Live in One, Rent the Rest: A Proven Real Estate Strategy to Build Wealth and Offset Your Mortgage

If you’re struggling to make the numbers work in today’s housing market, you’re not alone. With interest rates still high and prices remaining elevated in many areas, buyers are looking for smarter ways to afford a home—without compromising their long-term financial goals. One of the most effective

Invest in Scottsdale: Remodeled Ground-Level Condo at Optima Camelview Steps from Fashion Square & Old Town

Looking for a luxury condo in Scottsdale that offers unbeatable location, resort-style amenities, and flexible rental options? Welcome to 7131 E Rancho Vista Dr #1008, located in the heart of the iconic Optima Camelview Village — just steps from Scottsdale Fashion Square, Old Town, and top-rated res

Unlocking Hidden Tax Strategies: Real Estate Deductions Most Real Estate Agents Don’t Talk About

Your 2025 Playbook for Reducing Taxes and Building Wealth Still Recovering From Tax Season? Whether you ended up writing a check to the IRS or pocketing a refund, one thing’s certain—next year can look very different with the right planning in place. Most people miss out on powerful tax-saving opp

The Airbnb & STR Market Is Oversaturated—Here’s How to Stand Out and Succeed

The Market Has Changed—Are You Ready to Compete? The short-term rental (STR) boom has hit a turning point. What was once a wide-open space with minimal competition is now saturated with listings—and travelers are more selective than ever. No, the market isn’t dead. It’s maturing. And hosts who treat

What Everyone Gets Wrong About the Phoenix Housing Market in 2025

The Phoenix real estate market is full of opportunities—but also plenty of misinformation. Buyers think homes are unaffordable, while sellers worry demand is disappearing. The truth? Phoenix remains one of the strongest housing markets in the country. Not only that, but Phoenix has one of the lowest

The Phoenix Housing Market Is Shifting Fast: What Buyers and Sellers Need to Know in 2025

The Greater Phoenix housing market is shifting—and fast. As we close out the first quarter of 2025, several clear trends are emerging that both buyers and sellers need to understand. Whether you're planning to move, invest, or just keeping an eye on the market, now is the time to take notice. In thi

How to Build Wealth Through Real Estate: A Proven Strategy for Financial Freedom

When I first got into finance, I never imagined real estate would play such a pivotal role in building wealth. But then 2008 happened—the economy was in turmoil, and while many were running from real estate, I saw an opportunity. I always act on this phrase, and I recommend you do too: "The time t

TSMC’s $165 Billion Arizona Investment: How It’s Transforming Jobs, Real Estate, and the Economy

Arizona is on the brink of a technological and economic revolution, thanks to Taiwan Semiconductor Manufacturing Co. (TSMC)’s historic $100 billion investment in Phoenix. This expansion—adding three more semiconductor fabs, two advanced packaging centers, and a research and development hub—is the la

Is the Buyer’s Market Making a Comeback in Phoenix? Here’s What You Need to Know

The Phoenix real estate market is shifting, and if you’re thinking about buying or selling, now is the time to pay attention. Over the past month, we've seen conditions tilt in favor of buyers, with 15 cities experiencing price softening and more inventory hitting the market. But does this mean buye

Luxury Home for Sale in Peoria, AZ – $1.6M Estate with RV Garage, Pickleball Court & Resort-Style Backyard

If you’re searching for a luxury home for sale in Peoria, AZ, this extraordinary estate is now on the market! Featuring an expansive RV garage, private pickleball court, and a resort-style backyard, this property offers an unmatched blend of modern elegance, space, and energy efficiency. 🏡 This hom

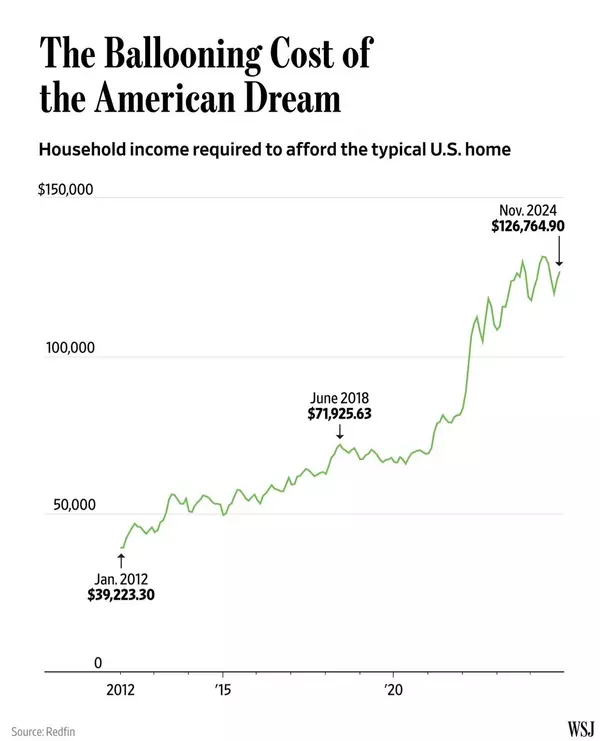

Can You Still Afford a Home in 2024? The Truth About Homeownership Costs (and How Buyers Are Winning in Arizona)

A recent viral chart from The Wall Street Journal claims you need $126,000+ to afford a typical home in America today. Since its release, many buyers have reached out to me, worried they can’t afford a home or assuming that homeownership is completely out of reach. But is this national data really t

Why Phoenix is the Ultimate City for Growth, Opportunity, and Affordability in 2025 – The Untold Stats & Insights

As economic uncertainties loom across the nation, Phoenix Metro stands out as a beacon of stability and growth. While other metropolitan areas face housing affordability challenges, rising interest rates, and labor market constraints, Phoenix continues to thrive with strong job creation, lower infla

5 Proven Real Estate and Wealth-Building Strategies to Transform Your Financial Future in 2025

As we kick off 2025, now is the time to take simple, impactful steps to set yourself up for financial success. From leveraging tax-advantaged accounts to rethinking your real estate strategy, these five easy actions will help you build and protect your wealth this year. 1. Reevaluate Your Real Estat

Should You Rent or Sell Your Home? The Surprising Math That Could Change Your Mind

Recently, yet another homeowner was convinced that selling was their best option in a strong buyer's market surrounded by new construction. Despite presenting them with numbers and scenarios, their mind was made up. So, I thought, when will this logic get through to people? Maybe this breakdown won’

Unlock Maximum Revenue: Proven Marketing Strategies for Your Vacation Rental or Short-Term Rental

Turning your home into a profitable vacation rental or short-term rental (STR) requires more than just listing it online. To maximize your revenue, you need a marketing strategy that sets your property apart. This guide provides actionable steps, creative strategies, and real-life examples to help y

Unlock Wealth Through Homeownership: How a Builder-Paid 3-2-1 Buydown Can Help You Grow Your Investment Portfolio

In today's real estate landscape, many buyers are deterred by high home prices and rising interest rates. However, for those willing to think strategically, the builder-financed 3-2-1 buydown offers not only a path to affordable homeownership but also a unique opportunity to build wealth. With initi

Complete Guide to Owning a Vacation Home in Arizona: Buying, Financing, Managing & Maximizing Income

Owning a vacation property in Arizona is much easier than many think, thanks to a variety of financing options and flexible investment strategies. Whether you’re looking to enjoy the home yourself, rent it out to tourists, or balance both, Arizona's diverse real estate market offers ample opportunit

Augusta Ranch Mesa AZ: Luxurious 5-Bedroom Home with High Investment Potential and ADU Opportunity

Augusta Ranch, located in the heart of Mesa, AZ, is known for its luxurious yet welcoming atmosphere, making it one of the most sought-after neighborhoods in the Greater Phoenix Metro area. With Arizona’s top-rated executive golf course as its centerpiece, Augusta Ranch blends the best of suburban l

Explore This Prime Opportunity in Vistancia | Peoria, Arizona Top-Ranked Master-Planned Community

This week's featured property and investor opportunity is located in the nationally ranked master-planned community of Vistancia in Peoria, AZ. This well-maintained Mattamy home offers a blend of modern luxury and strategic investment potential, making it an exceptional opportunity for both homeow

New Developments in Greater Phoenix Metro: Data Centers, Luxury Condos, and More!

The Greater Phoenix Metro: Where Exciting Developments Are Shaping the Future The Greater Phoenix Metro area is buzzing with new developments, from exciting retail expansions to cutting-edge entertainment venues and vibrant residential communities. Whether you're a resident, investor, or simply curi

Eric Ravenscroft, CRS

Phone:+1(480) 269-5858

Leave a Message

REQUEST A TOPIC TO BE PUBLISHED