Bonus Depreciation for Real Estate in 2025: The Ultimate Guide for Investors, Agents, and High-Income Earners

Bonus depreciation is back at 100% for qualifying real estate — and it's one of the most powerful tax strategies investors, real estate professionals, and W-2 earners can use to reduce their tax liability and build long-term wealth. With recent tax law changes set to take effect in 2025, now is the

Is Solar Worth It in Arizona? Why Homeowners Should Think Twice Before Installing Panels

In a state blessed with over 300 sunny days a year, installing solar panels seems like a no-brainer. But the math—and the market—tell a different story. For Arizona homeowners, solar isn’t just about cutting electric bills. It’s a financial decision that impacts resale value, long-term flexibility,

Selling in a Tough Market? Smarter Strategies for Homeowners in 2025

In a recent MarketWatch article, I shared insights into a rising trend in the Arizona real estate market: more and more sellers are pulling their listings rather than reducing prices further. Just days after the article was published, I began receiving messages from homeowners asking: “If I don’t wa

Phoenix Housing Market June 2025: Home Prices Slip as Buyers Gain Power

Prices Drop, Builders Offer Big Incentives, and Buyers Take Control The Greater Phoenix real estate market continued its steady correction in June 2025. While this isn’t a crash, there’s no denying the shift: home prices are trending down, buyer leverage is rising, and sellers are adjusting—some by

Stocks vs. Real Estate: Which Investment Builds Wealth Smarter?

In the world of personal finance, few debates are more common than this:Should I invest in stocks or real estate? Both have created millionaires. Both offer unique advantages. And both play a central role in many diversified portfolios. But understanding the differences between the two — from cash f

What If Downsizing Your Home Could Unlock Your Financial Future?

For many homeowners, there comes a time when the house that once felt like the perfect fit begins to feel like too much. Too much space. Too much maintenance. Too many costs.And not enough flexibility, liquidity, or lifestyle alignment. But here’s what most people don’t realize:Downsizing your home

Phoenix Housing Market: Prices Cooling, Buyers Gaining Leverage, But No Crash Ahead

The Greater Phoenix housing market has officially shifted. Prices are softening, inventory remains elevated, and buyers have taken back the advantage as we head into summer 2025. While every week seems to bring new headlines predicting either a crash or a rebound, the reality on the ground looks ver

Live in One, Rent the Rest: A Proven Real Estate Strategy to Build Wealth and Offset Your Mortgage

If you’re struggling to make the numbers work in today’s housing market, you’re not alone. With interest rates still high and prices remaining elevated in many areas, buyers are looking for smarter ways to afford a home—without compromising their long-term financial goals. One of the most effective

Phoenix Metro Growth Report: May 2025 Edition – IKEA, Cannon Beach, Teravalis & More

The Greater Phoenix Metro area is experiencing an unprecedented wave of growth. With major brands expanding, billion-dollar master-planned communities launching, and lifestyle destinations coming to life, the Valley is quickly becoming one of the most exciting real estate and economic zones in the U

Phoenix Housing Market Update April 2025: Home Prices Drop and Buyer Power Rises

After months of subtle signals, the shift is no longer theoretical — home prices in Greater Phoenix are officially falling. For much of 2024 and early 2025, we watched active listings linger longer, price cuts increase, and seller concessions grow. But until recently, closed sale prices hadn’t refle

Unlocking Hidden Tax Strategies: Real Estate Deductions Most Real Estate Agents Don’t Talk About

Your 2025 Playbook for Reducing Taxes and Building Wealth Still Recovering From Tax Season? Whether you ended up writing a check to the IRS or pocketing a refund, one thing’s certain—next year can look very different with the right planning in place. Most people miss out on powerful tax-saving opp

What Everyone Gets Wrong About the Phoenix Housing Market in 2025

The Phoenix real estate market is full of opportunities—but also plenty of misinformation. Buyers think homes are unaffordable, while sellers worry demand is disappearing. The truth? Phoenix remains one of the strongest housing markets in the country. Not only that, but Phoenix has one of the lowest

The Phoenix Housing Market Is Shifting Fast: What Buyers and Sellers Need to Know in 2025

The Greater Phoenix housing market is shifting—and fast. As we close out the first quarter of 2025, several clear trends are emerging that both buyers and sellers need to understand. Whether you're planning to move, invest, or just keeping an eye on the market, now is the time to take notice. In thi

How to Build Wealth Through Real Estate: A Proven Strategy for Financial Freedom

When I first got into finance, I never imagined real estate would play such a pivotal role in building wealth. But then 2008 happened—the economy was in turmoil, and while many were running from real estate, I saw an opportunity. I always act on this phrase, and I recommend you do too: "The time t

TSMC’s $165 Billion Arizona Investment: How It’s Transforming Jobs, Real Estate, and the Economy

Arizona is on the brink of a technological and economic revolution, thanks to Taiwan Semiconductor Manufacturing Co. (TSMC)’s historic $100 billion investment in Phoenix. This expansion—adding three more semiconductor fabs, two advanced packaging centers, and a research and development hub—is the la

Is the Buyer’s Market Making a Comeback in Phoenix? Here’s What You Need to Know

The Phoenix real estate market is shifting, and if you’re thinking about buying or selling, now is the time to pay attention. Over the past month, we've seen conditions tilt in favor of buyers, with 15 cities experiencing price softening and more inventory hitting the market. But does this mean buye

Luxury Home for Sale in Peoria, AZ – $1.6M Estate with RV Garage, Pickleball Court & Resort-Style Backyard

If you’re searching for a luxury home for sale in Peoria, AZ, this extraordinary estate is now on the market! Featuring an expansive RV garage, private pickleball court, and a resort-style backyard, this property offers an unmatched blend of modern elegance, space, and energy efficiency. 🏡 This hom

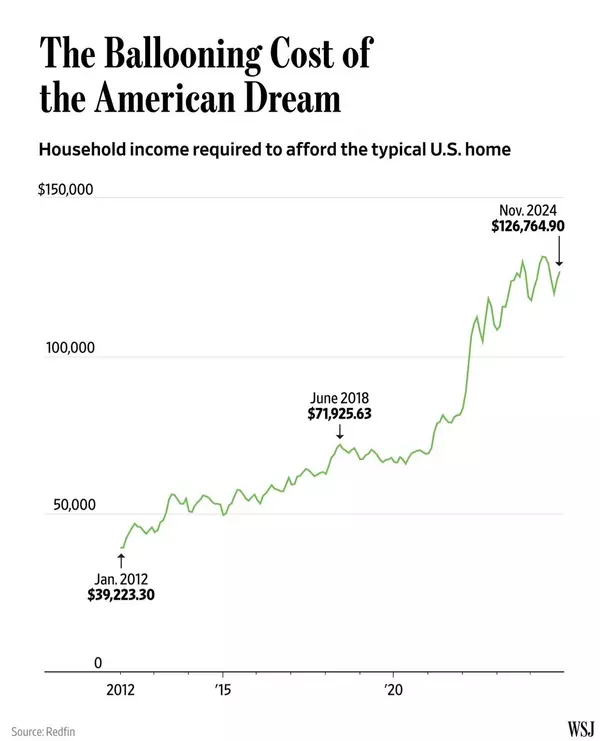

Can You Still Afford a Home in 2024? The Truth About Homeownership Costs (and How Buyers Are Winning in Arizona)

A recent viral chart from The Wall Street Journal claims you need $126,000+ to afford a typical home in America today. Since its release, many buyers have reached out to me, worried they can’t afford a home or assuming that homeownership is completely out of reach. But is this national data really t

Why Phoenix is the Ultimate City for Growth, Opportunity, and Affordability in 2025 – The Untold Stats & Insights

As economic uncertainties loom across the nation, Phoenix Metro stands out as a beacon of stability and growth. While other metropolitan areas face housing affordability challenges, rising interest rates, and labor market constraints, Phoenix continues to thrive with strong job creation, lower infla

5 Proven Real Estate and Wealth-Building Strategies to Transform Your Financial Future in 2025

As we kick off 2025, now is the time to take simple, impactful steps to set yourself up for financial success. From leveraging tax-advantaged accounts to rethinking your real estate strategy, these five easy actions will help you build and protect your wealth this year. 1. Reevaluate Your Real Estat

Eric Ravenscroft, CRS

Phone:+1(480) 269-5858

Leave a Message

REQUEST A TOPIC TO BE PUBLISHED