Simplified Retirement Planning: Expert Tips to Secure Your Future with Personalized Guidance

Planning for retirement can be overwhelming, with countless financial options and advice available. However, it doesn’t have to be. With a straightforward approach, consistent savings, and sound investment strategies, you can build the financial security you need for a fulfilling retirement.

This comprehensive guide simplifies retirement planning by breaking it into actionable steps, complete with practical tips, real-world scenarios, and easy-to-understand examples.

Why Retirement Planning Matters

Retirement marks a time when earned income ceases, and financial independence relies on your savings and investments. Without a clear plan, you may face challenges such as income shortfalls, delayed retirement, or difficulty covering unexpected expenses.

A solid retirement plan ensures:

- Financial Security: Maintain your lifestyle and manage unexpected costs.

- Peace of Mind: Avoid financial stress and enjoy your freedom.

- Flexibility: Adapt to changing circumstances with confidence.

Step-by-Step Approach to Retirement Planning

1. Start with Your Retirement Goals

Clearly defining your retirement goals sets the foundation for your plan. Ask yourself:

- When do you want to retire?

- What lifestyle do you envision (e.g., travel, hobbies, family time)?

- What are your expected expenses (housing, healthcare, leisure)?

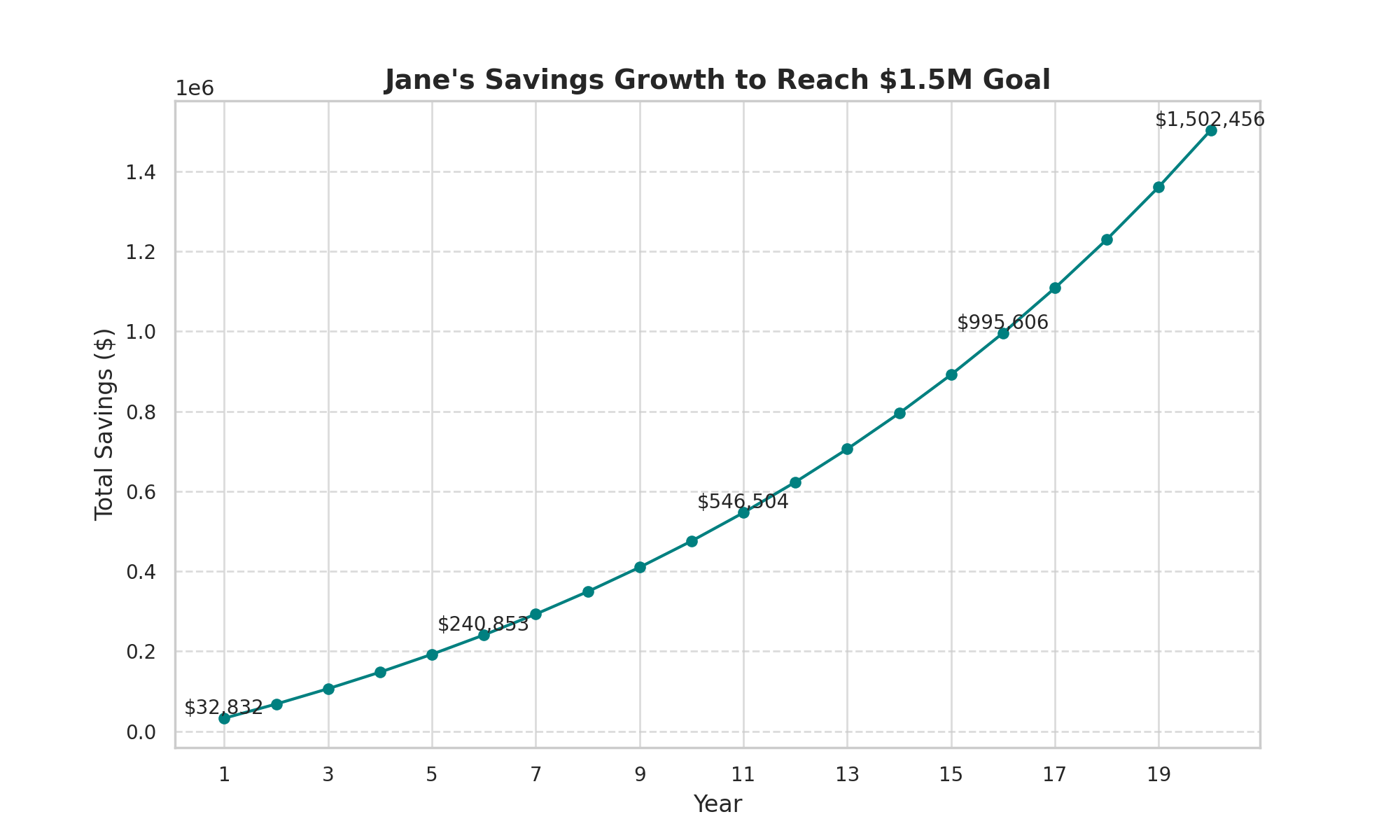

Scenario 1: Early Retirement at 55

Jane, 35, dreams of retiring at 55 and traveling extensively. She estimates needing $50,000 annually and plans for a 30-year retirement, requiring $1.5 million (excluding inflation). To achieve this, Jane saves aggressively, contributing 20% of her income to her retirement accounts.

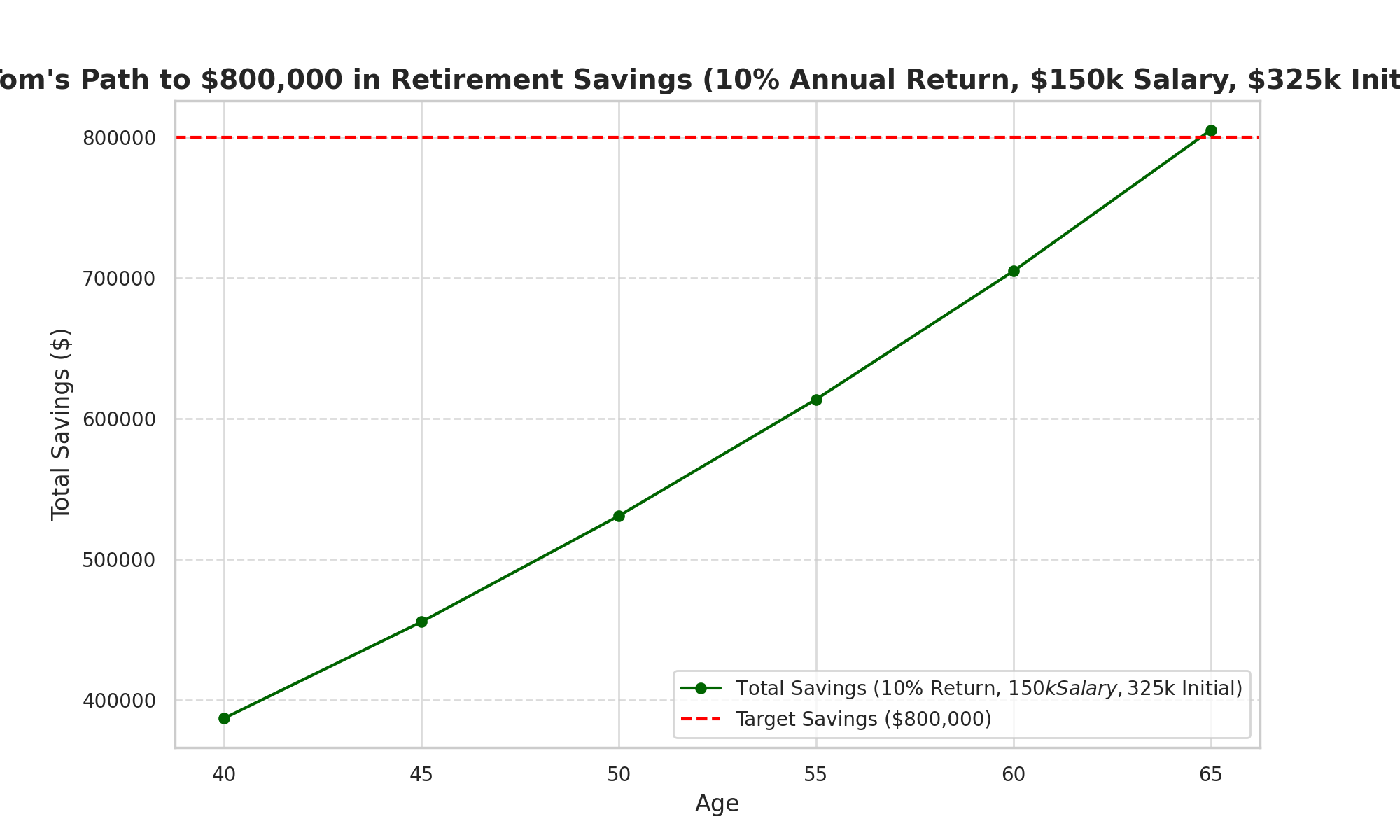

Scenario 2: Traditional Retirement at 65

Tom, 40, prefers retiring at 65 and spending time with family. He estimates needing $40,000 annually for 20 years, requiring $800,000 in savings. With more time to save, Tom contributes 15% of his income and focuses on employer-matched 401(k) contributions.

2. Understand Your Retirement Savings Options

Learn about the most common savings vehicles:

- 401(k)/403(b): Tax-deferred employer-sponsored plans.

- IRA (Traditional/Roth): Individual accounts offering tax-deferred or tax-free growth.

- Health Savings Account (HSA): A powerful tool for retirement healthcare savings.

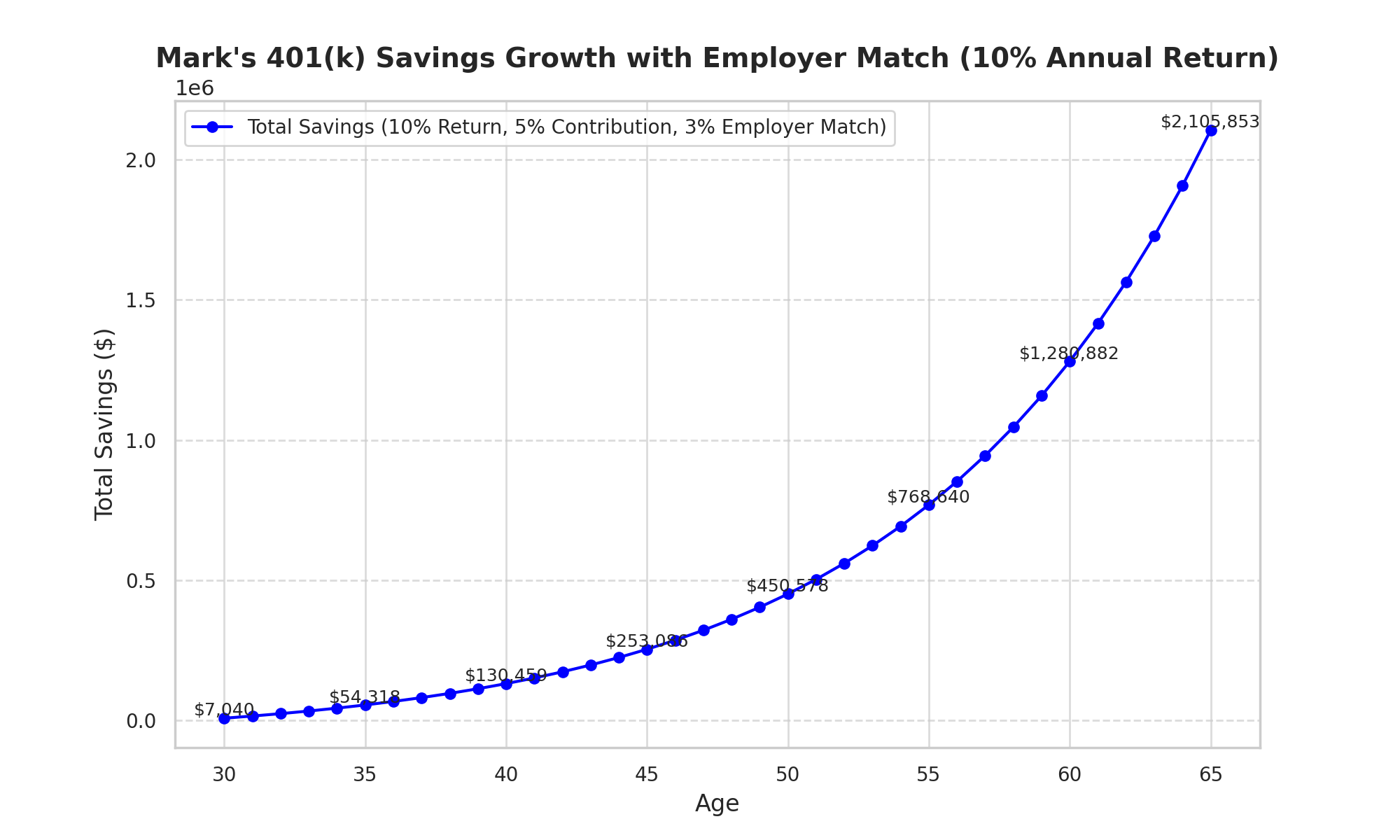

Example: Maximizing Employer Contributions

Mark, 30, contributes 5% of his salary to his employer’s 401(k), earning a 3% match. This "free money" adds significantly to his long-term savings.

3. Calculate How Much to Save

Retirement savings goals depend on age, income, and lifestyle.

- In Your 20s–30s: Save 10–15% of income.

- In Your 40s: Increase to 15–25%.

- In Your 50s: Maximize contributions to catch up.

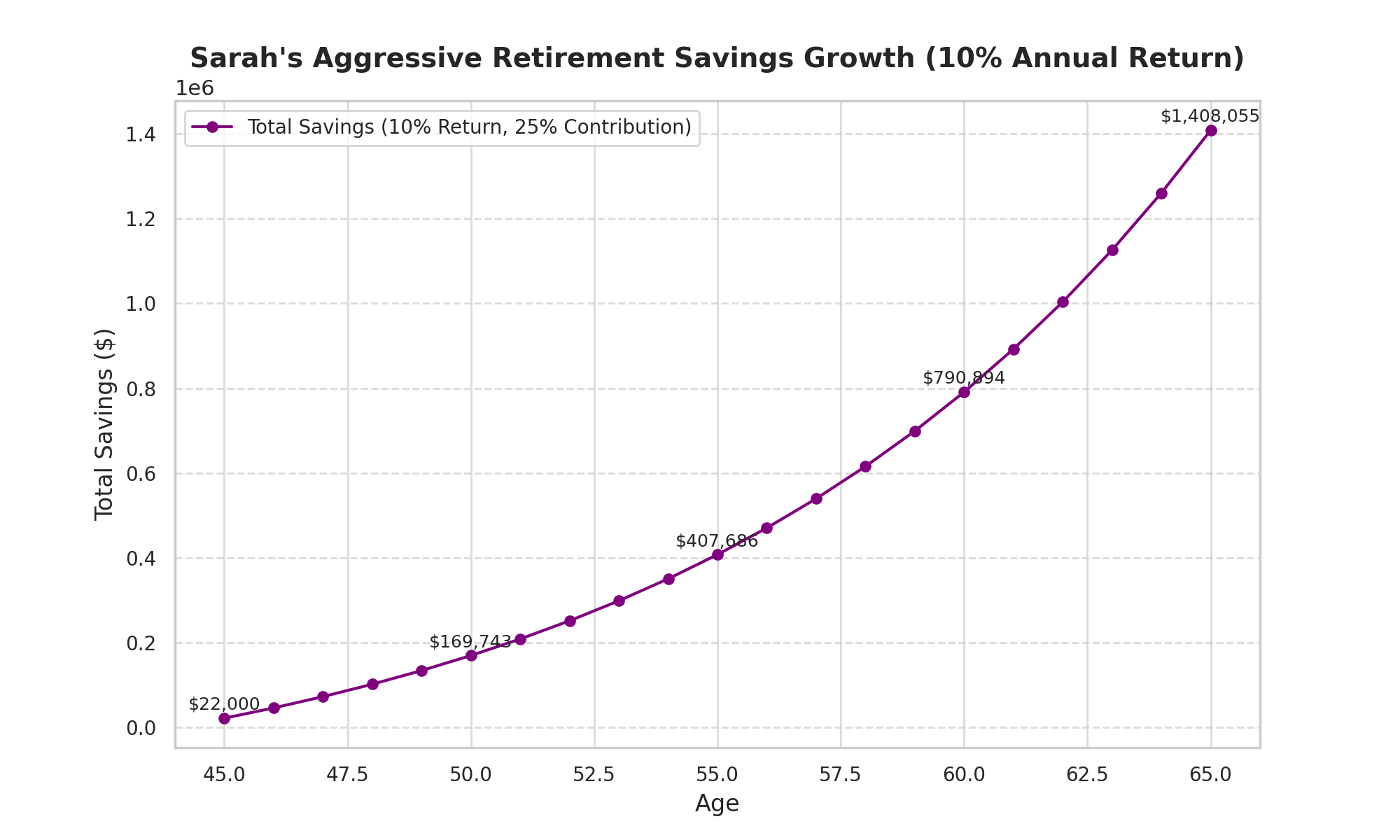

Scenario 3: Late Start in Retirement Savings

Sarah, 45, starts saving for retirement later in life. She contributes 25% of her income to her 401(k) to retire at 65 with $60,000 annually. With 20 years to save, she adjusts her lifestyle to prioritize aggressive savings.

4. Invest Wisely for Growth

Investing your savings ensures long-term growth. Adjust investments as you age:

- In Your 20s–30s: Focus on high-growth assets like stocks.

- In Your 40s: Diversify with bonds for balance.

- In Your 50s: Shift to conservative investments for stability.

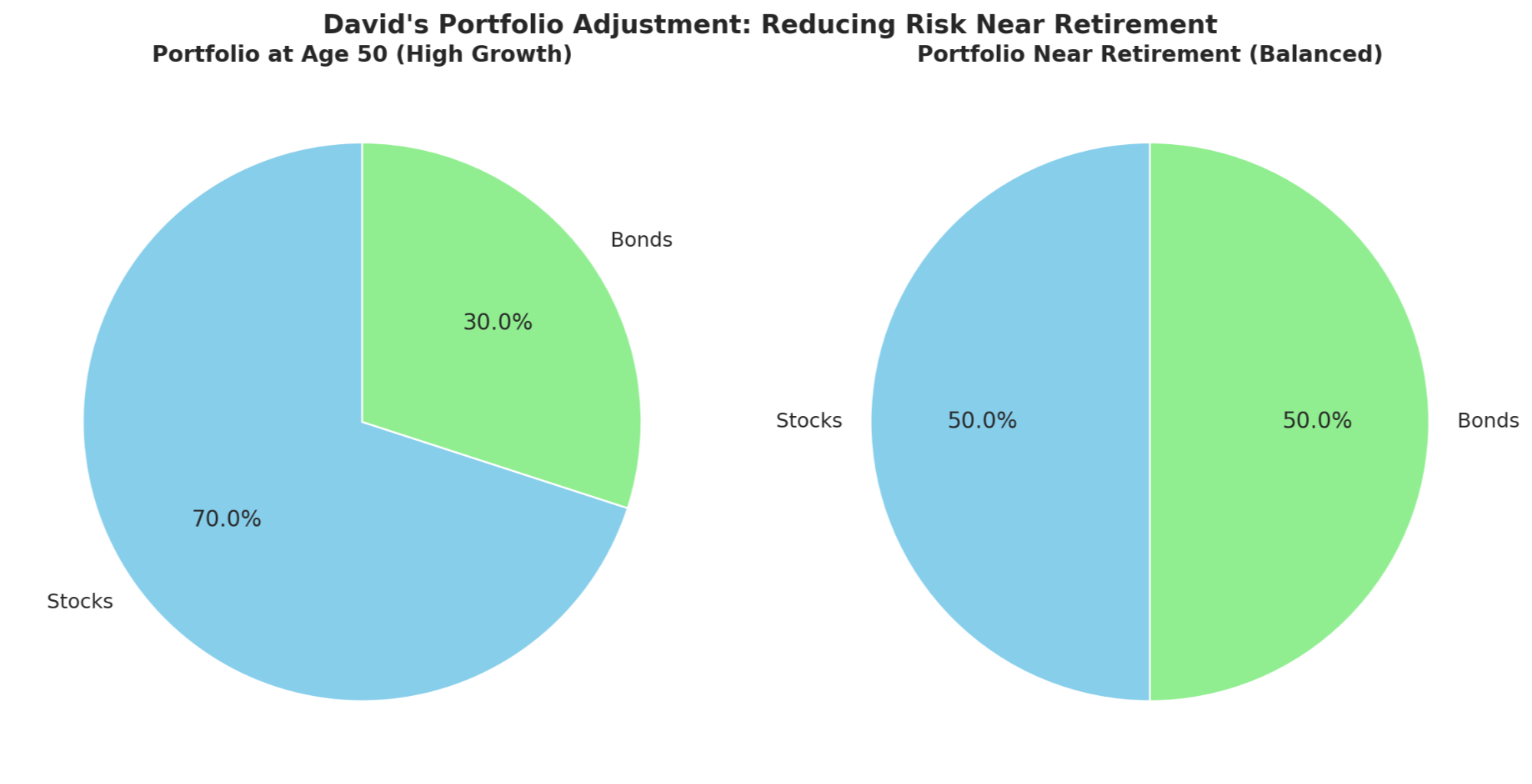

Example: Adjusting Investments Over Time

David, 50, adjusts his portfolio from 70% stocks and 30% bonds to 50% stocks and 50% bonds, reducing risk as retirement approaches.

5. Leverage Catch-Up Contributions

Once you turn 50, you can increase contributions:

- 401(k): Add $7,500 annually, totaling $30,000 per year.

- IRA: Add $1,000 annually, totaling $7,500 per year.

Scenario 4: Maximizing Catch-Up Contributions

John, 52, maximizes his 401(k) contributions. In 10 years, his savings grow to $550,000 with an average return of 6%.

6. Create a Withdrawal Plan

Plan withdrawals to avoid outliving your savings:

- Use the 4% rule to withdraw 4% of your savings in the first year, adjusting for inflation annually.

Example: Withdrawal Strategy

Emily saves $1 million. Using the 4% rule, she withdraws $40,000 in year one to sustain her lifestyle.

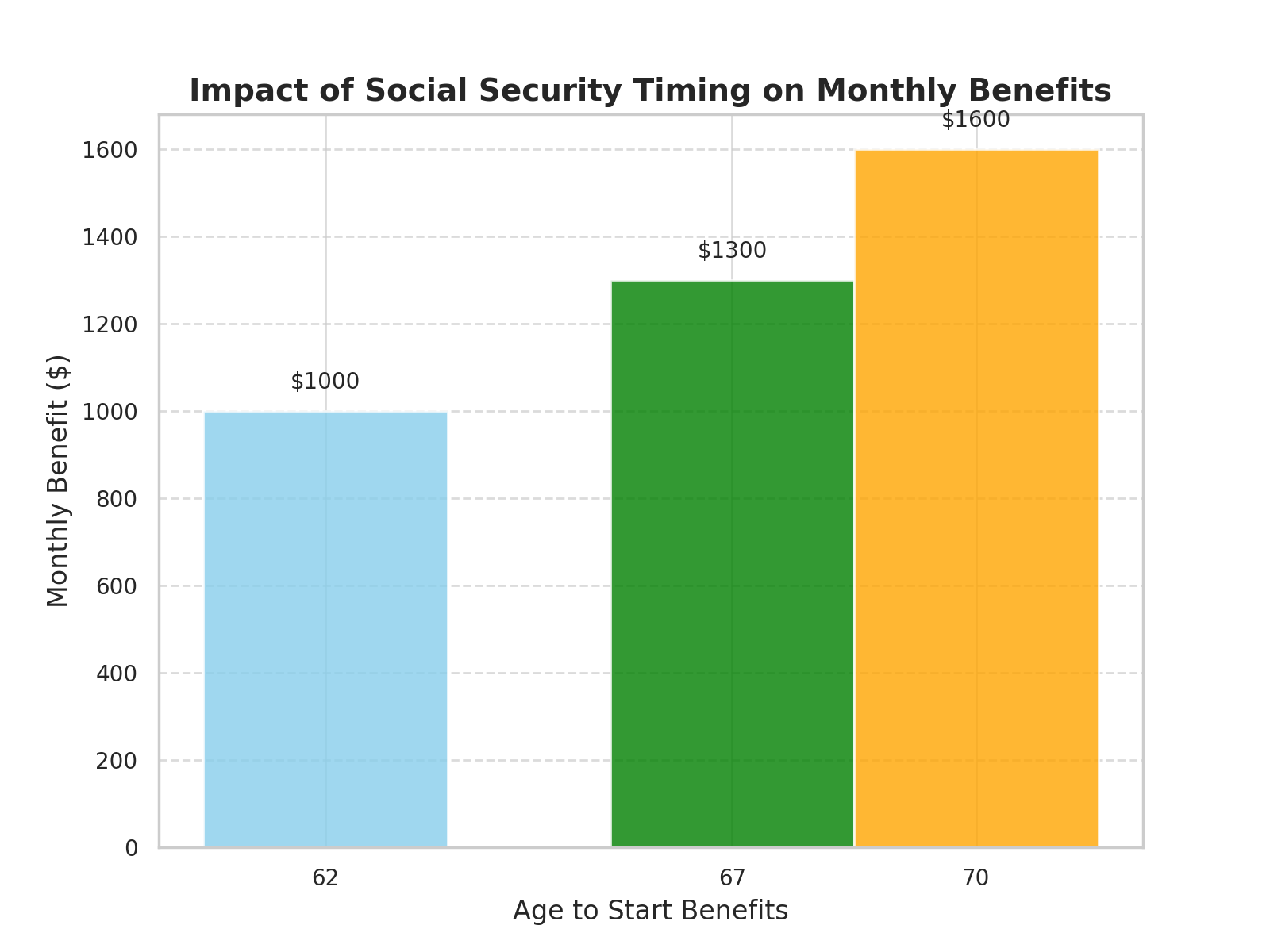

7. Maximize Social Security Benefits

Social Security can supplement your savings.

- Taking benefits at 62 reduces your monthly payments.

- Delaying until 67 or 70 increases benefits significantly.

Example: Social Security Timing

Bob, 62, delays benefits until 67, increasing his monthly payments by 30%.

8. Plan for Healthcare Costs

Healthcare costs are a major expense in retirement.

- Use an HSA to save tax-free for medical expenses.

- Estimate needing $300,000 for healthcare over a 20-year retirement.

Example: Preparing for Healthcare Costs

Sue and her husband contribute to an HSA to cover future out-of-pocket expenses.

9. Manage Debt Before Retirement

Eliminating high-interest debt before retiring ensures greater financial flexibility.

Scenario: Paying Off Debt Before Retirement

Gary, 50, focuses on paying off his mortgage and credit card debt within five years, freeing up funds for retirement.

10. Seek Professional Financial Advice

Consulting a financial advisor ensures personalized planning and confidence in your strategy.

Example: Tailored Financial Planning

Linda, 45, works with an advisor who helps her maximize her 401(k), open a Roth IRA, and prioritize debt repayment.

11. Monitor and Adjust Your Plan

Retirement planning isn’t a one-time task. Periodically review your progress and adjust as needed.

Scenario: Adapting to Changing Circumstances

Paul, 58, inherits money and adjusts his plan with his advisor, allowing him to retire earlier than expected.

Conclusion: Retirement Planning is a Lifelong Process

Retirement planning doesn’t have to be complicated. By setting clear goals, saving consistently, investing wisely, and reviewing your progress, you can secure a comfortable and financially stable retirement.

Take Action Today: Whether you’re in your 20s, 40s, or 50s, it’s never too early—or too late—to plan for your future. Start now to enjoy the freedom and peace of mind you deserve.

Ready to Take Control of Your Retirement Plan?

Whether you’re just starting to save, need to refine your current plan, or want expert guidance to ensure you're on track, I’m here to help. Schedule a free 1-on-1 consultation with me today to:

- Review Your Current Plan: Identify gaps and opportunities for improvement.

- Create a Customized Strategy: Tailored to your goals, age, and financial situation.

- Gain Confidence in Your Future: Ensure you’re taking the right steps to meet your retirement goals.

Click below to schedule your consultation now and take the first step toward securing your financial future. Let’s work together to make your retirement dreams a reality!

Categories

- All Blogs (249)

- 13707 W Linanthus Road (3)

- 2223 N BEVERLY Place (5)

- Active Adult & 55 Plus Communities (12)

- Alamar (1)

- Anthem (3)

- Anthem Arizona (3)

- Arizona Relocation Guides (11)

- Avondale (2)

- Bridges at Gilbert (1)

- Buckeye Arizona (15)

- Builders (6)

- Builders in Avondale (1)

- Builders in Buckeye (1)

- Builders in Goodyear (1)

- Builders in Mesa (3)

- Builders in Peoria (2)

- Builders in Queen Creek (3)

- Builders in Scottsdale (3)

- Builders in Surprise (1)

- Buyers (155)

- Cadence (2)

- Cantamia (2)

- Chandler Arizona (6)

- Eastmark (2)

- Estrella (4)

- Financial Planning (35)

- Flagstaff Arizona (2)

- Fulton Ranch (1)

- General Real Estate (95)

- Gilbert Arizona (11)

- Glendale Arizona (7)

- Golf Course Communities (22)

- Goodyear Arizona (16)

- Guest Houses and ADUs (7)

- Income From Real Estate (33)

- Las Sendas (1)

- Litchfield Park Arizona (6)

- Maricopa Arizona (3)

- Market Update (17)

- Marley Park (3)

- Mesa Arizona (11)

- Military (5)

- Morrison Ranch (2)

- New Construction (22)

- New Construction Communities (22)

- News, Updates and Coming Soon (51)

- Norterra (1)

- Ocotillo (1)

- Palm Valley (7)

- Peoria Arizona (22)

- Phoenix Arizona (19)

- Power Ranch (2)

- Prescott Arizona (2)

- Queen Creek Arizona (4)

- REAL (8)

- Real Estate Agent Financial Planning (11)

- Real Estate Investing (56)

- Scottsdale Arizona (14)

- Sedona Arizona (1)

- Sellers (80)

- Senior Resources (14)

- Show Low Arizona (1)

- Spring Training (6)

- Sterling Grove (6)

- Sun City Arizona (2)

- Sun City Grand (1)

- Surprise Arizona (13)

- Tempe Arizona (4)

- Teravalis (1)

- Vacation Rental News (23)

- Verrado (14)

- Vistancia (11)

- Waddell Arizona (2)

- Waterston (1)

Recent Posts

About the Author

Eric Ravenscroft is a Top 1% REALTOR® across North America and one of Arizona’s most trusted real estate strategists. With 15 years of experience spanning real estate, wealth management, and investment planning, he helps clients make smarter, financially grounded decisions, from new construction and relocations to STR investments, 1031 exchanges, and long-term portfolio strategy.

Eric’s expertise has earned him industry recognition, Elite status with Real Broker, and features in major publications including the Wall Street Journal, MarketWatch, MSN, and Morningstar. Clients across the Greater Phoenix Metro rely on his clarity, strategic insight, and results-driven guidance.

Ready to make a confident real estate move? Call or text Eric today.