

Here’s a powerful example that shows why starting early is so important. Let’s say two friends, Emily and Sarah, both invest $1,000, but Emily starts when she’s 25 years old, and Sarah waits until she’s 35. They both invest in the same account that earns 7% per year, and neither adds any more money after the initial $1,000.

By the time they’re both 65, Emily’s $1,000 will have grown to around $15,000. Sarah’s investment, even though it’s the same amount in the same account, will only have grown to about $7,600 because she started 10 years later. That’s nearly double the amount just because Emily gave her money more time to grow.

Scenario 3: Adding Regular Contributions

Now, let’s say you don’t just make one investment but add to it regularly. Imagine you start with $500 and add $50 every month to an account that earns 6% per year. After 20 years, you’ll have contributed $12,500, but thanks to compounding, your account will have grown to nearly $24,000.

This shows how powerful regular contributions can be. Even small amounts, when added consistently over time, can grow into a substantial sum.

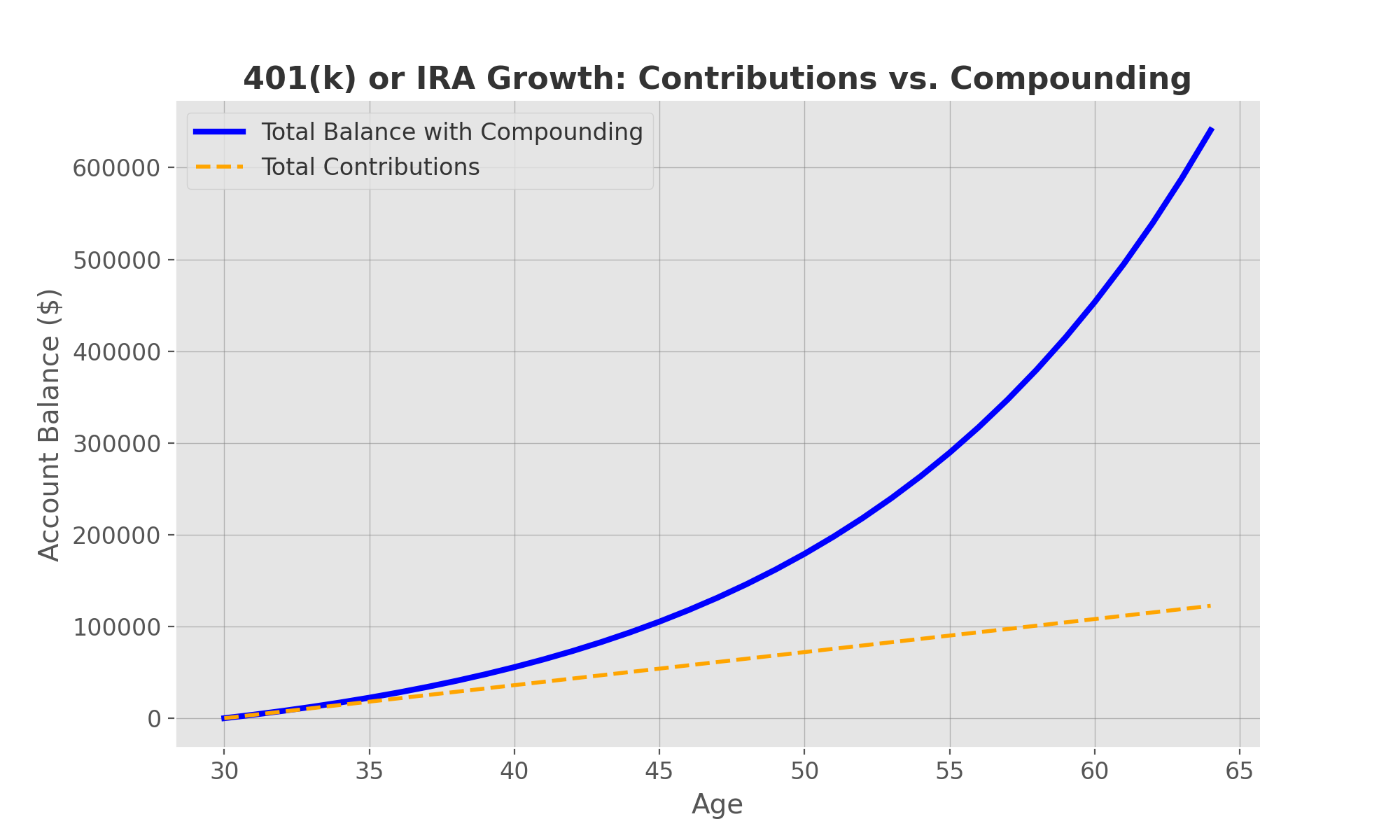

Scenario 4: Compounding in a Retirement Account

Let’s say you’re contributing to a 401(k) or IRA, both of which are common retirement accounts. One of the great things about these accounts is that they grow tax-deferred, meaning you don’t pay taxes on the money as it grows. This allows your money to compound even faster because more of it stays in the account.

Imagine you contribute $300 a month to a retirement account that earns 8% per year starting at age 30. By the time you’re 65, you will have contributed $126,000, but thanks to compounding, your account will have grown to over $560,000.

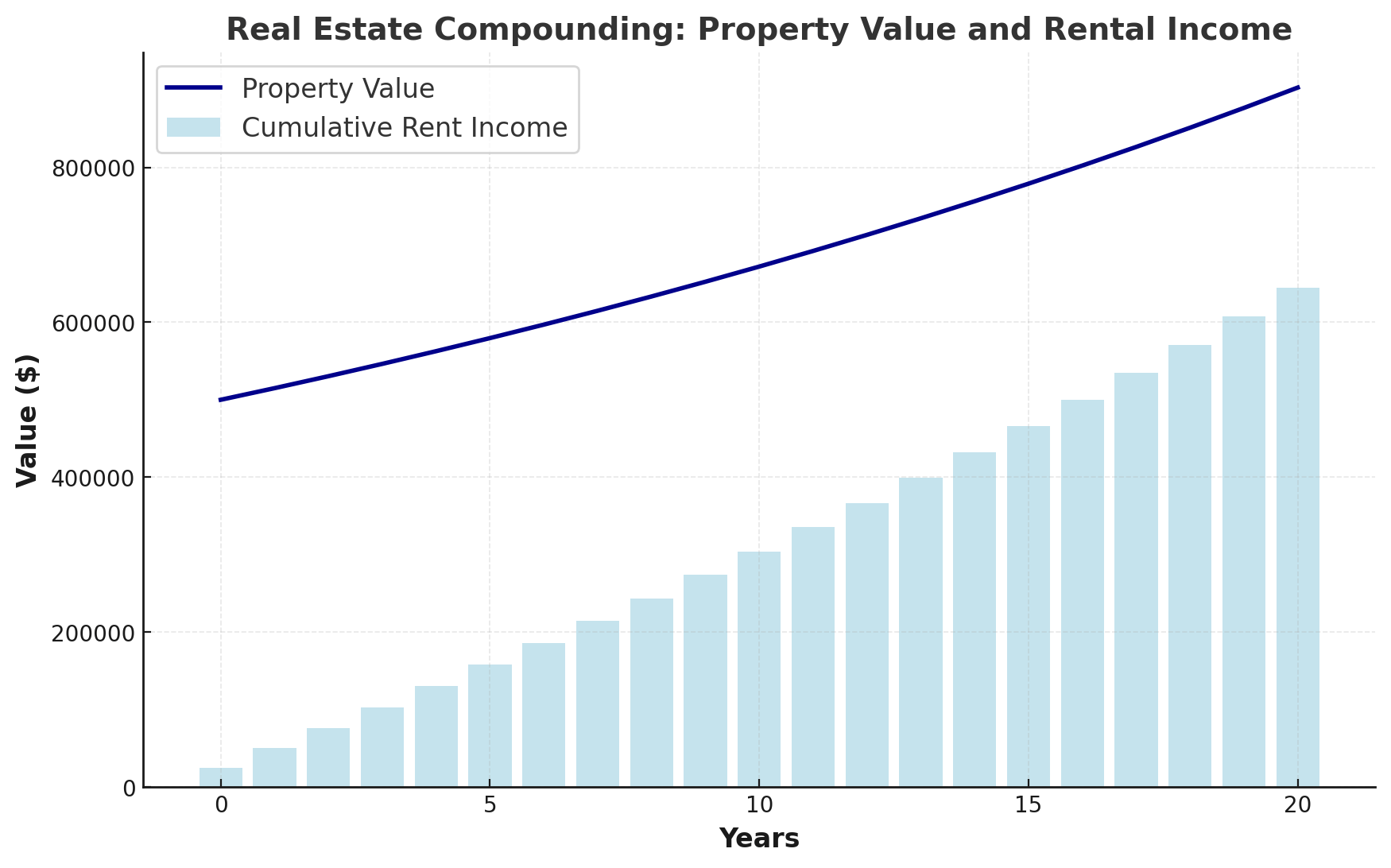

Scenario 5: Compounding in Real Estate with a $500,000 Property

Compounding doesn’t just apply to savings or stocks—it can also work with real estate. Let’s say you buy a rental property for $500,000. Over the years, you collect rent, and you reinvest that money into paying down the mortgage or making improvements to the property. As time passes, both the value of the property and the rental income can grow, creating a powerful compounding effect.

For example, after 20 years, your property might increase in value to $800,000, and the rent you collect could be significantly higher than when you first bought the property. The rental income helps pay down the mortgage while the property's value appreciates, creating multiple layers of financial growth. If you decide to sell the property after 20 years, the profits, combined with the rental income you’ve collected over time, could lead to a significant return on investment. This illustrates how compounding works in real estate—letting the value of an asset grow while reinvesting any income generated from it.

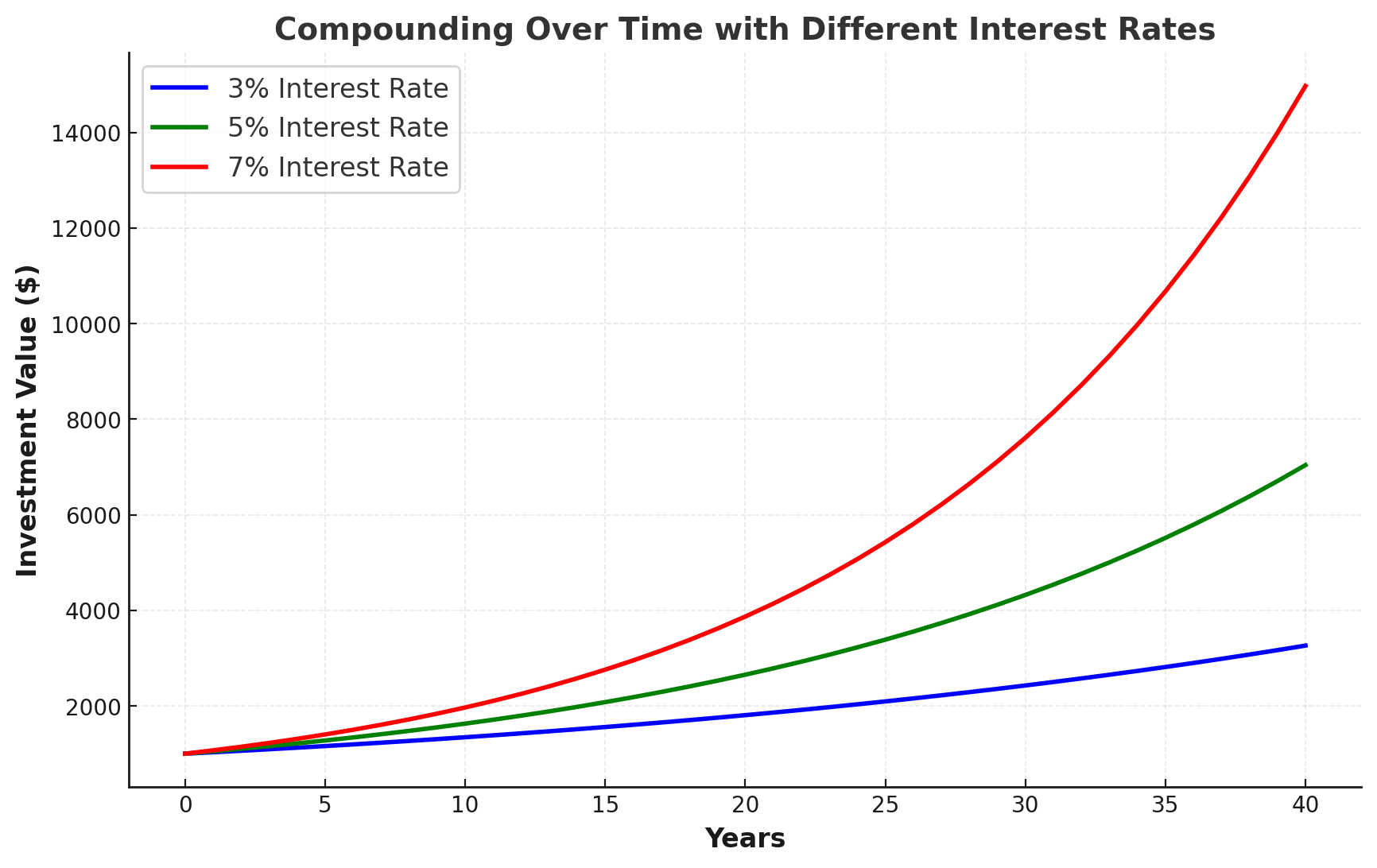

Compounding Over Time with Different Interest Rates

One of the key factors in compounding is the interest rate. Here's how an investment of $1,000 grows at different rates of return over 40 years:

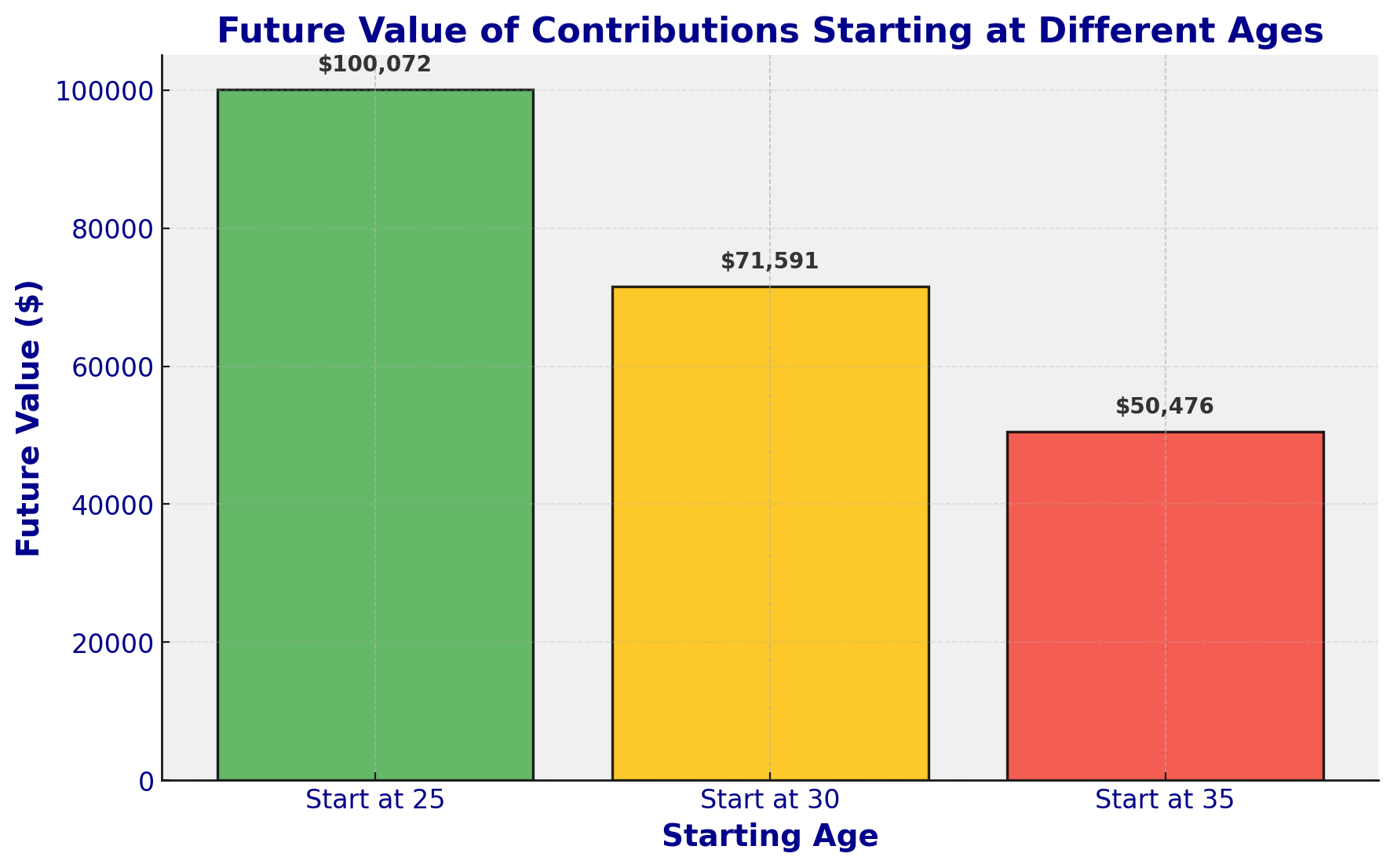

Impact of Delayed Contributions

Starting regular contributions later in life can have a major impact on the total amount you end up with. This visual shows the difference between starting at age 25, 30, and 35 with $50 monthly contributions at a 6% interest rate:

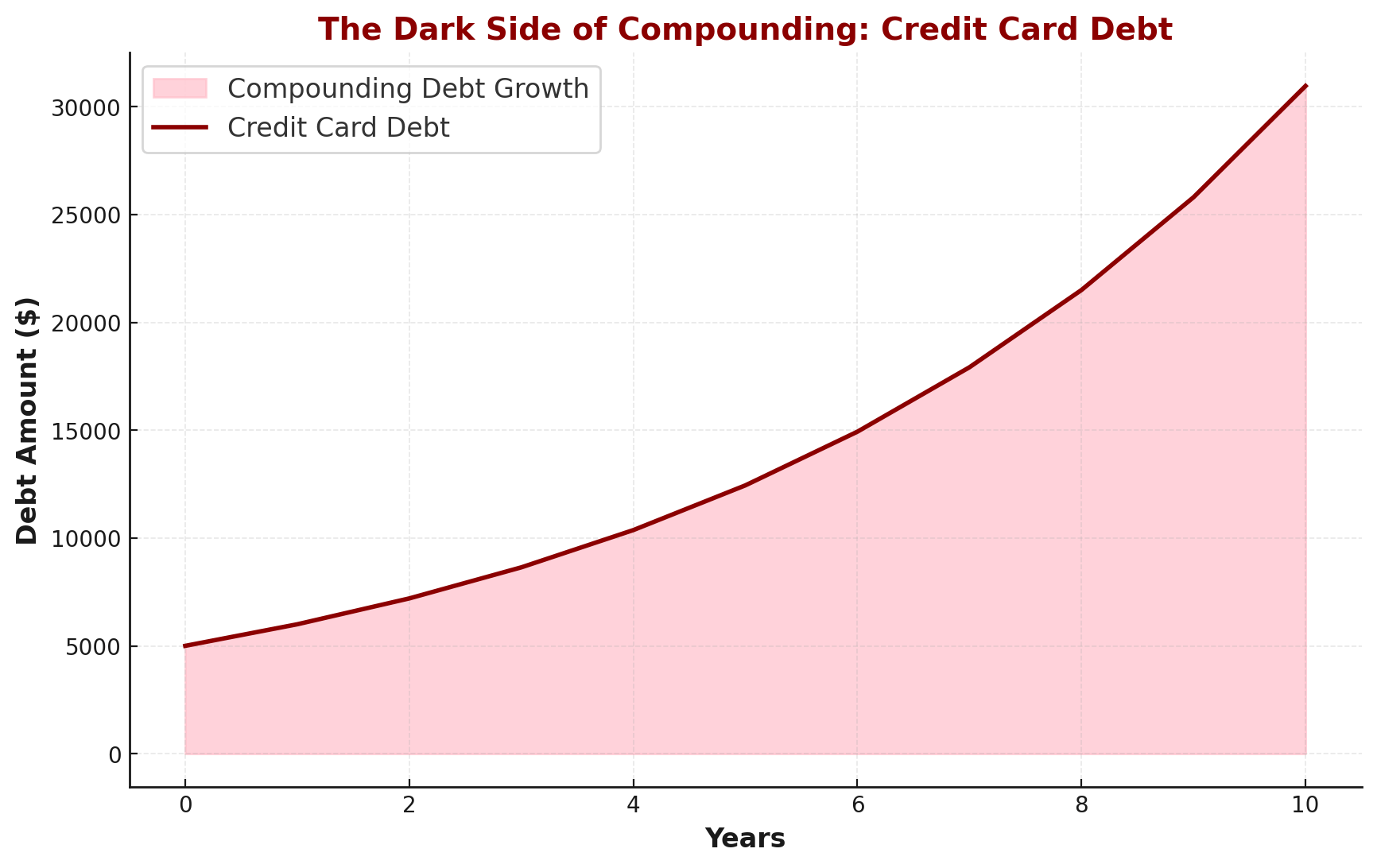

The Dark Side of Compounding: Debt

Compounding doesn’t just help investments grow—it can also make debts, like credit card balances, balloon out of control if left unchecked. Here’s what happens to a $5,000 credit card debt with a 20% annual interest rate if only minimum payments are made:

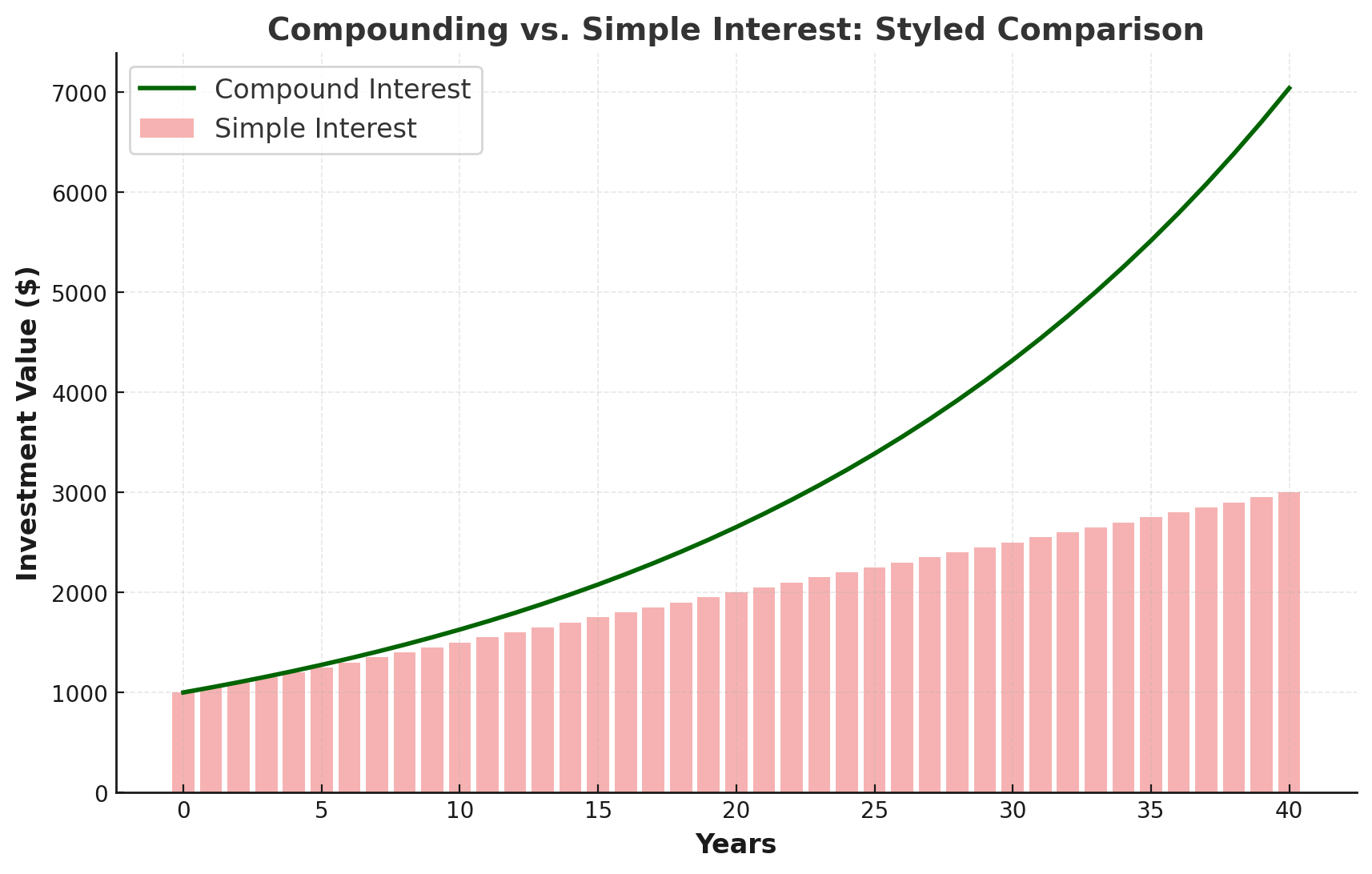

Compounding vs. Simple Interest

To help highlight the difference between compounding and simple interest, here’s a visual comparing the two:

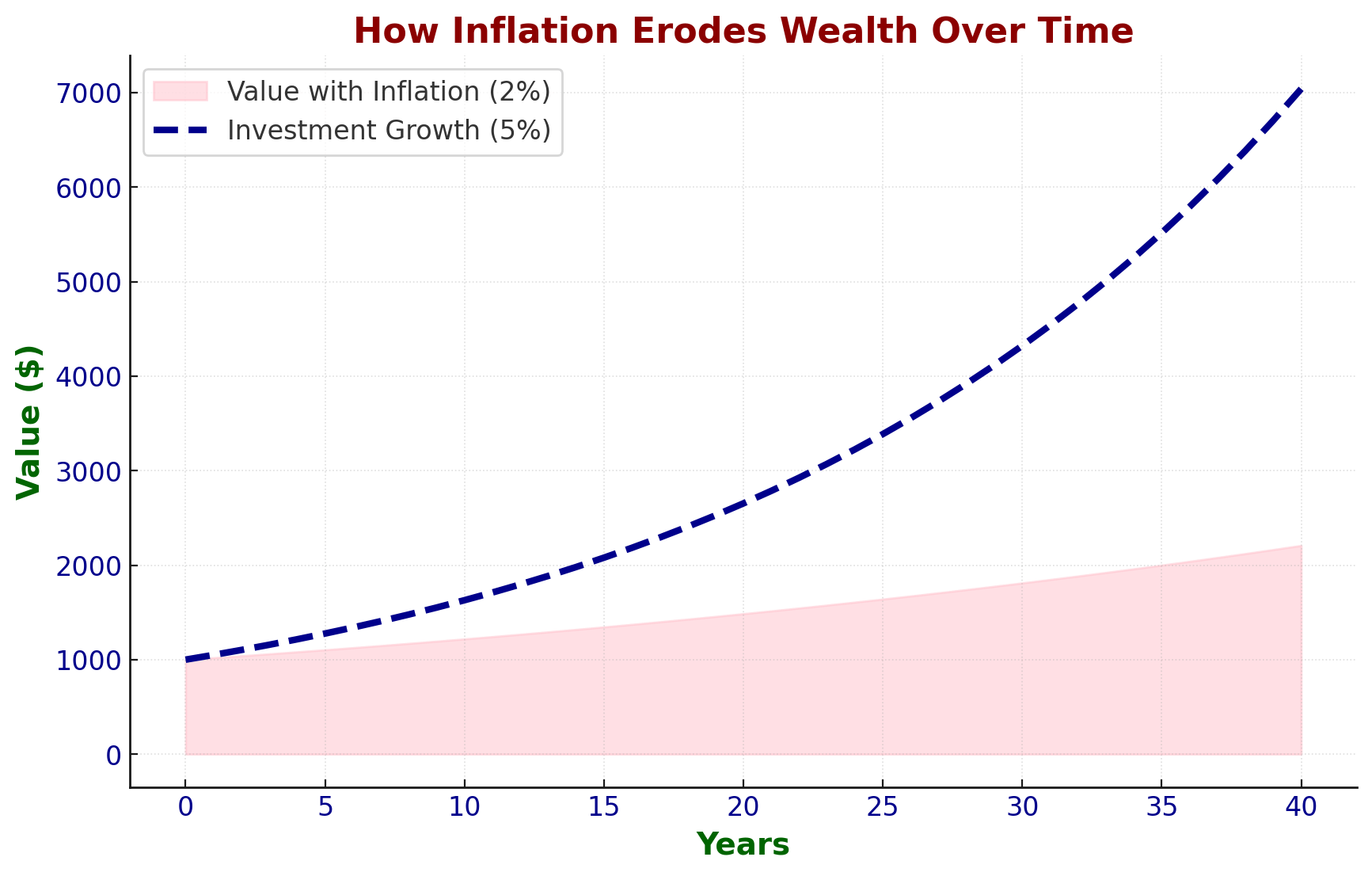

How Inflation Erodes Wealth

While compounding grows your investments, inflation can chip away at the purchasing power of your money. Here’s how a 2% inflation rate affects the value of your money compared to an investment growing at 5%:

Key Lessons from Compounding

Compounding is powerful because it multiplies your money over time. The longer you let it work, the more it grows. Here are a few key takeaways:

-

Start Early: The earlier you start investing, the more time your money has to grow. Even small investments can become significant over decades.

-

Be Consistent: Adding money regularly, even if it’s a small amount, can dramatically boost your investment growth over time.

-

Reinvest Your Earnings: Whenever you earn interest or returns, reinvest them. This allows your earnings to generate even more earnings, creating a compounding effect.

-

Patience Pays Off: Compounding takes time. The longer you leave your money to grow, the more dramatic the results. It’s a long-term game, but one that pays off in a big way.

Conclusion: Let Compounding Work for You

The power of compounding is available to anyone, and you don’t need a huge amount of money to get started. Whether through a savings account, the stock market, real estate, or a retirement account, the key is to start as soon as possible, stay consistent, and give your investments time to grow.

Over the years, compounding will take care of the rest, turning small amounts into larger sums and helping you build wealth with minimal effort.

If you're looking for personalized guidance on how to make compounding work for your specific financial goals, don't hesitate to contact me. I'm here to help you create a strategy that maximizes your wealth-building potential and sets you on the path to long-term success. Reach out today, and let's get started on your financial journey!

Categories

- All Blogs (253)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (12)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (157)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (36)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (97)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (35)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (58)

- Scottsdale Arizona (15)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (24)

- Verrado (15)

- Vistancia (12)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.