Phoenix Housing Market Update April 2025: Home Prices Drop and Buyer Power Rises

After months of subtle signals, the shift is no longer theoretical — home prices in Greater Phoenix are officially falling. For much of 2024 and early 2025, we watched active listings linger longer, price cuts increase, and seller concessions grow. But until recently, closed sale prices hadn’t refle

Unlocking Hidden Tax Strategies: Real Estate Deductions Most Real Estate Agents Don’t Talk About

Your 2025 Playbook for Reducing Taxes and Building Wealth Still Recovering From Tax Season? Whether you ended up writing a check to the IRS or pocketing a refund, one thing’s certain—next year can look very different with the right planning in place. Most people miss out on powerful tax-saving opp

The Airbnb & STR Market Is Oversaturated—Here’s How to Stand Out and Succeed

The Market Has Changed—Are You Ready to Compete? The short-term rental (STR) boom has hit a turning point. What was once a wide-open space with minimal competition is now saturated with listings—and travelers are more selective than ever. No, the market isn’t dead. It’s maturing. And hosts who treat

What Everyone Gets Wrong About the Phoenix Housing Market in 2025

The Phoenix real estate market is full of opportunities—but also plenty of misinformation. Buyers think homes are unaffordable, while sellers worry demand is disappearing. The truth? Phoenix remains one of the strongest housing markets in the country. Not only that, but Phoenix has one of the lowest

The Phoenix Housing Market Is Shifting Fast: What Buyers and Sellers Need to Know in 2025

The Greater Phoenix housing market is shifting—and fast. As we close out the first quarter of 2025, several clear trends are emerging that both buyers and sellers need to understand. Whether you're planning to move, invest, or just keeping an eye on the market, now is the time to take notice. In thi

Coming Soon to Metro Phoenix: Big Retail, Resorts & Real Estate Developments You Might’ve Missed

From luxury resorts and health innovation hubs to high-end shopping centers and family-friendly entertainment, Arizona is rapidly evolving. Here's what you need to know. Arizona is on fire — and we’re not just talking about the weather. The Grand Canyon State is seeing a wave of new developments tha

How to Build Wealth Through Real Estate: A Proven Strategy for Financial Freedom

When I first got into finance, I never imagined real estate would play such a pivotal role in building wealth. But then 2008 happened—the economy was in turmoil, and while many were running from real estate, I saw an opportunity. I always act on this phrase, and I recommend you do too: "The time t

TSMC’s $165 Billion Arizona Investment: How It’s Transforming Jobs, Real Estate, and the Economy

Arizona is on the brink of a technological and economic revolution, thanks to Taiwan Semiconductor Manufacturing Co. (TSMC)’s historic $100 billion investment in Phoenix. This expansion—adding three more semiconductor fabs, two advanced packaging centers, and a research and development hub—is the la

Is the Buyer’s Market Making a Comeback in Phoenix? Here’s What You Need to Know

The Phoenix real estate market is shifting, and if you’re thinking about buying or selling, now is the time to pay attention. Over the past month, we've seen conditions tilt in favor of buyers, with 15 cities experiencing price softening and more inventory hitting the market. But does this mean buye

Luxury Home for Sale in Peoria, AZ – $1.6M Estate with RV Garage, Pickleball Court & Resort-Style Backyard

If you’re searching for a luxury home for sale in Peoria, AZ, this extraordinary estate is now on the market! Featuring an expansive RV garage, private pickleball court, and a resort-style backyard, this property offers an unmatched blend of modern elegance, space, and energy efficiency. 🏡 This hom

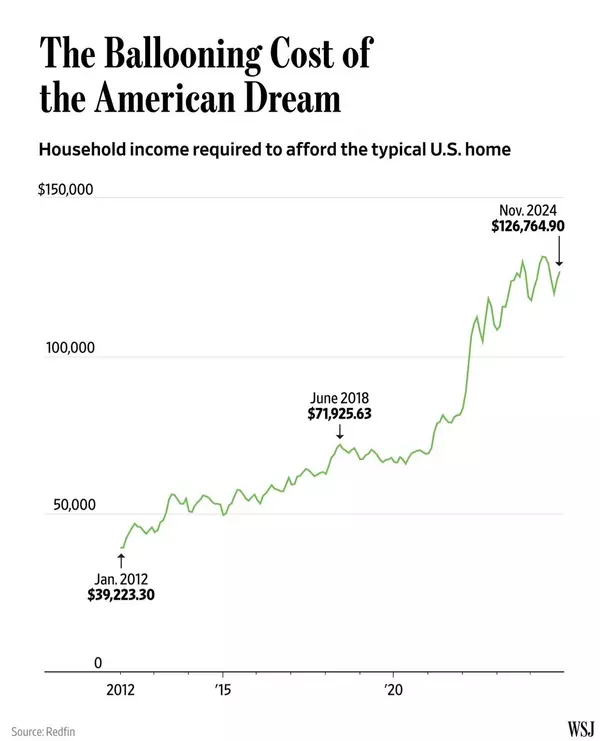

Can You Still Afford a Home in 2024? The Truth About Homeownership Costs (and How Buyers Are Winning in Arizona)

A recent viral chart from The Wall Street Journal claims you need $126,000+ to afford a typical home in America today. Since its release, many buyers have reached out to me, worried they can’t afford a home or assuming that homeownership is completely out of reach. But is this national data really t

The Future of Vistancia: Must-Know Developments Shaping Peoria, AZ

Vistancia, one of the most sought-after master-planned communities in Peoria, Arizona, and a key player in the Arizona real estate market, continues to thrive amid Peoria's rapid growth. With a host of exciting projects and developments on the horizon, from residential neighborhoods to commercial sp

Best Places to Raise a Family in Arizona: 9 Cities That Rank Among the Nation’s Top

Arizona continues to solidify its reputation as one of the best places to raise a family, with nine cities ranking among the best in the U.S. in a new study by This Old House. The report analyzed 149 of the most populous U.S. cities based on factors such as affordability, safety, school quality, hea

Arizona Housing Market Update: Key Trends & Insights for January 2025

Remember when I mentioned a few months ago that it had been 14 years since buyers had this much of an advantage? Well, if you waited, that rare window is closing fast. The Arizona real estate market is shifting, and while some outlying areas still favor buyers, overall conditions are moving toward b

Why Phoenix is the Ultimate City for Growth, Opportunity, and Affordability in 2025 – The Untold Stats & Insights

As economic uncertainties loom across the nation, Phoenix Metro stands out as a beacon of stability and growth. While other metropolitan areas face housing affordability challenges, rising interest rates, and labor market constraints, Phoenix continues to thrive with strong job creation, lower infla

5 Proven Real Estate and Wealth-Building Strategies to Transform Your Financial Future in 2025

As we kick off 2025, now is the time to take simple, impactful steps to set yourself up for financial success. From leveraging tax-advantaged accounts to rethinking your real estate strategy, these five easy actions will help you build and protect your wealth this year. 1. Reevaluate Your Real Estat

Discover Verrado’s Future: Exciting Shopping Centers, Healthcare, and Community Growth in Buckeye, AZ

Verrado, a master-planned community in Buckeye, Arizona, is already renowned for its charm, vibrant community life, and scenic surroundings. Its design focuses on walkability, tree-lined streets, and a small-town atmosphere while offering modern amenities. Verrado features over 75 parks, top-rated s

Top 10 Home Design Trends for 2025: Inclusive, Timeless, and Innovative

As home design continues to evolve, 2025 is shaping up to be a transformative year for innovative and inclusive trends. From sensory-friendly features to enduring elegance, this year’s ideas prioritize functionality, harmony, and timeless beauty. Let’s explore the top 10 trends redefining home desig

Real Estate Insights and 2025 Market Opportunities

As 2024 draws to a close, it’s the perfect time to reflect on the year’s lessons and look ahead to the opportunities awaiting us in 2025. For me, this year has been a testament to the transformative power of real estate as a wealth-building tool. It’s not just about buying or selling homes; it’s abo

Go Big for the End of 2024: Explore This Stunning New Build in Litchfield Park, AZ

As 2024 draws to a close, now is the perfect time to secure your dream home. If you’ve been waiting for the ideal opportunity to upgrade to a spacious, luxurious property with incredible incentives, look no further than The Hampton, located in the sought-after community of Litchfield Park, Arizona.

Eric Ravenscroft, CRS

Phone:+1(480) 269-5858

Leave a Message

REQUEST A TOPIC TO BE PUBLISHED